Securing Funds for Expansion of Chinese Plant

Seen as 'Preemptive Move' Ahead of Commercial Act Amendment

Food Industry on Alert Over Mandatory Retirement of Treasury Shares

As the amendment to the Commercial Act mandating the retirement of treasury shares is rapidly gaining momentum, attention is focused on whether Samyang Foods’ recent sale of all its treasury shares, worth about 100 billion won, will set a precedent for the food industry.

According to industry sources on the 27th, on the 24th, Samyang Foods disposed of 74,887 treasury shares through a block deal to three overseas institutional investors. The shares were sold at 1,326,875 won per share, totaling 99.37 billion won, which is a 3.5% discount compared to the previous day’s closing price. The buyers were Viridian Asset Management, Jump Trading, and Weiss Asset Management.

Samyang Foods explained, “We disposed of the treasury shares to secure funds for facility investments for business expansion and to improve our financial structure.” In fact, Samyang Foods recently increased its planned investment in its factory in Jiaxing, Zhejiang Province, China, from 20.14 billion won to 20.72 billion won, and decided to expand its production lines from six to eight. The Jiaxing factory, Samyang Foods’ first overseas production base, is scheduled for completion in January 2027. All products manufactured there will be supplied exclusively to the Chinese domestic market.

Sales of Buldak Bokkeummyeon in China continue to grow steadily. In the third quarter, Samyang Foods’ Chinese subsidiary posted cumulative sales of 2.21 billion yuan (about 456.7 billion won), up 37.2% from the previous year. Samyang Foods believes that, while penetration in first-tier cities has already reached nearly 100%, there is still significant growth potential in second- and third-tier cities.

However, there is considerable skepticism in the market. When Samyang Foods acquired its treasury shares on February 8, 2022, the board of directors stated that the purpose was to “enhance shareholder value and reward management and employees for performance.” Because of this, some critics argue that the company disposed of its treasury shares preemptively ahead of the amendment to the Commercial Act, which will mandate their retirement.

Previously, on the 25th, the Democratic Party of Korea introduced the so-called “third amendment to the Commercial Act,” which mandates the retirement of treasury shares, and announced plans to process it within the year. The amendment stipulates that when a company acquires its own shares, it must retire them within one year of acquisition. However, if certain conditions are met, such as compensation for employees and executives, approval must be obtained at a general shareholders’ meeting. Oh Ki-hyung, chairman of the KOSPI 5000 Special Committee, stated, “Acquiring treasury shares under the pretext of enhancing shareholder value but not retiring them constitutes false disclosure.”

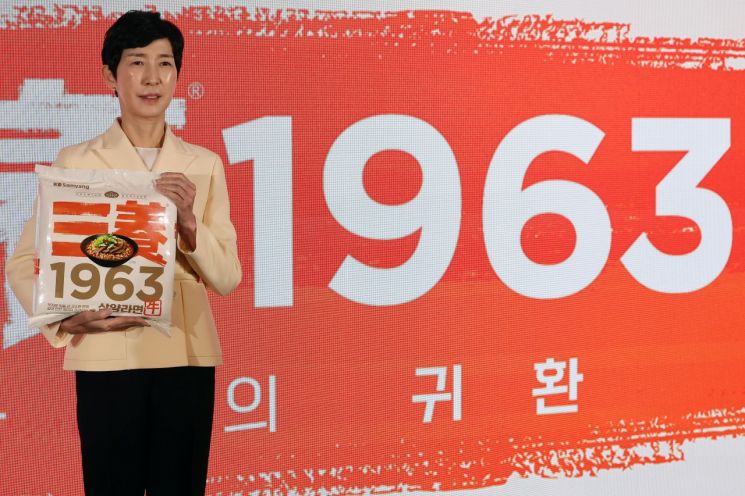

Vice Chairman Kim Jeongsu is introducing Samyang 1963, made with cow udder fat, at the Samyang Foods new product launch event held on the 3rd at the Boco Seoul Myeongdong Hotel in Jung-gu, Seoul. Photo by Yonhap News

Vice Chairman Kim Jeongsu is introducing Samyang 1963, made with cow udder fat, at the Samyang Foods new product launch event held on the 3rd at the Boco Seoul Myeongdong Hotel in Jung-gu, Seoul. Photo by Yonhap News

The Korea Corporate Governance Forum also publicly criticized Samyang Foods’ decision in a statement. The forum said, “We suspect that the board of directors urgently disposed of the treasury shares as assets before the amendment to the Commercial Act was proposed.”

The forum also raised concerns about the institutions that purchased the shares. “Two of the three overseas institutions are known to employ short-term trading strategies and are not long-term quality funds,” the forum noted, adding, “It is questionable why a leading K-Food company with a market capitalization of 10 trillion won would sell its treasury shares to short-term trading funds rather than respected long-term investors.”

Samyang Foods’ actions are having a significant impact across the food industry. If the mandatory retirement of treasury shares becomes a reality, companies with large holdings of treasury shares will inevitably have to adjust their accounting and governance strategies. According to the Financial Supervisory Service and FnGuide, among listed food companies, Sempio has the highest proportion of treasury shares (29.92%), followed by Ottogi (14.18%), Harim Holdings (13.16%), Kooksoondang (11.86%), and KT&G (11.62%).

An industry insider commented, “The Samyang Foods case could become a reference point for the industry going forward,” and added, “With policy changes accelerating, companies are likely to completely reassess their strategies for utilizing treasury shares.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.