The Era of Artificial Intelligence Brings Greater Legal and Ethical Responsibilities for Financial Companies

Calls Emerge for the Introduction of AI Accountability Charts

As the era of artificial intelligence (AI) becomes fully established, there are growing expectations that financial institutions will face significantly greater governance burdens, including heightened ethical and legal responsibilities. There are also calls for financial companies to prepare accountability charts specifically for AI and to further refine their internal control systems in anticipation of stricter governance-related regulations.

Financial Services Commission to Announce AI Guidelines for Financial Sector Next Year

According to industry sources on December 10, the Financial Services Commission plans to release AI guidelines for the financial sector next year. The commission is currently preparing new AI guidelines that will integrate the AI Operations Guidelines for the Financial Sector, first published in 2021, and the Financial AI Security Guidelines, which were released in 2023.

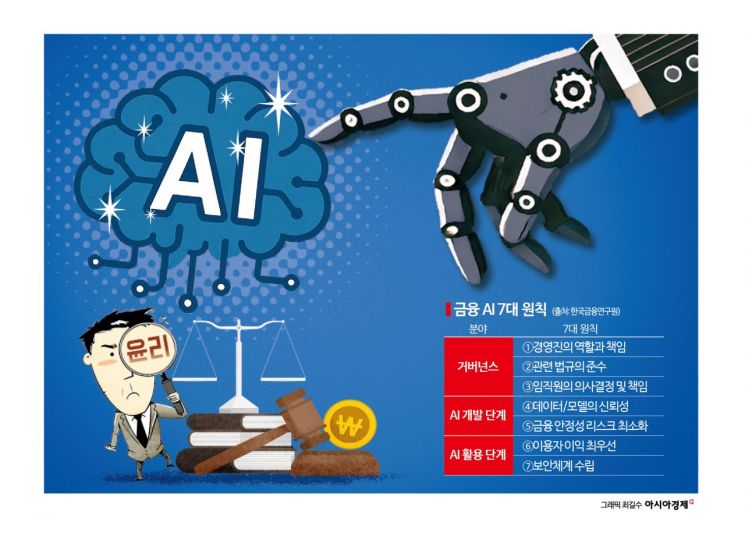

The AI guidelines from the Financial Services Commission are expected to include extensive measures to strengthen the governance of financial institutions. The commission has decided to consolidate the guidelines based on seven core principles, three of which are directly related to governance: assigning various internal control obligations to management, ensuring compliance with relevant laws and regulations, and holding executives and employees accountable for outcomes.

The Korea Institute of Finance has forecast that the AI guidelines for the financial sector, set to be announced next year by the Financial Services Commission, are likely to include requirements such as establishing detailed internal control systems for management responsibilities, implementing compliance verification procedures, and introducing accountability charts to clarify responsibility for outcomes.

The "AI Basic Act," which is scheduled to take effect next year under the leadership of the Ministry of Science and ICT, will also add to the regulatory burden for financial institutions. According to the enforcement decree of the AI Basic Act, as announced by the ministry, banks that wish to use AI for loan screening in the future will be subject to a variety of new obligations, including developing risk management measures. The Financial Supervisory Service is also reportedly planning to establish a dedicated organization to oversee the management and supervision of AI at financial institutions in line with the implementation of the AI Basic Act.

Seo Byungho, Senior Research Fellow at the Korea Institute of Finance, stressed that domestic financial institutions should proactively pursue AI Transformation (AX) in response to the rapidly changing environment surrounding AI. At the same time, he pointed out the need to minimize regulatory risks by strengthening AI governance and third-party risk management.

In fact, major banks such as KB Kookmin Bank, Hana Bank, and NH Nonghyup Bank are independently advancing their AI governance frameworks. These banks plan to overhaul their related systems in accordance with the AI Basic Act and the upcoming AI guidelines, both of which are scheduled to take effect next year.

Senior Research Fellow Seo particularly emphasized the necessity for financial institutions to create accountability charts related to AI. An accountability chart is a system that documents the internal control and risk management responsibilities of executives at financial institutions, clearly designating those responsible. It is designed to clarify lines of responsibility and thereby minimize the occurrence of financial accidents, and its content should be updated to reflect the realities of the AI era.

Seo stated, "In preparation for the strengthening of governance obligations under the AI guidelines for the financial sector, financial institutions need to establish AI-related accountability charts," adding, "Their related internal control systems also need to be refined with greater sophistication."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.