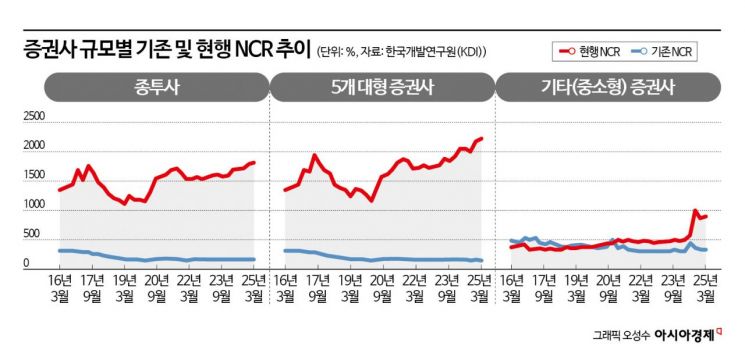

The Korea Development Institute (KDI), a state-run research institute, has suggested the need to introduce differentiated capital adequacy regulations that reflect the risks associated with the external growth of large securities firms. KDI believes it would be desirable to revert the current capital adequacy indicator, the Net Capital Ratio (NCR), for large securities firms to the pre-2016 calculation method to increase risk sensitivity, while maintaining the current regulations for small and medium-sized securities firms.

This perspective was included in the KDI Focus published by the Korea Development Institute (KDI) on December 17, in a report titled "Directions for Improving the Soundness Regulation of Securities Firms." Hong Jongsoo, a research fellow at KDI and author of the report, stated, "The systemic importance of large securities firms continues to rise as their assets and leverage expand," and added, "The current NCR system fails to reflect risks in its indicators even as leverage increases, thereby weakening the warning function of the regulation."

This concern stems from the fact that the current NCR system, which is used to assess the capital adequacy of securities firms, does not sufficiently capture the risks that accompany the external growth of these firms. Assets and leverage have been expanding rapidly, especially among large securities firms, leading to increased short-term funding through investments in derivatives, repurchase agreements (RP), and promissory notes. The average leverage ratio of all securities firms rose from 6.3 times in 2010 to 9.2 times in 2025, while large securities firms saw a relatively larger increase from 5.6 times to 9.4 times during the same period.

The current NCR system creates an illusion that the indicator improves as the firm's size increases, and fails to reflect risks when leverage rises, thereby weakening the warning function of the regulation. Hong pointed out, "Although large securities firms are rapidly increasing their systemic importance and market impact due to asset expansion and higher leverage, the current NCR does not adequately reflect these risks, which in turn contributes to an increase in the system risk of securities firms."

He recommended introducing a system that differentiates the intensity of regulations based on the size and business characteristics of securities firms. Major countries such as the United Kingdom and the European Union apply Basel-type liquidity regulations, such as the Liquidity Coverage Ratio (LCR), to large securities firms, while imposing only basic liquidity requirements on small and medium-sized firms, thereby operating a differentiated, importance-based liquidity regulation framework.

Considering these international trends, Hong argued that Korea should also consider implementing differentiated NCR requirements by size, while gradually expanding Basel III-type liquidity regulations such as the LCR for large securities firms, and introducing basic liquidity regulations for small and medium-sized firms.

Hong stated, "For large securities firms, it is necessary to revise the current NCR calculation method to the previous formula of operating net capital divided by risk amount in order to accurately reflect the risks associated with asset and leverage expansion." However, he added, "For small and medium-sized securities firms, a differentiated approach that maintains the current NCR is desirable, as imposing excessive capital adequacy requirements regardless of their size or business characteristics could be burdensome."

He further emphasized, "With the launch of the Integrated Investment Account (IMA) at the end of the year, the funding structure of securities firms will undergo further changes, and their asset size and market influence could expand even more. Therefore, it is time to systematically overhaul capital adequacy regulations to ensure that the expansion of securities firms' functions does not lead to excessive increases in systemic risk."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.