Amendment to the Restriction of Special Taxation Act Passes National Assembly Plenary Session

Tax Rates Eased Compared to Initial Draft, Implementation Timeline Moved Up

Shift of Funds from Interest Income to Dividend Income Expected from 1Q Next Ye

With the ruling and opposition parties reaching an agreement on the separate taxation of dividend income, the new policy is expected to be applied to dividends paid out starting next year. As funds move from interest income products such as savings and time deposits to dividend stocks, there are expectations that this will have a positive impact on the domestic stock market’s supply and demand dynamics.

According to the financial investment industry and political circles on December 5, the amendment to the Restriction of Special Taxation Act, which includes the separate taxation of dividend income, passed the National Assembly’s plenary session on December 2. Previously, if the combined amount of dividend and interest income exceeded 20 million won, income tax rates of up to 45% were imposed. With this legal revision, dividend income will now be subject to a separate tax rate.

In the initial draft, a 35% tax rate (38% including local taxes) was to be applied to dividend income exceeding 3 billion won. However, the revised bill has somewhat eased these rates: ▲ 25% (27.5% including local taxes) for dividend income between 3 billion and 5 billion won, and ▲ 30% (33% including local taxes) for income exceeding 5 billion won.

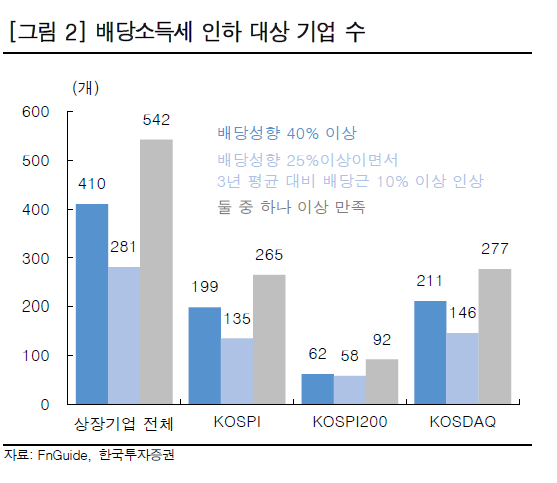

However, the requirements for companies eligible for separate taxation have become stricter. The condition for dividend growth compared to the three-year average has been raised from 5% to 10%.

The effect of the dividend income tax reduction is expected to be implemented immediately starting next year. In the initial bill, the separate taxation was to apply to business years beginning in 2026, meaning it would have affected dividends paid after April, when first-quarter dividends are distributed. However, under the revised bill, it will apply to dividends paid starting next year, including fourth-quarter dividends for this year, which will be paid in March next year. Although the number of companies paying quarterly dividends has increased, more than 60% of annual dividends from domestic companies are still concentrated in the fourth quarter. Therefore, the inflow of funds seeking tax savings is expected to appear as early as the first quarter of next year.

A significant shift of funds from interest income to dividend income is anticipated. With the separate taxation of dividend income, the attractiveness of dividend income has increased sharply compared to interest income for investors who earn more than 20 million won in financial income such as interest and dividends.

Yeom Dongchan, a researcher at Korea Investment & Securities, analyzed, "As of 2023, the total annual interest income for taxpayers earning more than 20 million won in interest income is about 10.7 trillion won, and the corresponding deposits, even conservatively estimated, exceed 200 trillion won." He added, "From the middle of the first quarter next year, funds are expected to move from interest income to dividend income, which will have a positive impact on the domestic stock market’s supply and demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)