Contingency Reserves of Five Major Insurers Reach 7.41 Trillion Won in Q3

Up 450 Billion Won from Last Year amid Large Fires and Aircraft Accidents

Dividend Capacity Impacted... "Further Deregulation Needed"

The emergency risk reserves of major domestic insurance companies have increased by nearly 450 billion won this year alone. This is attributed to a series of major incidents in recent years, including large building collapses, fires caused by climate change, and aircraft crashes. This trend is also expected to negatively impact insurance company dividends.

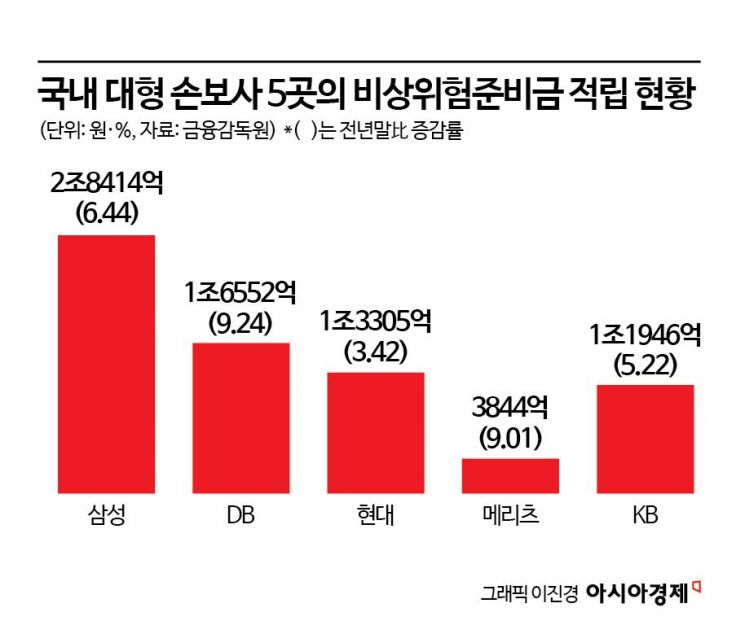

According to the financial sector on the 15th, the emergency risk reserves of the five major non-life insurers (Samsung, DB, Hyundai, Meritz, and KB) stood at 7.4061 trillion won in the third quarter of this year, up 6.43% (447.2 billion won) from 6.9589 trillion won at the end of last year. Emergency risk reserves are funds that insurance companies accumulate to prepare for unexpected incidents such as major accidents or natural disasters. While these are classified as capital as a type of retained earnings that are returned after a certain period, they are set aside for emergencies, making them less liquid.

By company, Samsung Fire & Marine Insurance held the largest emergency risk reserve at 2.8414 trillion won, followed by DB Insurance (1.6552 trillion won), Hyundai Marine & Fire Insurance (1.3305 trillion won), KB Insurance (1.1946 trillion won), and Meritz Fire & Marine Insurance (384.4 billion won).

Emergency risk reserves are accumulated by applying a certain percentage to premiums collected from six sectors: fire, marine, automobile, surety, special risk, and overseas inward and outward reinsurance. If the number of accidents in these sectors increases, the loss ratio rises, which in turn leads to higher premiums and an increase in emergency risk reserves. In recent years, there have been frequent major accidents in Korea. These include last year's Jeju Air passenger plane crash, as well as this year's fires in Sancheong, Gyeongnam and Uiseong and Andong in Gyeongbuk, the Kumho Tire Gwangju plant fire, and the E-Land Cheonan logistics center fire.

Recently, there are projections that emergency risk reserves will increase further due to the sharp rise in automobile insurance loss ratios. From January to October this year, the cumulative automobile insurance loss ratio for the five major non-life insurers was 85.5%, up 4.2 percentage points from 81.3% during the same period last year. This exceeds the break-even point for automobile insurance loss ratios among major insurers (82%). Excluding Meritz Fire & Marine Insurance, which has a low proportion of automobile insurance, the emergency risk reserves of the remaining four major insurers could reach an all-time high this year.

As the amount of emergency risk reserves that must be accumulated increases, insurance companies' capacity to pay dividends decreases accordingly. This is because, under the Insurance Business Supervision Regulation, even among statutory reserves, emergency risk reserves must be accumulated before surrender value reserves. Surrender value reserves are funds set aside by insurers in case customers cancel their policies early, and have recently been a factor eroding insurers' dividend capacity.

Financial authorities have recently decided to ease the burden by announcing plans to revise the "Detailed Enforcement Rules for the Supervision of Insurance Business," which will update the standard rates and accumulation limits for emergency risk reserves based on recent experience statistics. For standard rates, the automobile insurance rate will be reduced from 2% to 1%, surety insurance from 15% to 10%, and special risk insurance from 5% to 3%. The applicable percentage of premiums for accumulation will also be lowered: automobile insurance from 40% to 35%, surety insurance from 150% to 120%, special risk insurance from 50% to 40%, and overseas inward and outward reinsurance from 50% to 45%. The financial authorities plan to collect insurers' opinions by today and reflect the changes in the year-end settlement.

However, some insurers argue that further regulatory easing is necessary to secure dividend capacity. An industry official stated, "There is a need to further relax the standards for accumulating and returning emergency risk reserves, as well as to improve surrender value reserves," adding, "If the current regulations remain, it is highly likely that more than half of listed insurers will not be able to pay dividends this year as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)