Semiconductor Prices Surge on Strong Demand

International Prices of Gold, Silver, and Copper Push Product Prices Higher

Financial and Insurance Services Rise, Driven by Higher Brokerage Fees

The producer price index has risen for the second consecutive month. This increase is attributed to a significant price surge in semiconductors due to strong demand, as well as rising international prices for gold, silver, and copper, which have driven up the prices of related products.

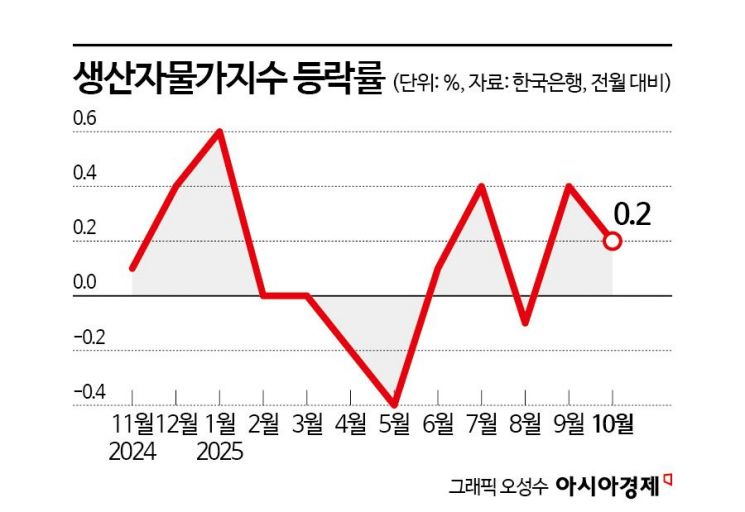

According to the "Producer Price Index (Preliminary) for October 2025" released by the Bank of Korea on November 21, last month's producer price index stood at 120.82 (2020=100), up 0.2% from the previous month. The index has been on the rise for two consecutive months, led by increases in computers, electronic and optical devices, and financial and insurance services. Compared to the same period last year, it rose by 1.5%, marking a wider increase.

By item, manufactured goods and services led the rise in producer prices. Manufactured goods saw a 0.5% month-on-month increase, driven by computers, electronic and optical devices (3.9%), and primary metal products (1.3%). This result stems from a sharp rise in semiconductor prices, particularly due to strong demand for memory semiconductors such as DRAM and flash memory. The recent surge in international prices for non-ferrous metals, including gold, silver, and copper, also contributed to higher prices for related products, further impacting the prices of manufactured goods. Services (0.5%) also rose, mainly due to a 2.9% increase in financial and insurance services, centered on entrusted trading commissions. Food and accommodation services (0.5%) also showed an upward trend.

In contrast, prices for agricultural, forestry, and fishery products fell by 4.2% from the previous month, as prices for agricultural products (-5.5%) and livestock products (-5.4%) declined. Electricity, gas, water, and waste services also dropped by 0.6% from the previous month, due to decreases in industrial city gas (-5.4%) and waste collection, transportation, and disposal (-1.6%).

So far this month, both upward and downward factors are affecting producer prices. Lee Moonhee, head of the Price Statistics Team 1 at the Bank of Korea's Economic Statistics Department, stated, "Looking at the conditions affecting producer prices, the price of Dubai crude oil so far this month is similar to last month's average, and the won-dollar exchange rate has risen by about 2%." He added, "However, industrial city gas rates were lowered again in November, and travel-related services, which contributed to the increase in October, may slow down, so we need to monitor the situation through the end of the month."

Last month, domestic supply prices rose by 0.9% compared to the previous month. This rate of increase is the highest in a year and six months since April last year (when it rose by 1.0%). On a year-on-year basis, it increased by 1.4%. The domestic supply price index measures price changes of goods and services supplied domestically (including domestic shipments and imports) to assess the ripple effects of price fluctuations. By stage of production, intermediate goods (1.0%), raw materials (1.5%), and final goods (0.3%) all saw increases.

The total output price index, which measures price changes for goods and services based on total output (including exports as well as domestic shipments) to capture overall price changes of domestic products, rose by 1.1% from the previous month. This is also the highest since April last year (1.6%). Both manufactured goods (1.9%) and services (0.5%) increased. On a year-on-year basis, it rose by 2.3%.

The recent surge in the exchange rate has contributed to the rise in both the domestic supply price index and the total output price index. Lee explained, "Both export and import prices, which are included in the index calculation, have risen due to the increase in the exchange rate," adding, "In addition, the sharp rise in semiconductor prices in October also played a significant role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.