Solid AI Earnings Signal a Pause, Not a Bubble

Global 'Rate Tantrum' Possible Amid Rising U.S. Long-Term Yields

Concerns Grow Over 'Triple Weakness' in Korean Stocks, Bonds, and Currency

The recent earnings announcements from Oracle in the United States and Broadcom have reignited concerns about an artificial intelligence (AI) bubble. Although risks related to debt and capital expenditure among major AI companies have resurfaced, analysts note that these are not significant burdens as long as earnings remain solid. Instead, they suggest that the ongoing rise in long-term U.S. Treasury yields is a more pressing concern.

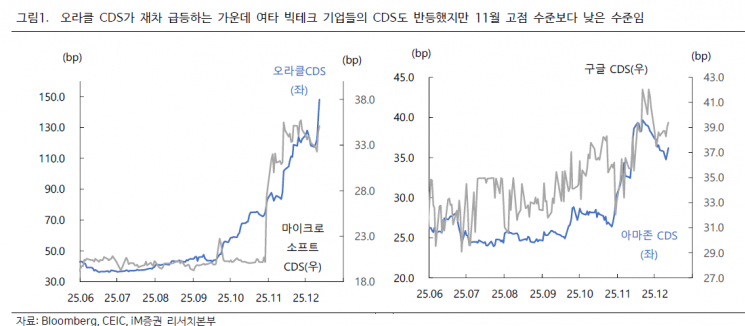

On December 15, iM Securities stated that while the AI bubble debate is unlikely to be resolved immediately, the financial and asset markets are not expected to experience the same level of instability or volatility as last month. The AI bubble theory was reignited last week following the earnings releases from Oracle and Broadcom. After Oracle's earnings announcement, its credit default swap (CDS) premium surged by 28.8 basis points (bp; 1 bp = 0.01%), surpassing its previous high and approaching the record levels seen during the global financial crisis.

Despite this, iM Securities views the AI bubble concerns as "overblown." While some big tech companies' earnings disappointed the market, the risk of a credit crunch spreading, as it did last month, appears limited.

First, AI companies' earnings are backed by real performance. Although the results were not strong enough to fully dispel concerns over increased capital expenditures and profitability, they are not as weak as those seen during the dot-com bubble. However, it is expected to take some time before earnings meet market expectations. Rather than a "bubble burst," the current situation is more likely to result in a temporary cooling of the AI frenzy.

Park Sanghyun, a researcher at iM Securities, commented, "It is particularly important to note that, unlike last month, concerns about an AI bubble or profitability issues stemming from increased capital expenditures are not spreading across the major big tech companies." He added, "While Oracle's CDS has surged, CDS premiums for other big tech firms have only rebounded slightly and remain below last month's highs."

Short-term liquidity crunches and heightened credit risk, similar to those seen last month, have also emerged. However, the overall atmosphere is stabilizing. Despite the spike in Oracle's CDS, U.S. credit spreads continue to trend downward. The U.S. dollar has also weakened compared to last month. There is no sign of a renewed flight to safe assets as was seen previously. Even the stock prices of regional banks, which contributed to last month's financial market anxiety, have rebounded, indicating that credit risk concerns are easing.

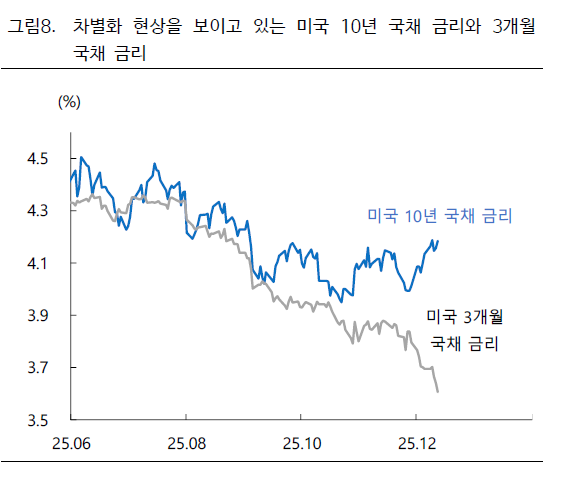

Expectations for increased market liquidity are also rising. Although there were concerns about a hawkish rate cut, this month's Federal Open Market Committee (FOMC) meeting had a distinctly dovish tone. The Federal Reserve implemented a Reserve Management Purchase (RMP) program, buying short-term Treasury securities and alleviating concerns over a liquidity squeeze in the market. Yields on short-term Treasuries have dropped significantly, and Bitcoin is stabilizing around the $90,000 mark.

Researcher Park explained, "By injecting liquidity into the short-term funding market early, the Federal Reserve is likely to reduce the risk of a credit crunch and related credit concerns. This will also help prevent the spread of the AI bubble narrative."

What is even more concerning is the upward trend in long-term U.S. Treasury yields. Despite additional rate cuts and short-term liquidity injections by the Federal Reserve, the yield on the 10-year U.S. Treasury remains at levels similar to those seen before this month's FOMC meeting. In fact, there is potential for further increases, as the European Central Bank (ECB) and the Bank of Japan (BOJ) both have monetary policy meetings scheduled this week.

If the ECB adopts a hawkish stance and the Bank of Japan not only raises rates but also signals further increases, long-term government bond yields in major countries, led by the United States, could rise further. This would heighten tension not only in the bond market but also across major asset markets. There is even the possibility of a "rate shock" triggered by surging long-term yields.

Researcher Park predicted, "If we see a synchronized rise in long-term yields among major economies led by the United States, the won-dollar exchange rate, which is already near its yearly high, could surpass its previous peak. This could result in a 'triple weakness' scenario in the domestic financial market, with simultaneous declines in stocks, bonds, and the value of the Korean won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.