Domestic Health Functional Food Market Reaches 5.96 Trillion Won This Year

Red Ginseng's Share of Purchases Drops from 25.9% in 2021 to 16% This Year

Red ginseng, which has long held the "throne" in South Korea's health functional food market, is now facing a decline. While the health supplement market expanded to the 6 trillion won range during the COVID-19 pandemic, the proportion of red ginseng purchases dropped significantly during this period. As consumer demand for health supplements has become more segmented by generation and function, the trend of maintaining health with a single pack of red ginseng has faded.

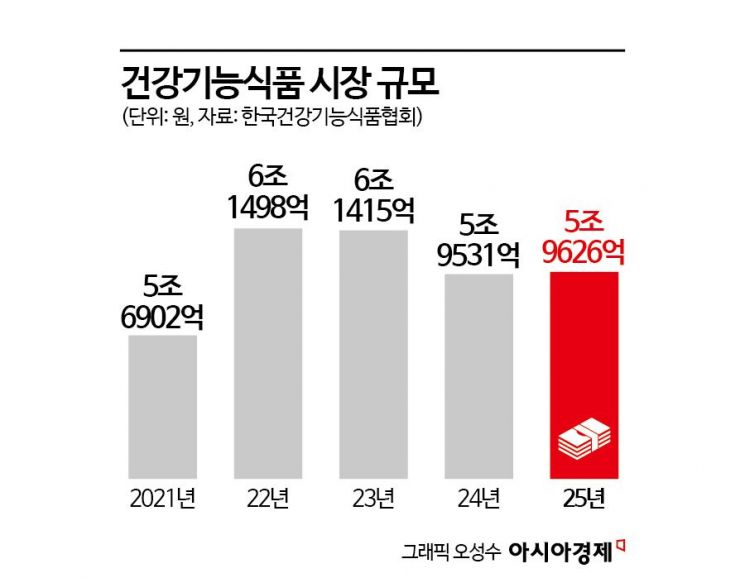

According to the "2025 Health Functional Food Market Status and Consumer Survey" released by the Korea Health Supplements Association on the 25th, the domestic health functional food market is projected to reach 5.9626 trillion won this year, up 0.2% from the previous year. The market, which had expanded to 6.1498 trillion won in 2022, shrank to 5.9531 trillion won last year before rebounding slightly this year.

The landscape of the health supplement market has been significantly reshaped during this period. The most notable change is the decline of red ginseng, once called the "absolute powerhouse." Red ginseng, which at one point replaced herbal medicine prescriptions at oriental clinics and experienced rapid growth, is now losing ground to a variety of other health functional foods.

Red Ginseng Purchases Down by 500 Billion Won in Five Years

The share of red ginseng in total health supplement purchases, which stood at 25.9% in 2021, has dropped to around 16% this year. Over the same period, the total amount spent on red ginseng declined from 1.471 trillion won to 953.6 billion won. That means nearly 500 billion won has evaporated in five years. In contrast, the combined share of multivitamins and single vitamins rose from 13.6% (717.6 billion won) to 18.1% (1.078 trillion won). This suggests that consumer choices are shifting from red ginseng to vitamin-based products.

Changes in red ginseng purchasing behavior are also evident. The number of red ginseng purchases as a proportion of total transactions fell from 12.4% (17.216 million times) in 2021 to 9.6% (13.8 million times) this year. Although the average amount spent per household on red ginseng remains the highest among health supplement ingredients, the growth trend has halted. The average purchase amount this year is 125,420 won, a 24% decrease from 164,708 won in 2021. The overall average purchase amount for health supplements also declined by 3.3%, from 336,194 won to 325,182 won.

The key reason behind red ginseng's downward trajectory is a shift in consumption patterns among people in their 20s and 30s. This age group perceives health functional foods not as "comprehensive management" but as targeted products that quickly address specific needs such as vitamins, magnesium, or probiotics. As it has become common to switch products based on specific symptoms like fatigue, gut health, energy, or sleep, the priority of red ginseng-known for its high price and traditional image-has naturally declined. The perception of red ginseng as "old-fashioned" has also played a role. Younger consumers tend to prefer modern health supplements with clear, proven benefits over traditional red ginseng.

In fact, among consumers aged 21 to 40, red ginseng has been pushed to the background, while "purpose-driven consumption" centered on vitamins and probiotics is clearly leading the market. Among those aged 21 to 30, red ginseng's purchase share is 8.2%, ranking fourth after body fat reduction products (17.1%), probiotics (16.6%), and multivitamins (15.4%). In the 31 to 40 age group, red ginseng's share is 6.4%, placing it fifth, behind probiotics (16.7%), multivitamins (13.0%), body fat reduction products (8.9%), and single vitamins (7.0%). Red ginseng still holds the top spot among consumers aged 51 and above. For those under 20, red ginseng ranks third after probiotics and multivitamins.

A trend toward multi-item portfolio consumption is also emerging. The combined purchase share of the "big five" ingredients (red ginseng, probiotics, multivitamins, single vitamins, EPA, DHA), which once led the health supplement market, has dropped from 60% in 2021 to 51% this year. On the other hand, the "others" category-including products with complex functions, new ingredients, and themed concepts-has grown from 22.3% to 32.8%. The shares of coenzyme Q10, iron and zinc, magnesium, dietary fiber, and hyaluronic acid have also increased. The market structure is shifting from a single-ingredient focus on red ginseng to a diversified, multi-ingredient, and functionally segmented market.

Red Ginseng Companies Also See Declining Results

The weakening of red ginseng is also evident in the financial results of red ginseng manufacturers. KGC Ginseng Corporation, which owns the nation's leading red ginseng brand CheongKwanJang, reported sales of 894.8 billion won for the January-September period this year, down 8.6% from 979.3 billion won a year earlier. In particular, domestic sales of red ginseng fell from 713.3 billion won to 685.5 billion won. As a result, the domestic sales ratio dropped slightly from about 84.2% to 83.7%. The second-largest brand, Hansamin from Nonghyup Red Ginseng, recorded sales of 58.7 billion won last year, remaining in the 50 billion won range for five years.

In response, the red ginseng industry is also pursuing diversification of its product portfolios. KGC Ginseng Corporation is expanding its product lineup using new oriental medicine ingredients such as deer antler and agarwood. This is a strategic move to compensate for stagnation in the red ginseng market. Small and medium-sized companies are mainly focusing on targeting niche markets through price competitiveness. Overseas markets are also emerging as a new breakthrough. For KGC Ginseng Corporation, the export sales ratio in the third quarter was about 16.3%, up slightly from 15.8% a year earlier. The company plans to expand into new overseas markets, including the United States, Europe, and Southeast Asia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.