Japan Halts Photoresist Shipments to China

Foreign Media Report Complete Suspension

Production Disruptions Expected at CXMT and SMIC

Korean Companies May Expand Cooperation with Japan

Potential Shifts in Semiconductor Market Strategy

As evidence emerges that Japan has effectively halted shipments of photoresist to China, the Korean semiconductor industry is closely monitoring the potential production disruptions at SMIC (Semiconductor Manufacturing International Corporation) and CXMT (Changxin Memory Technologies) as a key variable. If these two companies experience delays in expanding their foundry and premium DRAM production, the resulting reduction in competitive pressure could directly affect the domestic memory price trends and order environment. Should Chinese companies, which are highly dependent on photoresist, find it difficult to maintain their production pace, this could also impact the market share and investment strategies of Samsung Electronics and SK Hynix.

On December 1, major foreign media outlets such as the Hong Kong-based Asia Times reported that "Japan appears to have completely suspended shipments of photoresist to China since mid-November." Although neither the Japanese government nor companies have made an official announcement, both Japanese and Chinese industry insiders reportedly consider this a settled matter. The fact that specific company names such as Canon, Nikon, and Mitsubishi Chemical have been mentioned underscores the tangible nature of the measure. Asia Times described this suspension as "the worst-case scenario China had feared."

Currently, the semiconductor market is experiencing a comprehensive supply shortage, with demand surging not only for HBM but also for standard DRAM. This is seen as a critical moment for Chinese companies to accelerate their growth. CXMT and SMIC have been expanding their production capacity with government support in line with this trend, but Japan's suspension of photoresist exports is now considered a direct threat to their expansion plans. If the procurement of this key material becomes unstable, the pace at which Chinese memory products enter the market could be affected, potentially triggering changes in the global supply chain and overall price structure.

On the other hand, this situation is also seen as a factor that further distances Japanese material manufacturers from China while strengthening the supply chain connection between Korea and Japan. As Japan's photoresist controls increase procurement uncertainty for Chinese companies, Korean firms are finding it increasingly necessary to solidify stable partnerships with Japanese material, component, and equipment suppliers. In fact, the scope of cooperation between companies from both countries is expanding. As technological and material linkages with Japan become stronger, there is growing analysis that Korea is more likely to establish itself as a central axis in the semiconductor supply chain between China and Japan.

This move by Japan is being interpreted as a sign that the escalating conflict between China and Japan-especially after Japanese Prime Minister Sanae Takaichi expressed willingness to intervene in the event of a Chinese invasion of Taiwan-is now spilling over into the semiconductor supply chain. Japan is intensifying pressure by restricting the flow of materials, components, and equipment in which it has a competitive edge, and the Korean industry is closely watching what kind of indirect benefits might arise for domestic companies if this conflict creates variables in Chinese semiconductor production.

Photoresist is a "photosensitive material" whose chemical properties change in response to light. It has the particular property of concentrating light into a single spot, making it a key material in the initial "photo process" stage of semiconductor manufacturing. Once applied to a wafer, it helps focus the light onto a specific point, enabling the drawing of fine circuit patterns.

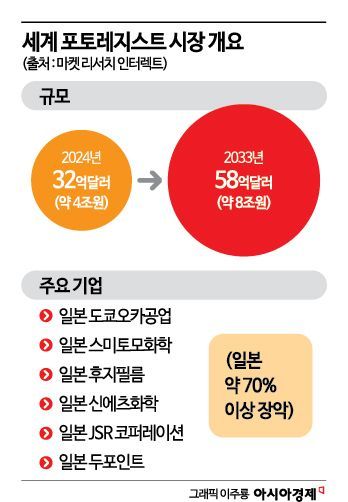

Japan holds a dominant position, accounting for more than 70% of the global photoresist market. For this reason, photoresist has often been the first pressure card played by the Japanese government in political or economic conflicts with other countries. When Japan excluded Korea from its export "whitelist" (preferred trading partners) in 2019, photoresist was the first item restricted in the semiconductor sector.

With Japanese support effectively cut off, there is growing analysis that the recent momentum in China's semiconductor industry will also lose steam. The suspension of photoresist shipments by Japan is seen as preventing China from even taking the first step in manufacturing various semiconductors. Memory companies such as SMIC, which has recently rebounded in global foundry market share, and CXMT, which has unveiled premium DRAM products comparable to those of Korean firms, are all expected to be significantly impacted. A domestic industry official stated, "Especially in memory, Chinese companies such as CXMT have been moving to build additional factories and increase capacity in response to the recent surge in DRAM prices, but Japan's export restrictions could act as a major obstacle."

There are also signs that Japan's export controls on Chinese semiconductors may gradually expand beyond photoresist. According to Japan's Nihon Keizai Shimbun, leading Japanese semiconductor company Kioxia recently stopped importing Chinese-made DRAM and other memory products. An executive explained, "We halted imports due to concerns about quality and security."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.