Both the U.S. and Saudi Arabia Maintain Crude Oil Production Increases

Expectations for End of Russia-Ukraine War... Further Expansion of Oil Supply

Falling Oil Prices Offset Inflationary Risks

There is increasing downward pressure on international oil prices. This is due to an oversupply resulting from increased crude oil production by the Organization of the Petroleum Exporting Countries (OPEC) and the United States, as well as expectations for an end to the Russia-Ukraine war. These factors are expected to have a positive impact on inflation and interest rate declines.

On November 27, iM Securities reported that the price of West Texas Intermediate (WTI) crude oil has fallen to around $57-58 per barrel, but there is still room for further declines. JP Morgan has even forecast that international oil prices could plunge by 50% within two years, citing the ongoing oversupply as the reason.

First, OPEC continues to expand crude oil production despite falling oil prices. Rather than making a decision to cut production in response to the price decline, the current policy is expected to be maintained for the time being. This is because Saudi Arabia is likely to continue increasing production in order to maintain its share of the international crude oil market.

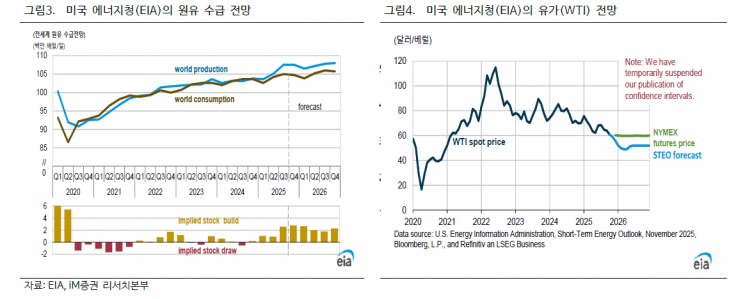

Crude oil production in the United States is also increasing. After being stagnant since last year, U.S. crude oil output began to rise again following the inauguration of President Donald Trump, as drilling-related regulations were eased under the "Drill, Baby, Drill" policy. In order to stabilize prices and maintain price stability, oil price stabilization policies are likely to continue. As the trend of expanding crude oil production led by the United States and Saudi Arabia continues, the U.S. Energy Information Administration (EIA) has projected that the oversupply situation that began at the start of this year will persist into next year.

Expectations for an end to the Russia-Ukraine war have also contributed. If Russian crude oil is fully exported after the war ends, the oversupply in the global oil market is expected to worsen further.

Due to the federal government shutdown, speculative net long and net short position data for crude oil have not been properly released. Considering that net long positions in crude oil dropped sharply by mid-last month, it is estimated that market sentiment betting on falling oil prices is spreading.

The decline in oil prices is positive for both inflation and interest rate reductions. The U.S. Energy Information Administration has forecast that next year’s average international oil price, based on WTI, will be in the low $50 range, indicating a further drop from current levels.

Further declines in oil prices are likely to offset inflationary risks stemming from tariffs. President Trump is focusing on price stabilization ahead of next year’s midterm elections, including lifting tariffs on some agricultural products. Falling oil prices can also significantly lower gasoline prices, which have a major impact on the U.S. consumer cycle. This is why analysts believe lower oil prices will have a positive effect on U.S. consumer sentiment.

Park Sanghyun, a researcher at iM Securities, said, "A decline in oil prices is a positive signal for the domestic economy, as it can further widen the trade surplus and improve domestic terms of trade, including the semiconductor supercycle." He added, "While falling oil prices are not a cure-all, they can provide some breathing room for the somewhat stagnant or sluggish global economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.