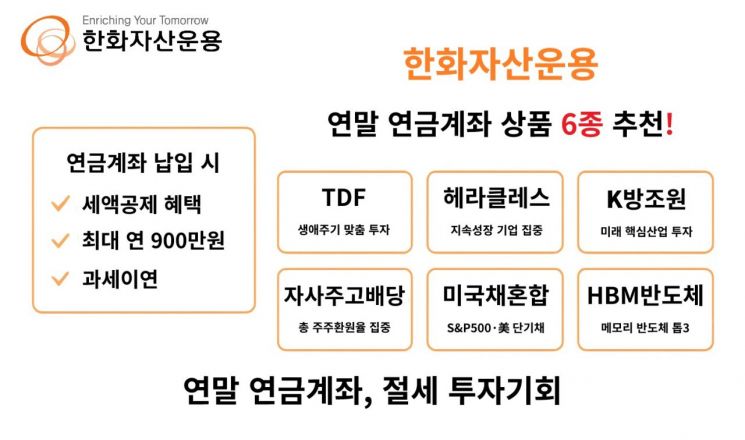

Hanwha Asset Management announced on December 4 that it is recommending six products to fill pension accounts such as pension savings and IRP (Individual Retirement Pension) as year-end interest in pension investment intensifies.

For public offering funds, the company recommended the following: Hanwha LIFEPLUS TDF Fund, Hanwha Hercules Developed Markets Active Fund, and Hanwha K-Defense·Shipbuilding·Nuclear Power Fund. The focus is on products that can generate stable long-term returns.

The Hanwha LIFEPLUS TDF Fund automatically adjusts the ratio of risk and safe assets according to the retirement date. It boasts differentiated returns through collaboration with global investment bank JP Morgan. For the 2040 and 2045 vintages targeting the Millennials generation born in the 1980s, it has ranked first in TDF returns since the beginning of the year.

The Hanwha Hercules Developed Markets Active Fund invests in companies with strong cash flow generation at fair value. Since companies with good cash flow can continue to invest and grow, the fund is suitable for long-term investment.

The Hanwha K-Defense·Shipbuilding·Nuclear Power Fund invests in all three of Korea’s core industries: defense, shipbuilding, and nuclear power. Its key feature is the pursuit of more stable returns and lower volatility compared to investing in individual sectors, thanks to the effect of diversification.

For exchange-traded funds (ETFs), the company recommended the following: PLUS Share Buyback High Dividend ETF, PLUS US S&P500 US Treasury Hybrid 50 ETF, and PLUS Global HBM Semiconductor ETF. These selections offer both stable dividends and promising future growth potential.

The PLUS Share Buyback High Dividend ETF invests in the top 30 companies ranked by total shareholder return, which combines expected dividend yield and share buybacks. As the portfolio mainly consists of companies with high proportions of treasury shares or those that consistently buy back and retire their own shares, it is expected to benefit from the passage of the third amendment to the Commercial Act, which mandates share retirement.

The PLUS US S&P500 US Treasury Hybrid 50 ETF is a bond-mixed ETF that invests 50% each in the S&P500, the leading US index, and ultra-short-term US Treasuries. Classified as a safe asset within retirement pension (DC, IRP) accounts, it is an optimal product for allocation to the mandatory safe asset portion (30%).

The PLUS Global HBM Semiconductor ETF invests about 75% in major memory semiconductor companies such as Samsung Electronics, SK hynix, and Micron. With demand for memory semiconductors surging relative to limited supply, prices have risen significantly, indicating high growth potential.

If you contribute to pension savings and IRP accounts by the end of the year, you can receive a tax deduction benefit of up to 9 million won per year. The maximum refund amount, depending on income level, is 1,485,000 won.

In addition to tax deduction benefits, tax deferral is also provided on investment gains. By reinvesting the deferred gains, you can maximize the effect of compound interest.

A Hanwha Asset Management representative advised, "A pension account is the optimal investment vehicle to enjoy both long-term investment and tax benefits," adding, "It is important to build your portfolio with products that balance stability and growth potential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.