KODEX Silver Futures (H) ETF up 97% this year

Silver futures surpass $60 per ounce on New York Commodity Exchange

Rising expectations drive interest in silver-related ETFs

On the New York Mercantile Exchange (COMEX), silver futures prices have surpassed $60 per ounce. As international silver prices continue to rise, interest in exchange-traded funds (ETFs) that allow investment in silver is also growing.

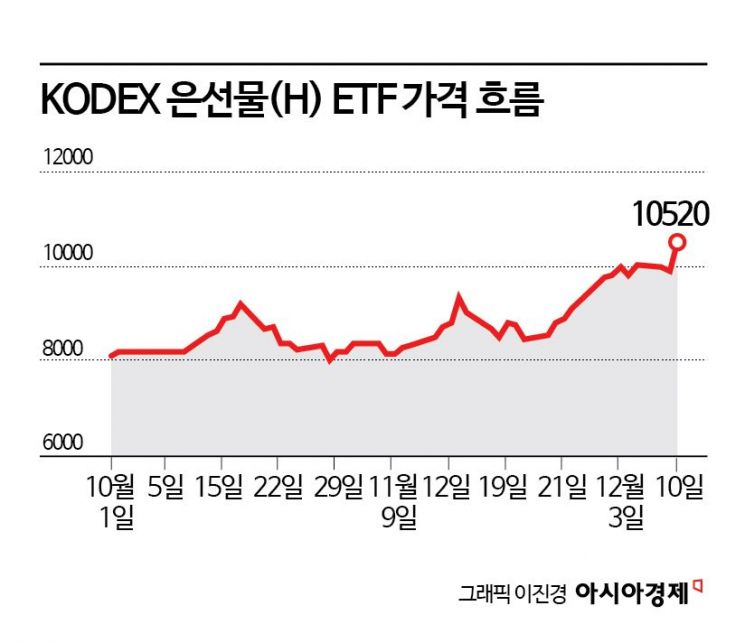

According to the financial investment industry on December 11, the KODEX Silver Futures (H) ETF has risen by 96.6% so far this year. The assets under management (AUM) of the KODEX Silver Futures (H) ETF, launched by Samsung Asset Management in July 2011, have exceeded 300 billion won. KODEX Silver Futures (H) is the only ETF in Korea that allows investors to focus exclusively on silver.

An official is showing a silver bar at the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul. Photo by Yonhap News Agency

An official is showing a silver bar at the Korea Gold Exchange Jongno Main Branch in Jongno-gu, Seoul. Photo by Yonhap News Agency

Individual investors who prefer assets with a medium- to long-term industrial demand base while reducing inflation risk through safe-haven investments are making aggressive buy orders. The cumulative net purchases by individuals this year have reached 136 billion won.

Kim Sunhwa, Team Leader of ETF Management 2 at Samsung Asset Management, analyzed, "The recent rise in silver prices is not a short-term event, but rather a trend stemming from structural changes based on industrial demand."

On December 9 (local time), silver futures on the New York Mercantile Exchange (COMEX) closed at $60.84 per ounce. The reason silver prices, which were trading below $30 per ounce at the beginning of this year, have more than doubled is due to increased industrial demand.

As silver is classified as both a safe-haven asset and an industrial commodity, the upward trend in its price is expected to continue. Hwang Byungjin, a researcher at NH Investment & Securities, stated, "We are raising our forecast range for next year's silver price to $45-$70 per ounce, up from the previous estimate of $40-$60 per ounce," and explained, "As long as expectations for monetary policy easing by the US Federal Reserve and a weak dollar index persist, the investment appeal remains valid." He added, "From a global fundamentals perspective, there is sufficient momentum for silver prices to rise," and "With inventories in China, the largest producer and consumer of silver, declining, a silver supply shortage is expected to continue for the fifth consecutive year."

There are not many options for investing in rising silver prices in Korea. One of the easiest ways to invest is through ETFs. Mirae Asset Global Investments operates the TIGER Gold & Silver Futures (H) ETF, which invests 90% in gold, a representative safe-haven asset, and 10% in silver, which has high industrial demand.

A representative from Mirae Asset Global Investments explained, "Due to a structural supply deficit in the silver market and the simultaneous expansion of industrial and investment demand, upward pressure is likely to persist in the medium term." The representative added, "If monetary policy easing by the Federal Reserve occurs, investment demand could be further strengthened." He continued, "The US designation of silver as a critical mineral and low inventory levels in China could act as factors that intensify regional supply-demand imbalances."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.