The Art Market Faces a Deepening Downturn

Rising Sales of Mid- and Lower-Priced Works

High-Priced Transactions Are Increasing

But Focus Remains on Well-Known Artists

"Polarization Intensifies, Too Soon to Call a Recovery"

"It seems that polarization in the art market has become more severe these days. Overall, the atmosphere is stagnant, and within that, it feels as though only works by famous artists are selectively gaining attention."

Visitors are viewing the exhibition at a gallery in Seoul.

Visitors are viewing the exhibition at a gallery in Seoul.

This is how a gallery curator I recently met described the current situation. As the bubble in the market has burst, buyers are now only seeking works with clear appeal. Although interest in art has increased compared to the past, spending has become more cautious. As a result, inquiries are concentrated only on well-known works, leading to the analysis that it is still too early to talk about a market recovery.

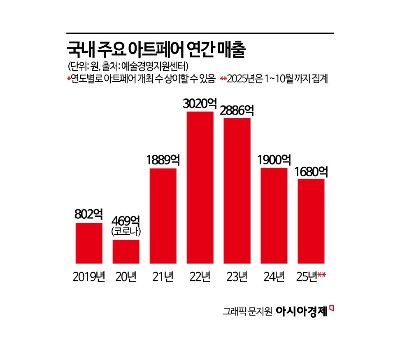

According to the "Korea Art Market 2025" report published on November 25 by the Seoul National University Business Research Institute and the Paradise Cultural Foundation, as of October this year, the total transaction amount at major art fairs was approximately 168 billion won, a 12% decrease compared to the previous year. On the other hand, both the number of participating galleries and visitors increased. In particular, the VIP preview of the 2025 Korea Galleries Art Fair attracted 6,100 visitors, a 30% increase from the previous year, and Kiaf·Frieze Seoul surpassed 120,000 total visitors, setting a new record for scale.

The increase in visitors did lead to more transactions, but not to an increase in transaction amounts. This indicates a decline in high-priced artwork sales. It can be interpreted that transactions of works priced over 1 billion won have decreased, while sales of mid- to lower-priced works in the 100 million to 500 million won range have increased.

The report also found that 62.3% of respondents said they "visited to discover new artists rather than to purchase works," while experiential activities such as creating social media content (42%) and participating in talk programs or performances (31%) had higher response rates than purchase motivation.

As art fairs transform from sales-centered events to experience-centered platforms, there are calls for changes in performance measurement indicators (KPIs). In 2025, the average stay at Frieze Seoul was 2.8 hours, a 45% increase from 2023, and 38% of visitors said they "stayed longer than before." This suggests that 'stay-type cultural consumption' is becoming the new standard, going beyond simple viewing.

This trend is also evident in the auction market. The art auction market in 2025 is on a downward trend for the third consecutive year, following 2023 and 2024. According to the Korea Arts Management Service (KAMS), the total annual hammer price from the second half of 2024 to the first half of 2025 was about 102.6 billion won, a 24.2% decrease from 135.4 billion won the previous year. This is even lower than the 120.1 billion won recorded in 2020, when the consumer market froze due to COVID-19. However, the total hammer price in the first half of 2025 was approximately 56.5 billion won, a 22% increase from the previous half, and the half-yearly success rate also rose from 45.8% to 50.4%. The combined annual average success rate was 48.1%, a slight improvement from 47.6% the previous year.

Recently, however, the atmosphere has started to shift. A series of high-priced works exceeding 1 billion won have been successfully auctioned, signaling a positive change in the market. Last month at Seoul Auction, Yayoi Kusama's "Infinity Nets (SHOOX)" sold for 1.9 billion won, and at K Auction, Lee Jungseop's "Cow and Child" found a new owner for 3.52 billion won. At Christie's "20th Century Evening Sale" in New York, Kim Whanki's "19-VI-71 #206" (1971) was auctioned for 8.4 million dollars (about 12.3 billion won), and on November 24 at Seoul Auction, Chagall's "Bouquet" set a new domestic record at 9.4 billion won.

With continued high-priced transactions, expectations are growing that the art market may have hit bottom and is now on a rebound. A Seoul Auction official stated, "In the first half of the year, we mainly sourced works in the 100 million to 500 million won range, but recently the atmosphere has changed. As high-priced works have started to be traded, we can feel a shift in market sentiment. The total hammer price, which had remained in the 3 billion won range, expanded to 4.9 billion won in September and 5.3 billion won in October."

However, some remain cautious. An industry insider commented, "If you look at the works that are selling, they are ultimately just the representative pieces of famous artists. It is difficult to see this as a full recovery of the entire art market. The unsold rate for works by young, emerging artists remains high. While the market is becoming healthier as the bubble deflates, polarization is likely to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.