"Restructuring and Opportunities in the Vietnamese Life Insurance Industry" Report Released

Analysis of Customer Trends and Changes in Sales Channels, with Strategic Recommendations

"Insurtech Growth Will Drive Digital Transformation to Korean Levels Within Five Years"

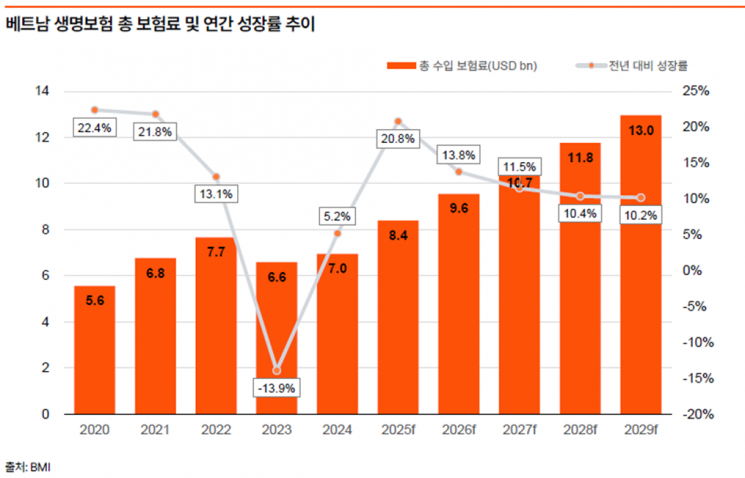

The Vietnamese insurance industry is experiencing rapid growth, particularly in the life insurance sector, and undergoing significant changes in product structure, sales methods, consumer trust, and regulatory environment. As a result, companies considering entering the market are advised to reassess their existing growth strategies and develop more sophisticated approaches, according to a recent analysis.

PwC Consulting announced on the 27th that it has published a report titled "Restructuring and Opportunities in the Vietnamese Life Insurance Industry." The report aims to identify the current trends transforming the Vietnamese life insurance market and to propose strategic approaches that domestic companies should adopt.

First, the report analyzes recent changes in the Vietnamese life insurance market across four key pillars: customers, product structure and demand, sales channels, and information technology (IT) and digitalization. On the customer front, the expansion of the middle class, rising income levels, shifting perceptions regarding health and retirement, and increased acceptance of digital technologies are all changing how insurance is selected and utilized. With a high smartphone penetration rate, there is a growing preference for digital channels, resulting in more online insurance offerings and active non-face-to-face consultations.

Sales channels are also expanding beyond traditional face-to-face models to include a variety of options. Since the pandemic, the importance of digital channels has surged, leading to tangible results in areas such as mobile-based insurance enrollment, lead generation through digital advertising, and artificial intelligence (AI)-based underwriting.

Accelerated digital transformation is also underway, driven by government policies promoting the digital economy. The report states, "Insurtech, a combination of insurance and technology, is transforming the insurance value chain-including product development strategies, process and technology utilization, pricing policies, and sales models. The Vietnamese life insurance market is expected to reach the level of digital transformation seen in Korea within the next five years."

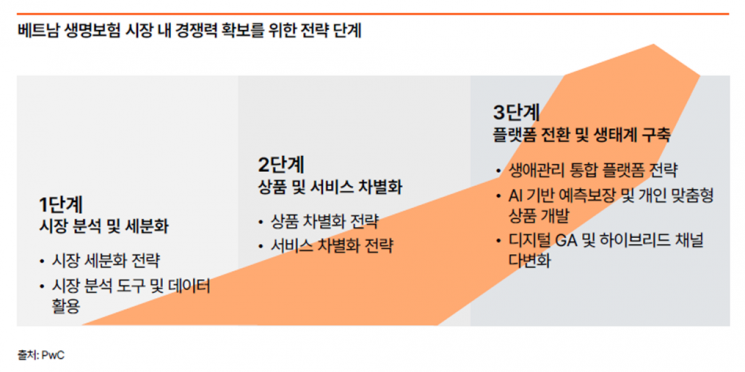

Finally, the report advises, "To secure competitiveness in the Vietnamese life insurance market, domestic companies must evolve beyond simply providing risk coverage and become integrated platforms that support customers throughout their entire life cycle. It is essential to differentiate products and services through detailed market analysis and segmentation, and to deliver offerings that exceed customer expectations."

Jo Kyusang, a partner at PwC Consulting, stated, "The Vietnamese life insurance market is promising in the long term due to its young, digitally savvy population, high growth potential, and improved access to financial services. However, there are short-term entry barriers. In the initial phase, strategies focused on simplicity and trust are crucial; in the medium term, operational efficiency and data-driven strategies are key; and in the long term, a platform-based ecosystem strategy should be implemented to achieve organic and gradual market expansion."

Further details are available on the PwC Consulting website.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.