Overseas Sales Account for 80%, Operating Margin Reaches 22%

Key Driver Behind the 2 Trillion Won Era in Korean Ramen Exports

Sales Double and Operating Profit Grows Fivefold in Just Three Years

According to the food industry and financial information provider FnGuide on December 18, the consensus for Samyang Foods’ fourth-quarter results, compiled over the past month, is 667.9 billion won in revenue and 149.6 billion won in operating profit. These figures represent year-on-year increases of 39.5% and 70.6%, respectively. Analysts attribute this significant improvement in profitability to increased sales of Buldak Bokkeum Myun in major export markets such as North America, China, and Southeast Asia, as well as the positive impact of a strong exchange rate.

Revenue Surpasses 2 Trillion Won and Operating Profit Exceeds 500 Billion Won for the First Time

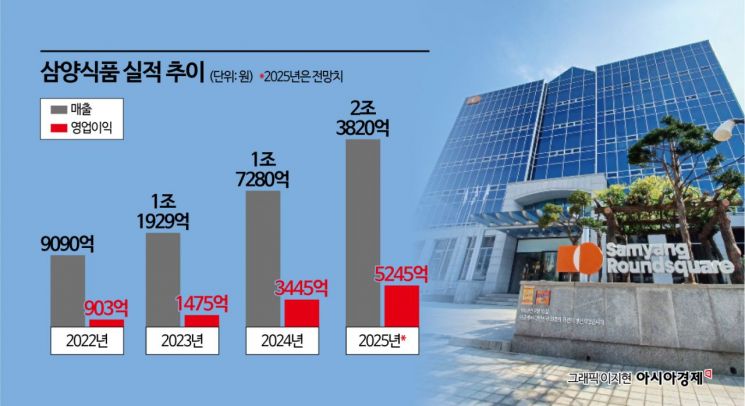

Samyang Foods has already recorded cumulative revenue of 1.7141 trillion won and operating profit of 385 billion won through the third quarter. Considering the year-end peak season, annual results are expected to grow even further. The market expects Samyang Foods to achieve 2.382 trillion won in revenue and 524.5 billion won in operating profit this year, both all-time highs.

The pace of growth is also accelerating. Samyang Foods’ revenue jumped from 909 billion won in 2022 to 1.1929 trillion won in 2023 and 1.728 trillion won in 2024, marking substantial annual increases. Over the same period, operating profit expanded from 90.3 billion won to 147.5 billion won and then to 344.5 billion won. This year, the company is set to continue this trend, ushering in an era of 2 trillion won in revenue and 500 billion won in operating profit.

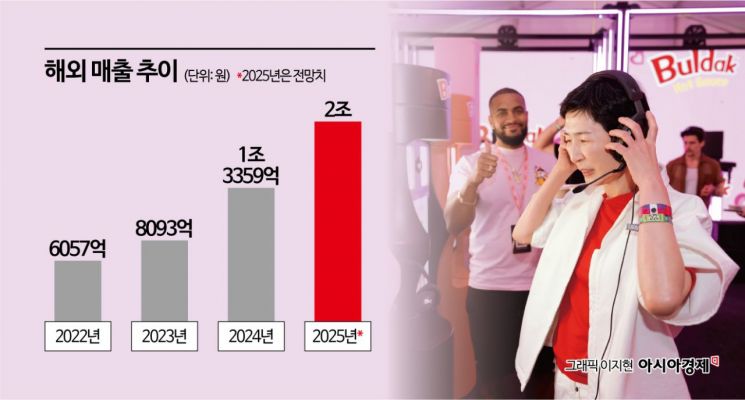

The driving force behind this growth is overseas sales. Samyang Foods’ overseas revenue increased rapidly from 605.7 billion won in 2022 to 809.3 billion won in 2023 and 1.3359 trillion won in 2024. Given that overseas sales account for around 80% of Samyang Foods’ total revenue, there are even projections that overseas sales alone could reach 2 trillion won this year. From January to September this year, overseas revenue stood at 1.3747 trillion won.

The increased proportion of overseas sales has led to improved profitability. Samyang Foods’ operating margin rose from 9.9% in 2022 to double digits at 12.4% in 2023, and soared to 19.9% last year. This year, the operating margin is estimated to reach 22.0%, thanks to rising sales and a higher proportion of high-margin products. As Buldak Bokkeum Myun has established itself as a “premium K-ramen” in global markets, its pricing power has increased, and the structure in which derivative products like sauces and snacks boost profitability has become firmly established. The “spicy challenge” content that spread through social networking services (SNS) also contributed to raising brand awareness without incurring large-scale marketing expenses.

The Era of 2 Trillion Won in Korean Ramen Exports: Samyang Foods Accounts for 67%

Samyang Foods’ rapid growth is also reshaping the landscape of Korean ramen exports. This year, Korea’s ramen exports surpassed 2 trillion won for the first time ever. According to the Korea Customs Service, ramen exports from January to November this year reached 1.38176 billion US dollars (about 2.039 trillion won), already exceeding last year’s annual performance of 1.24838 billion US dollars. This marks the eleventh consecutive year of record ramen exports since 2015. Industry observers note that, unlike Nongshim, Samyang Foods is essentially built around an export-oriented structure. It is estimated that Samyang Foods accounts for more than 67% of Korea’s ramen export value. It is rare for a single brand to drive a country’s export performance to this extent.

The company’s headquarters relocation is also drawing attention. Next month, Samyang Foods will move its headquarters to a new building in Myeong-dong, Seoul. This move is aimed at strengthening global sales and marketing functions in line with the expansion of its overseas business. The location in Myeong-dong is also likely to serve as a symbolic space to increase engagement with foreign tourists.

Expansion of Miryang and China Factories... Positive Outlook for Performance Beyond Next Year

The outlook for next year is also bright. Samyang Foods is responding to rising global demand by expanding its production facilities both domestically and internationally. This year, the company completed its second Miryang plant, boosting its export-dedicated production capacity. Its first overseas production base, a factory in China, is scheduled for completion in January 2027. The Miryang 2nd plant, built three years after the Miryang 1st plant was completed in May 2022, is equipped with six production lines-three for pack noodles and three for cup noodles-and can produce about 830 million units annually. The securities industry estimates that Samyang Foods’ production capacity next year will reach 2.7 billion units per year and about 2.9 trillion won in value, assuming an average selling price (ASP) of 1,100 won per unit.

Supply in the Chinese market is also expected to become more stable once the local production base is completed. As of this year, Samyang Foods’ sales volume in China is estimated at about 600 million units. If annual sales increase by 20% each year, the figure is expected to exceed 1 billion units by 2028. This would represent a market share of 4-5% in the Chinese ramen market. Han Yoojeong, a researcher at Hanwha Investment & Securities, commented, “Walmart is the only major US distribution channel where Samyang Foods has achieved a placement rate of over 90%, and the average penetration rate in Chinese cities below tier-2 is less than 30%. Through expanded collaboration with global food and beverage franchise companies, the Buldak brand’s recognition and the performance of the sauce segment are expected to contribute significantly going forward.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.