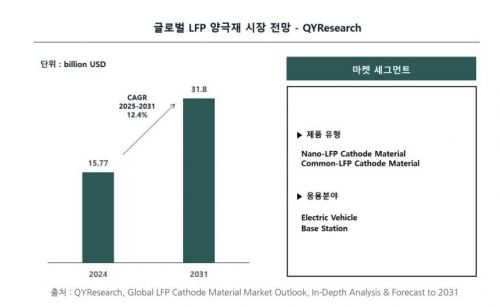

QY Research Report: Annual Growth of 12.4%

Steady Demand from ESS and Mass-Market EVs

Improvements in Energy Density Through Nanotechnology and High-Density Materials

Korean Companies Such as LN Energy & Future, POSCO, and Lotte Compete in

The lithium iron phosphate (LFP) cathode material, which is increasingly being used in energy storage systems (ESS) and mass-market electric vehicles, is projected to grow at an annual rate of 12.4%. Analysis indicates that LFP cathode materials are overcoming their performance gap with ternary cathodes through nanotechnology and increased density. Following China, domestic materials companies are also actively entering mass production of LFP cathode materials.

On December 17, market research firm QY Research projected that the LFP cathode material market, valued at $15.77 billion (approximately 23.25 trillion won) in 2024, will grow at an average annual rate of 12.4%, reaching $31.8 billion (about 46.8 trillion won) by 2031.

LFP cathode material refers to cathode materials that use lithium iron phosphate (LFP, LiFePO₄) as the active material. Compared to nickel- and cobalt-based ternary cathodes, they offer advantages such as thermal stability and long cycle life. Although their energy density is lower, they are less expensive because they do not use costly rare metals.

LFP cathode materials are generally produced through solid-state or hydrothermal synthesis. Technologies such as particle morphology control, doping, and carbon coating are used to enhance conductivity and performance. LFP cathode materials have a stable olivine crystal structure, providing excellent structural stability during charging and discharging.

Due to these characteristics, batteries equipped with LFP cathode materials are increasingly preferred for stationary ESS, mass-market electric vehicles, and electric buses, leading to rising demand. In particular, Chinese companies are dominating the global market by significantly reducing production costs through large-scale manufacturing capabilities and supply chain integration. Outside of China, usage is also increasing due to the cost-effectiveness, long lifespan, and excellent thermal stability of LFP cathode materials.

QY Research identified several factors driving the global growth of LFP cathode materials in the lithium-ion battery market: automakers’ efforts to reduce supply chain risks associated with cobalt and nickel; advancements in materials engineering such as nanosizing, surface modification, and lithium manganese iron phosphate (LMFP); the expansion of renewable energy and modernization of power grids; and the acceleration of local LFP production in regions like North America and Europe.

In particular, the recent emergence of nano LFP cathode materials is improving electrochemical performance. Nano LFP refers to materials manufactured at the nanometer (nm) scale or designed with nanostructures. These nanosized particles feature increased surface area, shorter lithium-ion diffusion paths, and enhanced electrical conductivity. As a result, they improve charging speed, power density, and cycle life.

LFP cathode materials are evolving into next-generation materials with significantly improved compaction density. Fourth-generation products (with a powder compaction density of 2.6-2.7g/cm³) have already been commercialized on a large scale, and fifth-generation products (with a powder compaction density of 2.70g/cm³ or higher) are also being introduced. These advancements are expected to improve the energy density and charging speed of batteries, making LFP cathode materials competitive with nickel cobalt manganese (NCM) cathode materials.

China’s Dynanonic succeeded in developing fifth-generation high-performance LFP in September and has entered the pilot production stage. Hunan Yuneng has launched its fifth-generation high-voltage, high-capacity LFP cathode material (YN-13 series). This product increases voltage from 3.2V to 3.8V and achieves an energy density of 220Wh/kg, and is already being mass-produced for use in semi-solid batteries.

With the continued growth of the LFP market, domestic companies are also actively developing LFP cathode materials. Starting in 2026, Korean companies are expected to begin full-scale mass production of LFP cathode materials.

Lotte Energy Materials completed a pilot line for LFP cathode materials with an annual capacity of 1,000 tons at its second plant in Iksan, North Jeolla Province, in January. The company is currently developing third- and fourth-generation LFP cathode materials and aims to begin mass production in 2026.

LN Energy & Future has begun construction of an LFP cathode material plant in Daegu, aiming for an annual production capacity of 60,000 tons starting in the second half of 2026. The company is also considering building an LFP cathode material plant in Michigan, USA. If confirmed, the US plant will begin construction in 2026 and target mass production from 2027.

POSCO Future M has decided to build a dedicated LFP cathode material plant in the Yeongilman 4 General Industrial Complex in Pohang through additional investment in CNP New Material Technology, a joint venture with China’s CNGR. Construction will begin in 2026, with mass production scheduled for the second half of 2027. Separately, the company plans to convert part of the NCM cathode material production line at its Pohang plant for LFP production, with supply to begin at the end of 2026.

EcoPro completed a cathode material plant in Debrecen, Hungary last month. Starting in 2026, the company plans to expand its portfolio from high-nickel ternary cathode materials such as NCA and NCM to include LFP cathode materials.

LG Chem is developing LFP cathode materials for use in electric vehicles and ESS. The company plans to commercialize the business after verifying new process technologies that enable the use of non-Chinese raw materials.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)