On November 26, Samsung Asset Management proposed its "Five Year-End Pension Investment Recommended Funds" to mark the pension investment season, enabling investors to build portfolios tailored to their individual preferences.

An increasing number of investors are choosing performance-based products to secure substantial retirement assets.

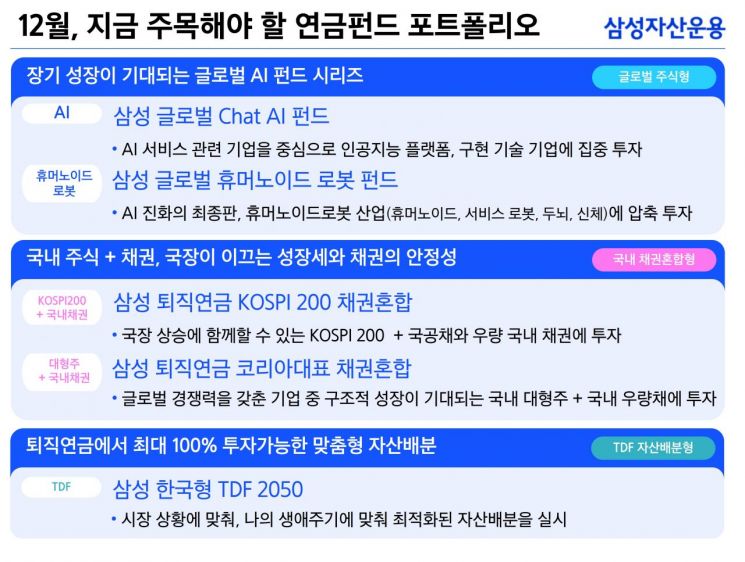

Samsung Asset Management presented a balanced strategy that allows for both exposure to structural growth themes with long-term potential and stable cash flows. As practical alternatives, the company suggested two global AI funds with long-term growth prospects, two domestic bond-mixed funds suitable for diversified investment, and one asset allocation TDF that allows for 100% investment in retirement pensions.

The company identified artificial intelligence (AI) and robotics industries as sectors that align with the core principle of "long-term growth" in pension investing. AI has become a megatrend that is transforming the paradigm of all industries, far beyond a simple theme. The "Samsung Global Chat AI Fund" focuses on investing in leading global service platform and software companies at the forefront of the generative AI boom.

The "Samsung Global Humanoid Robot Fund" is also considered a powerful future growth engine. As Jensen Huang, CEO of Nvidia, recently emphasized that "the ultimate evolution of AI is humanoid robots," the robotics industry is accelerating commercialization through convergence with AI technologies. This fund aims for long-term capital gains by making preemptive investments in global humanoid value chain companies with technological capabilities.

For investors who prioritize stability, or those concerned about the mandatory 30% allocation to safe assets in retirement pension (DC, IRP) accounts, two domestic bond-mixed funds were recommended. For those who wish to track the market by following a major domestic index, the "Samsung Retirement Pension KOSPI200 Bond Mixed Fund" is suitable. For investors seeking selective investments in undervalued, high-quality large-cap stocks, the "Samsung Retirement Pension Korea Representative Bond Mixed Fund" was advised. With expectations that Korea's stock market this year and next will be led by "earnings-based large-cap stocks," these funds are gaining attention as alternatives that can capture both stability and profitability.

The "Samsung Korea TDF 2050 Fund," which allows up to 100% investment from retirement pensions, was also recommended. A TDF (Target Date Fund) automatically adjusts the allocation between stocks and bonds according to the investor's retirement date, making it a "set-and-forget" fund. This fund invests in a wide range of global asset classes, allowing for efficient and convenient diversification within a pension portfolio using a single product.

Jeon Yongu, Head of Pension OCIO at Samsung Asset Management, explained, "Pension investing is a long-term race for life after retirement, so allocating structurally growing assets and stable assets appropriately is more important than chasing short-term trends." He added, "By placing solid future growth themes like AI and robotics at the center of your portfolio and managing volatility with bond-mixed products, you can build a robust retirement asset while also enjoying tax deduction benefits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)