"Much-Hyped" Pinkfong Hits Record Low After Listing

Shares Mirror The Born Korea's Performance After Last November's IPO

8 Trillion Won Raised in IPO Subscription on "Baby Shark" Fame

Stock Price Falls Below Offering Price After Listing

The Pinkfong Company, which made its debut on the KOSDAQ market on November 18, has seen its stock price hit a record low since its listing. Despite attracting over 8 trillion won in deposits during the pre-listing public offering subscription, the stock has performed poorly since going public. Some observers are noting that, much like The Born Korea, which was listed on the Korea Exchange in November last year, The Pinkfong Company has failed to live up to its name value.

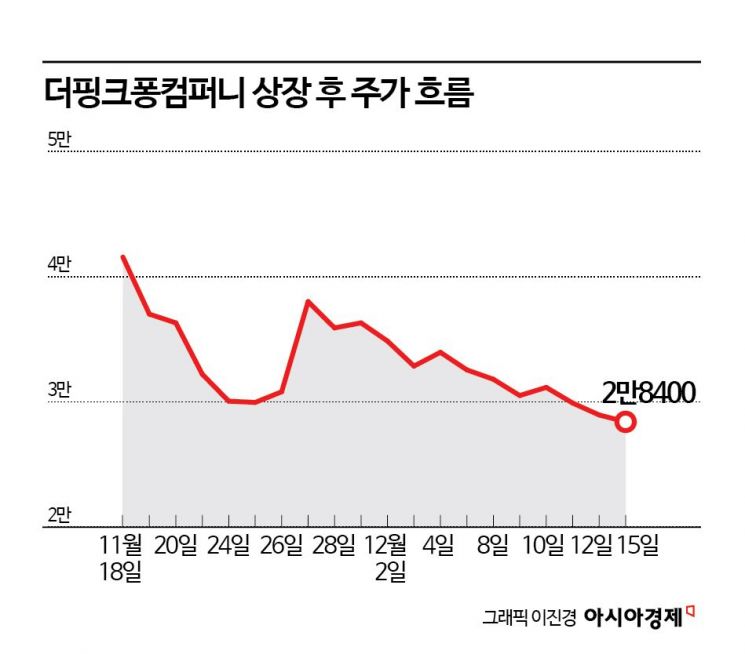

According to the financial investment industry on December 16, The Pinkfong Company’s share price has dropped 25.3% in just one month since listing, compared to the initial offering price of 38,000 won. The previous day, the stock closed at 28,400 won, marking its lowest price since the listing. Compared to the highest price of 61,500 won recorded on the first day of trading, the price has plunged by more than 50%. Individual investors, who put their faith in Baby Shark, purchased shares worth 119.6 billion won after the listing, but are now facing a valuation loss rate of 33.7%.

Founded in 2010, The Pinkfong Company entered the domestic stock market on the back of the global success of the YouTube video "Baby Shark Dance," which holds the record for the most views worldwide. From October 28, the company conducted a five-day demand forecast for institutional investors and set the offering price at the upper end of the desired range. The enthusiasm continued with the public offering subscription for general investors. Over the two days from November 6 to 7, subscriptions were received for 423.43 million shares. The deposit for the subscription reached approximately 8.0452 trillion won.

On November 18, at the Korea Exchange in Yeongdeungpo-gu, Seoul, officials are taking a commemorative photo after presenting the listing commemorative plaque at The Pinkfong Company's KOSDAQ market listing ceremony. Photo by Yonhap News Agency

On November 18, at the Korea Exchange in Yeongdeungpo-gu, Seoul, officials are taking a commemorative photo after presenting the listing commemorative plaque at The Pinkfong Company's KOSDAQ market listing ceremony. Photo by Yonhap News Agency

As The Pinkfong Company prepared for its listing, expectations for its stock price on the first day soared, fueled by the popularity of its next-generation intellectual property (IP), "Sealook," which was launched on Netflix. On November 13, The Pinkfong Company announced that Sealook had made it into the "Top 10" in nine countries worldwide, generating significant buzz.

On its listing day, November 18, the stock opened at 58,000 won, up 52.6% from the offering price. It rose to 61,500 won early in the session before closing at 41,550 won. The following day, the share price dropped more than 10%, quickly falling below the offering price. Aside from a surge of over 20% on November 27, the stock has continued to decline without any significant rebound.

The financial investment industry has pointed out that the sluggish performance of The Pinkfong Company’s stock is similar to that of The Born Korea, which was listed on the Korea Exchange a year ago. On November 6 last year, The Born Korea was listed with an offering price of 34,000 won. At the time, The Born Korea CEO Paek Jongmin drew attention by appearing on the Netflix variety show "Black and White Chef." Paek’s popularity positively influenced The Born Korea’s listing. However, contrary to expectations, the stock price trended downward after the listing and fell below the offering price within about a month.

An industry official commented, "Fame does not always guarantee success in the initial public offering (IPO) market," adding, "The higher the expectations before listing, the greater the pressure on the stock price after going public."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.