Bank Capital Ratios Deteriorate as Exchange Rate Surges Above 1,400 Won in Q3

Concerns Mount Over Further Decline in Financial Soundness Amid Continued Exchange Rate Rise in Q4

During the third quarter, the rise in the won-dollar exchange rate led to a slight decline in the financial soundness of domestic banks. As the upward trend in the exchange rate continues into the fourth quarter, there are concerns that financial soundness indicators may continue to deteriorate.

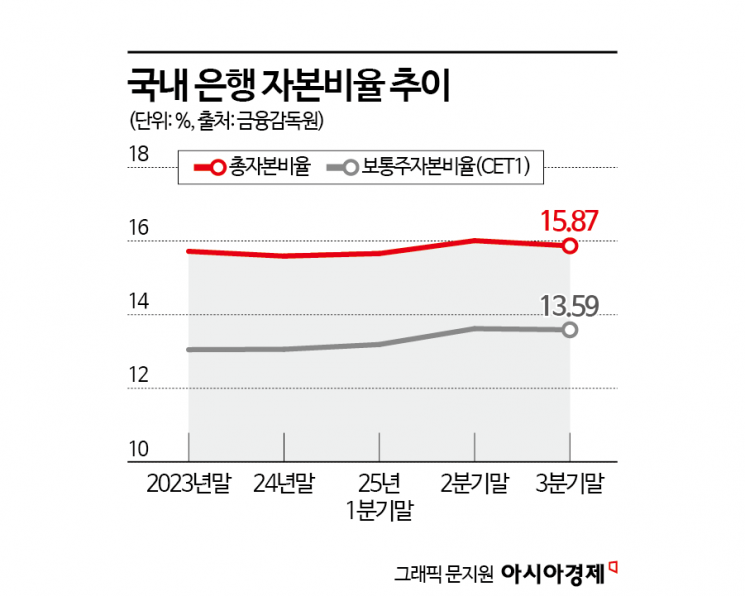

According to the “Status of Bank Holding Companies and Banks’ BIS Capital Ratios as of the End of September (Provisional),” released by the Financial Supervisory Service on December 5, the Common Equity Tier 1 (CET1) ratio of domestic banks at the end of the third quarter stood at 13.59%, down 0.03 percentage points from the previous quarter. During the same period, the total capital ratio also fell by 0.14 percentage points to 15.87%.

The BIS capital ratio, which measures a bank’s capital as a proportion of its total risk-weighted assets, is a key indicator of a bank’s financial health. In particular, the CET1 ratio is used not only to assess capital soundness but also as a major benchmark for decisions regarding shareholder returns such as dividends and share buybacks or cancellations. Regulatory standards set by supervisory authorities are 8.0% for the CET1 ratio, 9.5% for the Tier 1 capital ratio, and 11.5% for the total capital ratio.

The sharp rise in the won-dollar exchange rate in the third quarter contributed to the deterioration of banks’ financial soundness. An increase in the exchange rate results in a higher value of risk-weighted assets (RWA) denominated in dollars, which in turn lowers banks’ capital ratios and net income. The won-dollar exchange rate, which was in the mid-1,300 won range in early July, surpassed 1,400 won by the end of September. In the fourth quarter, it has climbed to the 1,470 won range, further raising concerns about capital ratios.

By institution, Citibank Korea, Standard Chartered Korea, KakaoBank, Export-Import Bank of Korea, and Toss Bank all recorded CET1 ratios above 14%. KB Financial Group, Hana Financial Group, and Shinhan Financial Group also posted relatively high levels, with ratios above 13%. While major domestic banks are considered to have stable financial structures that exceed regulatory requirements, the high exchange rate remains a risk factor for their soundness.

An official from the Financial Supervisory Service explained, “The decline in capital ratios in the third quarter was mainly due to the impact of the rising exchange rate, which led to a greater increase in the RWA conversion amount of foreign currency loan assets.” The official added, “There is a possibility that unexpected losses could increase due to domestic economic recovery delays and exchange rate fluctuations, among other internal and external uncertainties. We will continue to monitor capital ratios and other indicators to ensure that banks maintain sufficient loss-absorbing capacity.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)