Controversy Over "New Government-Led Finance" Follows Remarks at Group Chairmen's Meeting

Criticism Grows Over Calls for National Pension Service-Nominated Outside Directors as "Governance Intervention"

Tensions Rise Ahead of Regular Board Chair

Lee Chanjin, Governor of the Financial Supervisory Service, recently made remarks regarding the composition of outside directors at financial holding companies, stating that "the nomination process should include representatives from institutions that represent the entire nation." This has caused a significant stir in the financial sector. Tensions are rising further as he is also scheduled to hold a meeting with the chairpersons of boards of directors. Although this meeting is a regular year-end event, it comes immediately after the spread of controversy over the so-called "new government intervention in finance," leading the industry to closely watch for any additional messages that may emerge from this gathering.

Lee Chanjin, Governor of the Financial Supervisory Service, is speaking at the meeting between the Governor of the Financial Supervisory Service and the Chairmen of Financial Holding Companies held at the Korea Federation of Banks in Jung-gu, Seoul, on the afternoon of the 10th. Attending the meeting were Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group; Lee Chanwoo, Chairman of Nonghyup Financial Group; and Hwang Byungwoo, Chairman of iM Financial Group. Photo by Yonhap News

Lee Chanjin, Governor of the Financial Supervisory Service, is speaking at the meeting between the Governor of the Financial Supervisory Service and the Chairmen of Financial Holding Companies held at the Korea Federation of Banks in Jung-gu, Seoul, on the afternoon of the 10th. Attending the meeting were Yang Jonghee, Chairman of KB Financial Group; Jin Okdong, Chairman of Shinhan Financial Group; Ham Youngjoo, Chairman of Hana Financial Group; Lim Jongryong, Chairman of Woori Financial Group; Lee Chanwoo, Chairman of Nonghyup Financial Group; and Hwang Byungwoo, Chairman of iM Financial Group. Photo by Yonhap News

According to the financial industry on December 12, the Financial Supervisory Service has notified the board chairpersons of the eight major financial holding companies-KB, Shinhan, Hana, Woori, NH Nonghyup, iM, BNK, and JB-about the upcoming meeting. The meeting between the Governor of the Financial Supervisory Service and the board chairpersons is an annual year-end event. However, this year, the schedule has been delayed, making it likely to be held around January next year. An official from the Financial Supervisory Service said, "Since we just held a meeting with the group chairmen, there is a scheduling burden," adding, "It will be difficult to convene the chairpersons in December."

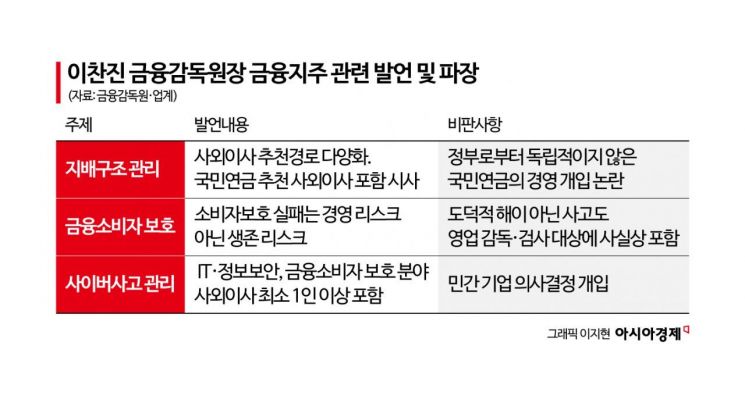

Despite being a regular event, news of this notification has fueled concerns within the financial sector about "new government intervention in finance." At the meeting with the financial holding group chairmen on the 10th, Governor Lee emphasized the need to improve governance, calling for diversification of the nomination channels for outside directors, particularly by including those recommended by the National Pension Service. Many in the financial sector have criticized this as a signal that the supervisory authority is directly intervening in the composition of private financial holding company boards.

The National Pension Service is a quasi-governmental institution under the Ministry of Health and Welfare and is not free from political influence. During the Moon Jae-in administration, there was controversy over the National Pension Service's intervention in the management of listed companies during the introduction of the stewardship code. The renewed proposal to involve the National Pension Service in the nomination of outside directors for financial holding companies is therefore a sensitive issue in the industry. The National Pension Service is also a major shareholder in key holding companies, with stakes of 8.28% in KB Financial Group, 9.13% in Shinhan Financial Group, 8.77% in Hana Financial Group, and 6.56% in Woori Financial Group. Moreover, the fund management committee, which manages assets of around 1,300 trillion won, is often referred to as the "president of the capital market." This is why there is backlash and concern in the industry that an institution with weak political neutrality expanding its influence over the governance of private financial firms through the appointment of outside directors is undesirable.

Another point of controversy is Governor Lee's request that at least one outside director specializing in information technology, information security, or financial consumer protection be included. While Governor Lee has consistently emphasized that "failure to protect consumers is a survival risk," making the rationale clear, there are concerns that this could be seen as direct intervention by the supervisory authority in board composition.

The current supervisory and inspection stance is also increasing unease in the financial sector. The Financial Supervisory Service has maintained a tough approach, targeting not only internal employee embezzlement and other moral hazards but also electronic financial incidents caused by external hacking for sanctions and inspections. Recent intensive inspections and suggested sanctions against electronic financial service providers such as Lotte Card and Coupang Pay are prime examples.

Furthermore, Governor Lee's remarks during a National Assembly audit, where he singled out a specific financial holding company by saying, "There are many unusual aspects, so we are keeping a close watch. If there are issues, we will conduct ad hoc inspections," have also sparked controversy. Afterward, the company in question re-nominated its current chairman as a candidate for the next term. Although Governor Lee explained, "It was not intended as management intervention," it is reported that even within the Financial Supervisory Service, there were many who believed that the remarks unnecessarily triggered the debate over government intervention.

Amid these developments, with the board chairpersons' meeting scheduled to follow the recent group chairmen's meeting, the financial sector is feeling a sense of pressure. Industry insiders say, "Even though it is a regular meeting, given that it is taking place while the repercussions of recent remarks have not yet subsided, we cannot rule out the possibility of additional demands or messages being issued," expressing their unease.

An official from the financial industry commented, "It is quite unsettling that the head of the supervisory authority, who previously served as a member of the National Pension Service's fund management committee and was deeply involved in decision-making, is now demanding that financial holding companies include National Pension Service personnel as outside directors. If the supervisory authority's intervention in decision-making becomes routine in line with the political community's 'coexistence finance' policy direction, the controversy over new government intervention in finance will only intensify."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)