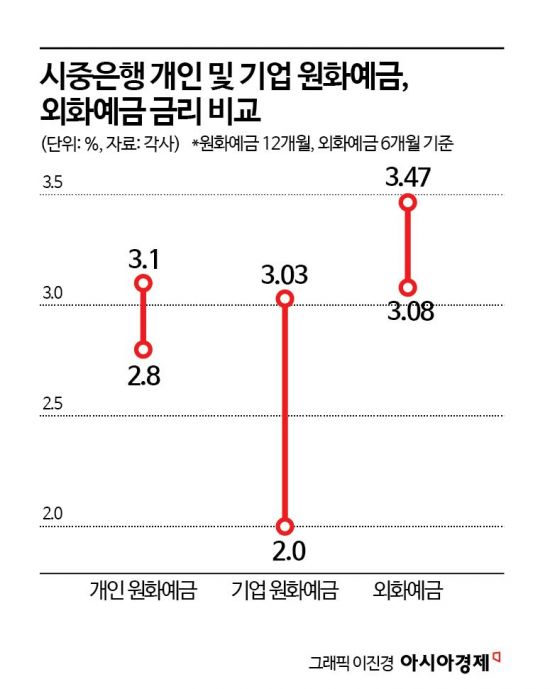

Gap Widens to Up to 1 Percentage Point Over Won Deposits

US-Korea Rate Gap and Bank Competition Drive Higher Dollar Rates

Dollars Locked in Banks, Limiting Market Supply

The interest rates on US dollar time deposits at major commercial banks have been found to be at least 1 percentage point higher than those on Korean won deposits. Due to the interest rate gap between South Korea and the United States, as well as competition among some banks to attract more dollar deposits, interest rates have risen further this month. Observers point out that this phenomenon is dampening demand for converting dollars into won and keeping dollars locked in banks, which in turn is affecting the structurally high exchange rate.

As of November 26, the six-month maturity foreign currency time deposit rates at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stand at 3.08% to 3.47% for US dollars. For individual customers, the Korean won time deposit rates at these banks range from 2.8% to 3.1%, meaning that dollar deposit rates remain higher despite the recent trend of rising deposit rates for won. Compared to corporate won deposits, the gap widens to as much as 1.47 percentage points. The corporate won time deposit rates at these banks are between 2.0% and 3.03%.

The higher interest rates on dollar time deposits compared to won deposits are due to the interest rate differential between South Korea and the United States. Interest on dollar deposits is calculated based on the US policy (base) rate. Although the US Federal Reserve cut rates consecutively in September and October, the Korea-US interest rate gap still stands at about 1.5 percentage points (based on the upper bound).

The rapid decline in dollar deposits last month also prompted commercial banks to raise interest rates in order to manage their foreign currency liquidity.

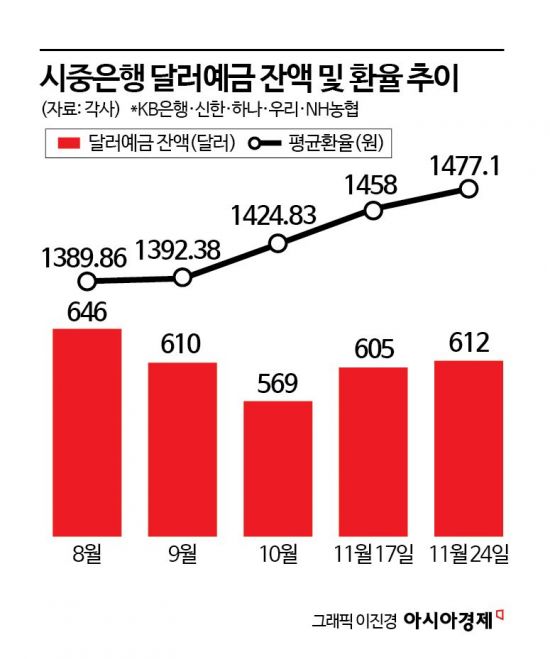

The dollar deposit balance at the five major banks fell from $61 billion in September to $56.9 billion last month, a decrease of $4.1 billion in just one month. This is the lowest monthly figure so far this year. While some of this was due to profit-taking as the won-dollar exchange rate rose from 1,392.38 won to 1,424.83 won during the same period, a significant factor was also the rapid outflow of dollars as individual investors increased their investments in US stocks. According to the Korea Securities Depository, domestic individual investors invested a record $6.855 billion in US stocks last month.

Banks, concerned about the rapid liquidity changes, responded by raising interest rates for corporate customers, which also led to higher rates for foreign currency deposits. A foreign exchange expert commented, "Since October, the start of the fourth quarter, dollars have been flowing out rapidly, and despite high foreign currency liquidity coverage ratios (LCR), banks have become more alert to managing their foreign currency. To defend against the decline in dollar deposits and attract additional funds, some banks have offered interest rates 0.1 to 2 percentage points higher than their competitors."

There are also indications that these interest rate differences have contributed to suppressing demand for converting dollars into won. For individuals or export companies holding dollar deposits, the prospect of higher returns compared to won deposits removes the incentive to exchange their dollars for won. As a result, dollars remain locked in banks rather than being released into the foreign exchange market, which is said to be supporting the high exchange rate. As of November 24, the balance of dollar deposits at commercial banks stood at $61.16208 billion, which has actually increased from the previous month despite the high exchange rate (weekly closing price of 1,477.1 won).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)