Big Tech Ramps Up Bond Market Funding for AI Investments

Recent Surge in Investment-Related Debt Compared to Early This Year

Investors Increase CDS Trading to Hedge Against Risks

In the United States, there has been a recent surge in trading of products that pay compensation in the event of corporate defaults. This trend is interpreted as investors seeking to hedge their portfolios amid fierce competition in artificial intelligence (AI) investments, in case the bubble bursts.

According to the Financial Times (FT) on December 15 (local time), the Depository Trust & Clearing Corporation (DTCC) announced that trading volume of credit default swaps (CDS) focused on U.S. tech companies has soared by 90% compared to early September. CDS are financial derivatives that allow bond investors to hedge against the risk of an issuer's default.

FT explained that the sharp increase in CDS trading volume indicates that some investors are concerned about bonds issued by tech companies for AI investments. Global tech firms are raising capital by issuing large amounts of bonds for AI investments, but it takes a long time to realize returns.

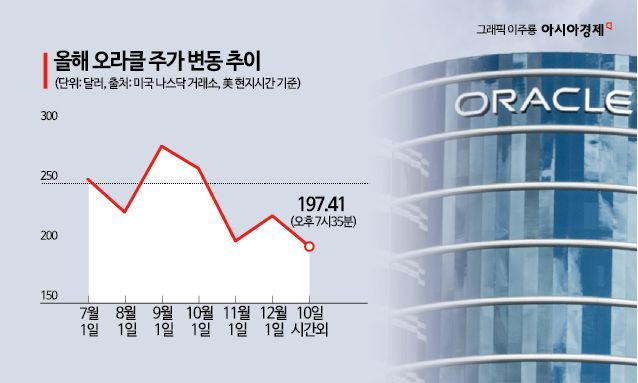

This movement became particularly pronounced after last week's earnings announcements from Oracle and Broadcom. On December 10 (local time), Oracle announced after the market closed that its revenue for the previous quarter was $16.06 billion, falling short of the market expectation of $16.21 billion. The next day, Oracle's stock price plummeted by 10.83%.

Broadcom, in particular, experienced a classic "panic sell" phenomenon, with its stock price plunging more than 11% despite reporting better-than-expected results for the previous quarter and providing an optimistic outlook for the current quarter.

The increase in CDS trading volume was especially notable for Oracle and CoreWeave. Recently, investors have been analyzing the financial conditions of companies investing in AI in connection with demand for semiconductors and data centers, which appears to have influenced the trend. Both companies are raising billions of dollars in debt to expand their data center capacity.

Nathaniel Rosenbaum, investment-grade credit strategist at JPMorgan, said, "This quarter, there has been a significant increase in individual company CDS trading volume, particularly among hyperscaler companies building large-scale data centers across the United States."

Moreover, the formation of a new market after Meta issued $30 billion in bonds in October to fund AI projects has also played a role. Earlier this year, tech companies financed their AI investments with massive cash reserves and solid earnings, resulting in minimal demand for CDS on highly rated U.S. companies.

The mood in the CDS market shifted when big tech companies began tapping the bond market to address rising costs. Meta, Amazon, Alphabet, and Oracle collectively raised $88 billion this fall to fund AI projects. JPMorgan predicts that investment-grade companies will raise $1.5 trillion by 2030.

Bri Kurana, portfolio manager at Wellington, pointed out, "Single-name CDS are in the spotlight," adding, "Banks and private equity funds are exposed to much greater risks on an individual company basis." She continued, "Investors are seeking insurance on their investment assets to mitigate these risks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)