"1.0% Growth This Year, 1.8% Next Year, 1.9% in 2027"

Continued Consumption Improvement and Construction Investment Rebound Next Year

Exports: "Semiconductors Will Lead" Despite Full Impact of U.S. Tariffs

Interest Rate Held at 2.50% for Fo

The Bank of Korea has raised its forecast for South Korea's economic growth rate next year to 1.8%. This figure is generally in line with the country’s potential growth rate (1.8-2.0%). The central bank also expects that, contrary to previous expectations of “zero percent growth,” the economy will achieve “1% growth” this year. Despite the anticipated impact of U.S. tariffs in 2025, robust semiconductor performance is expected to drive exports, while domestic demand is projected to improve, supported by a rebound in construction investment and a recovery in consumption. The base interest rate has been held steady at 2.50% per annum. With concerns over the economy easing due to the upward revision of the growth rate, the decision to prioritize financial stability was seen as a response to continued increases in housing prices and exchange rate volatility.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee's plenary session held on the 27th at the Bank of Korea headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency Joint Coverage Team

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee's plenary session held on the 27th at the Bank of Korea headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency Joint Coverage Team

South Korea’s Economy Expected to Grow 1.8% Next Year... Continued Consumption Recovery and Rebound in Construction Investment

On the 27th, following the Monetary Policy Committee meeting at its headquarters in Jung-gu, Seoul, the Bank of Korea announced in its revised economic outlook that South Korea’s economy is expected to grow by 1.8% next year. This is an upward revision of 0.2 percentage points from the August forecast of 1.6%. The growth rate for this year was also revised upward by 0.1 percentage points to 1.0%. The forecast for 2027 is 1.9%.

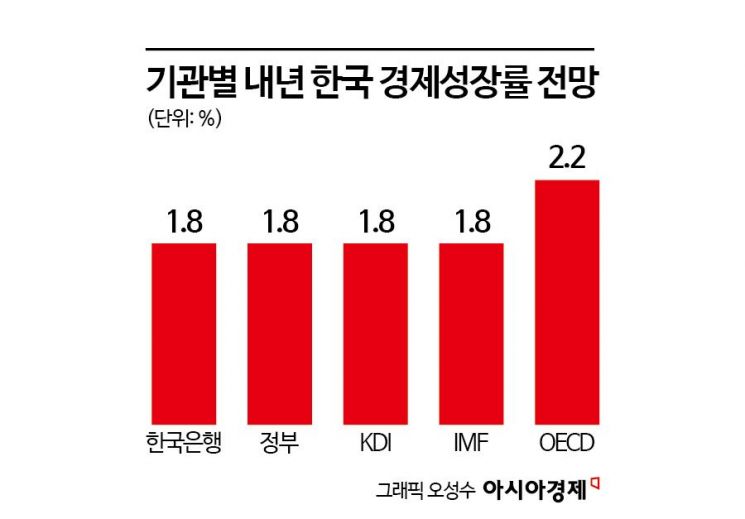

The “1.8%” growth rate for next year matches the projections by the government, Korea Development Institute (KDI), and International Monetary Fund (IMF), and is lower than the forecasts of the Korea Institute of Finance (2.1%) and the Organisation for Economic Co-operation and Development (OECD) (2.2%). It is also generally consistent with the potential growth rate (an annual average of 2.0% for 2024-2026 and 1.8% for 2025-2029).

The Bank of Korea’s upward revision reflects its assessment that the economic recovery that began in the second half of this year will continue into next year. Until the first half of this year, the Korean economy experienced sluggish domestic demand and uncertainty over tariffs, resulting in negative growth of -0.2% in the first quarter and only 0.7% growth in the second quarter. However, from the second half, consumption and investment have picked up, and increased demand for semiconductors has boosted exports, leading to 1.2% growth in the third quarter, surpassing the earlier forecast of 1.1%. In particular, private consumption grew by 1.3% quarter-on-quarter, driving the overall growth.

This trend of domestic demand-led economic improvement is expected to become more pronounced next year. The government has submitted a record-high budget proposal of 728 trillion won for next year to the National Assembly. With this expansionary fiscal stance, government consumption-a component of domestic demand-could increase further next year compared to this year. Private consumption, which rebounded in the second half of this year, is also expected to maintain a favorable trend in 2025. Facility investment is projected to continue its moderate growth, mainly driven by demand for semiconductor-related investments. According to the National Data Agency, facility investment in September increased by 12.7% from the previous month, marking the largest rise in seven months.

Construction investment, which has been dragging down the growth rate, is expected to shift from negative growth this year to positive growth next year, partially alleviating its sluggishness. In the third quarter of this year, construction investment declined by 0.1% quarter-on-quarter, marking the sixth consecutive quarter of negative growth, but the rate of decline has slowed. Leading indicators also show a clear rebound, with construction orders in the third quarter surging by 26.5% year-on-year. However, there are analyses that the recovery in construction investment will be slow, as there are some delays in turning construction orders into actual groundbreakings. The Bank of Korea also expects that, with increased infrastructure (SOC) budgets and the resumption of semiconductor plant construction, the recovery will begin from the third quarter of this year.

Exports: “Semiconductors Will Lead” Despite the Full-Scale Impact of U.S. Tariffs

Exports are expected to slow somewhat as the negative impact of U.S. tariff hikes becomes more pronounced from next year. However, robust demand for semiconductors is expected to offset the downward pressure. In fact, despite a decline in exports to the U.S., overall export performance remains strong. According to the Korea Customs Service, exports to the U.S. last month were $8.71 billion, down 16.2% year-on-year, but total exports reached $59.57 billion, setting a record for the highest export value for any October. As of the 20th of this month, exports stood at $38.5 billion, up 8.2% from the same period last year. Exports to the U.S. during the same period also increased by 5.7%.

Kang Sungjin, Professor of Economics at Korea University, commented, “While 1.8% is not significantly above the potential growth rate, it is a solid figure compared to this year’s growth and other countries.” He added, “Given the full-scale impact of U.S. tariffs, high exchange rates, challenging domestic conditions in sectors like petrochemicals, and the fact that even with a current account surplus, more capital is flowing out, it remains to be seen whether the forecast will actually be realized.”

The consumer price inflation forecast has also been revised upward to 2.1% for both this year and next year, an increase of 0.1 and 0.2 percentage points, respectively, compared to the August forecast. The forecast for 2027 is 2.0%. While oil prices are expected to stabilize downward next year, the higher won-dollar exchange rate is anticipated to increase the burden on import prices. In October, the consumer price inflation rate reached 2.4%, the highest level so far this year. However, the Bank of Korea emphasized stability around 2% rather than the possibility of further increases. Kim Woong, Deputy Governor of the Bank of Korea, stated at the “Price Situation Review Meeting” on November 2, “Considering the lower oil prices compared to last year and the expected slowdown in travel service prices, consumer price inflation is expected to stabilize around 2% at the end of this year and the beginning of next year.”

Interest Rate Held at 2.50% for Fourth Consecutive Time... Monitoring Exchange Rate and Real Estate Instability

Meanwhile, the Monetary Policy Committee decided to keep the base interest rate at 2.50% per annum. This marks the fourth consecutive hold following July, August, and October, aligning with market expectations. In a previous survey conducted by The Asia Business Daily, all 13 respondents predicted that the rate would be held this month.

With the won-dollar exchange rate hovering near the 1,500 won mark and housing prices continuing to rise in key areas of Seoul even after the October 15 real estate measures, the focus has shifted to financial stability. The upward revision of the expected growth rates for this year and next year in the revised economic outlook is also seen as reducing the pressure to cut rates in response to economic downside risks.

The main reason for this month’s rate hold is exchange rate instability. On November 24, the weekly closing price of the won-dollar exchange rate in the Seoul foreign exchange market was 1,477.1 won, the highest in about seven and a half months since April 9 (1,484.1 won), when fears of a U.S. tariff war were at their peak. Despite the foreign exchange authorities’ emphasis on stabilizing the exchange rate, it continues to hover around the 1,470 won level. The real effective exchange rate, which reflects the won’s actual purchasing power, is also at its lowest since the global financial crisis. According to the Bank of Korea’s Economic Statistics System (ECOS), South Korea’s real effective exchange rate index stood at 89.09 (2020=100) at the end of October, the lowest since August 2009 (88.88) during the global financial crisis, marking a 16-year, two-month low. Although the U.S. has recently started to lower its policy rate, the Korea-U.S. interest rate differential remains high at around 1.5 percentage points at the upper end.

Continued concerns about the real estate market have also supported the decision to hold rates. After the October 15 measures, the upward trend in Seoul housing prices, which had been slowing, has recently picked up again, influencing the rate hold decision. According to the Korea Real Estate Board, the average sales price of apartments in Seoul in the third week of November (as of November 17) rose by 0.20% from the previous week. After surging to 0.50% in the third week of October, immediately following the October 15 measures, the average sales price increase slowed to 0.23% in the fourth week of October, 0.19% in the first week of November, and 0.17% in the second week, before expanding again after four weeks. Although listings have decreased and transactions have slowed, a wait-and-see attitude has emerged, but there is still demand for “prime properties” in preferred areas.

The Monetary Policy Committee stated, “Although the growth forecast has been revised upward, both upside and downside risks remain, and inflation is somewhat higher than expected. It is necessary to continue monitoring the impact of housing prices and household debt risks in the Seoul metropolitan area, as well as increased exchange rate volatility.” Accordingly, the central bank plans to keep the possibility of a rate cut open, but will closely monitor changes in domestic and external policy conditions, trends in growth and inflation, and financial stability before deciding on the timing and extent of any additional cuts.

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee's plenary session held on the 27th at the Bank of Korea headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency Joint Coverage Team

Lee Changyong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee's plenary session held on the 27th at the Bank of Korea headquarters in Jung-gu, Seoul. Photo by Yonhap News Agency Joint Coverage Team

Next Rate Cut Outlook Divided... “January Next Year Also Unlikely”

Expert opinions are sharply divided on the timing of the next rate cut, but most believe a cut is unlikely before January next year. Even experts who expect a cut in the first quarter of next year say that, despite improvements in the domestic economy, the recovery in domestic demand remains slow, so there is a need for further rate cuts, but the timing will depend on confirmation of financial stability. Kang Minjoo, Senior Economist at ING Bank, said, “A rate cut will be implemented after confirming improvements in global financial market sentiment due to the U.S. Federal Reserve’s rate cuts, reduced exchange rate volatility, stabilization of the domestic economy, and the gradual stabilization of the real estate market following the October 15 measures.”

On the other hand, a significant number of experts believe that the rate cut cycle has effectively ended. Kim Seongsu, Researcher at Hanwha Investment & Securities, pointed out, “Cash investment in the U.S. and Korea-U.S. currency negotiations have generally limited the authorities’ ability to stabilize the foreign exchange market. Once the gap between GDP and potential growth rate is closed, the need for monetary policy responses to growth will be greatly reduced.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.