Dual-Track Restructuring: Reducing Commodity Products and Shifting to Specialty Products

Priority Review for Fields Requiring Technological Competitiveness

The government has set the core of its petrochemical industry restructuring policy as reducing commodity products and shifting toward specialty (high value-added) products, and is accelerating the development of support measures to back this transition. The 'Chemical Industry Research and Development (R&D) Roadmap,' which will be released this month, is expected to outline development directions centered on specialty technologies.

This roadmap is drawing attention because it goes beyond simply declaring a 'shift to specialty products'; it includes the government presenting support directions focused on specific product groups. It is known that priority is being given to areas requiring technological competitiveness, such as eco-friendly and bio-based materials, high-performance chemical materials, materials for batteries and semiconductors, and catalyst and process innovation technologies. The strategy is to strengthen sectors where quality certification barriers can be established or where there is a lack of alternative overseas suppliers. Once the roadmap sets the direction, companies will be able to propose new technology development or expansion of production facilities.

Specialty products are difficult to manufacture, resulting in lower competition and higher profitability. Their high productivity also makes petrochemical plant operations more efficient. Industry insiders explain that most production lines that maintain high operating rates regardless of market conditions are specialty lines. For this reason, companies have strongly demanded government support for R&D of specialty products as a counterbalance to the reduction of ethylene production.

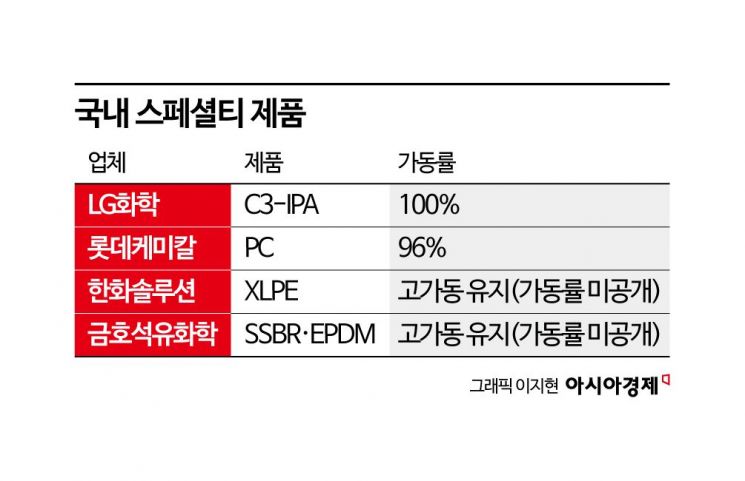

Domestic petrochemical companies are already seeing some results from their specialty-focused strategies. While shipment volumes of commodity products have recently been sluggish according to domestic statistics, companies are concentrating on specialty sectors with solid demand, such as high-performance polymers, specialty rubber, and cable insulation materials.

LG Chem's semiconductor cleaning-grade 'Isopropyl Alcohol (C3-IPA)' production line has maintained a 100% operation rate this year. The Polycarbonate (PC) line in Lotte Chemical's Advanced Materials Division has maintained an operating rate of 96-97% for three consecutive years. Kumho Petrochemical has been focusing on producing high value-added synthetic rubbers such as 'Solution Styrene-Butadiene Rubber (SSBR)' and 'Ethylene-Propylene-Diene Monomer Rubber (EPDM).' Hanwha Solutions last year became the first in Korea to localize 400kV-grade cable 'Cross-Linked Polyethylene (XLPE).' Specialty materials such as high-performance compounds for wires and cables played a key role in supporting this year's performance as well. According to industry sources, cable insulation materials like XLPE have strict certification and specification requirements, making it difficult to enter the market without technological capabilities, and demand is increasing as they are linked to renewable energy projects.

Globally, demand for specialty products continues to grow. According to research agencies such as Grand View Research, the global specialty chemicals market is estimated at around $979 billion (about 1,300 trillion won) as of 2024, and is expected to grow at an average annual rate of about 5% to reach approximately $1.3 trillion by 2030. In particular, the Asia-Pacific region is analyzed to account for nearly half of the market.

The government R&D roadmap is also expected to influence overall industry investment directions. As the performance gap between commodity and specialty products widens, companies are likely to realign their technology development and facility investment plans in accordance with the priority areas presented in the roadmap.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.