Canada Announces Plans for Additional Pipeline Following TMX

Crude Oil Transport to the West Coast... Onward to Asia via the Pacific

"Preventing Middle Eastern Oil Producers from Charging High Prices in Asia"

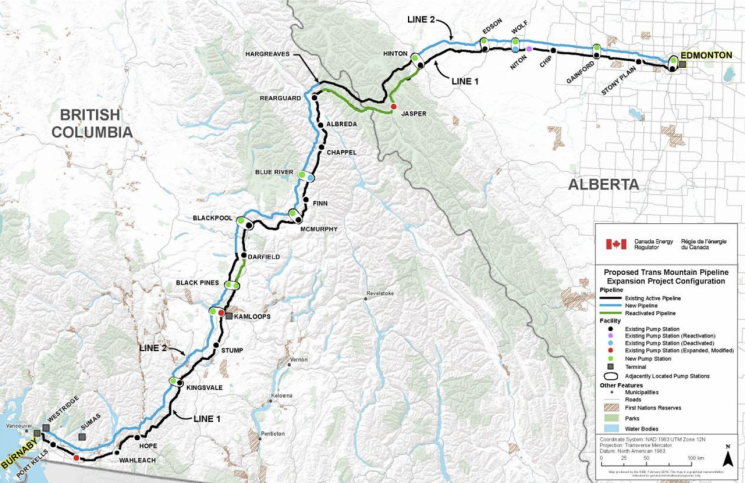

Canada has constructed a second pipeline along the existing Trans Mountain (TM) pipeline through the Trans Mountain Expansion (TMX) project to diversify its crude oil exports, with operations commencing in May of last year. This expansion has increased the country's crude oil transportation capacity from central Canada to the western Pacific coast from 300,000 barrels per day to approximately 890,000 barrels per day, nearly tripling the previous capacity.

This pipeline, which connects Edmonton in Alberta to Burnaby in British Columbia, operates as a multi-product pipeline capable of transporting not only crude oil but also various petroleum products such as jet fuel, gasoline, and diesel simultaneously.

On December 2, Hana Securities stated in its report, "Expansion of Canada's Crude Oil Exports and the Downward Trend of OSP," that "the TMX project is a strategic move to broaden Canada's crude oil export routes beyond the US-centric market to Asia," and analyzed that "it will encourage price reductions of Middle Eastern crude oil, which will have a positive impact on Asian refiners."

Canada's Commitment to Diversifying Energy Exports

The motivation behind Canada's TMX expansion is to address the issue of discounted crude oil sales (estimated at up to $40 per barrel) resulting from US-centric exports and to escape the threat of trade tariffs, while targeting the higher-priced Asian market. Since Vancouver Port faces the Pacific Ocean directly, this route can reduce transportation time to Asia by about 20 to 30 days compared to the previous route that shipped crude oil from Texas through the Panama Canal to Asia.

In the first half of this year, some Asian refiners adopted a mutually beneficial strategy by sourcing Canadian crude oil at a $5 per barrel discount to WTI. Over the past year since May of last year, approximately 48% of Canadian crude oil exports through Vancouver Port have been destined for Asian countries such as China and South Korea, making the diversification of exports increasingly evident.

Canadian Government Announces Plans for Additional Pipeline Expansion

On November 27, the Canadian federal government and the Alberta provincial government signed a comprehensive memorandum of understanding (MOU) for the construction of a new pipeline with a capacity of 1 million barrels per day. This new pipeline is a separate project from the existing TM and TMX pipelines, which have a combined capacity of 890,000 barrels per day, and upon completion, the daily transportation capacity will be doubled compared to the current level.

Mark Carney, Prime Minister of Canada, is delivering a special keynote speech at the Asia-Pacific Economic Cooperation (APEC) CEO Summit held at Gyeongju Arts Center, Gyeongbuk, on October 31, 2025. Photo by Kang Jinhyung

Mark Carney, Prime Minister of Canada, is delivering a special keynote speech at the Asia-Pacific Economic Cooperation (APEC) CEO Summit held at Gyeongju Arts Center, Gyeongbuk, on October 31, 2025. Photo by Kang Jinhyung

The pipeline will span approximately 1,100 kilometers, with the application process expected to be completed by July 1 of next year, and completion and operation anticipated after 2030. This plan is a core part of Canada's national energy strategy to establish itself as an energy superpower, reduce dependence on US crude oil exports, and expand exports to Asia through Pacific coastal ports.

Asian OSP Expected to Enter a Broad Downward Cycle

In the Asian petroleum market, after the outbreak of the Russia-Ukraine war in 2022, Saudi Arabia set its official selling price (OSP) for the Asian market at a high level of $2-3 per barrel from 2023 to 2025, which significantly increased the cost burden for Asian refiners, including those in South Korea. This premium was similar to the level seen in 2011-2013 when WTI was above $100 per barrel, and was excessive compared to the current WTI price of $60 per barrel.

However, as OPEC+ now aims to expand its market share by easing production cuts, Saudi Aramco's monthly OSP announcement for January next year is expected to drop to $0.6-0.7 per barrel, the lowest level in five years. Yoon Jaesung, an analyst at Hana Securities, stated, "As the inflow of Canadian crude oil to Asia is set to expand continuously beyond 2030, competition is inevitable, and Saudi Arabia will have no choice but to continue lowering its OSP for Asia to maintain market share," adding, "The story of cost reduction for South Korean refiners is only just beginning."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)