Hana Bank to Suspend Mortgage and Jeonse Loans at Branches Starting November 25

Other Banks Also Impose Limits, Including Halting Online Mortgage Loans and Setting Monthly Caps

High Interest Rates of 6-7% Add to Borrowers’ Burden

As mortgage loans and jeonse loans are now being blocked even at commercial bank branches, concerns over a year-end "loan cliff" are becoming a reality. This is due to the early exhaustion of each bank’s lending cap, a result of stricter total household loan management. Following the suspension of mortgage loans through loan brokers, even branch counters are now closed off, meaning that borrowers are likely to face even higher barriers, along with the burden of interest rates in the 6-7% range.

According to the financial sector on November 21, Hana Bank has decided to suspend new mortgage and jeonse loan applications at its branches from November 25 until the end of the year. Previously, Hana Bank had already halted new household loan applications through loan brokers last month and restricted non-face-to-face jeonse loan applications. While non-face-to-face mortgage loan applications are still possible, a daily limit is in place, reinforcing the sense of a "year-end shutdown." However, applications at branches are being accepted for loans to be executed after January 1 next year.

The situation is similar at other commercial banks. KB Kookmin, Shinhan, and NH Nonghyup Bank have also suspended loan broker applications until the end of the year. In addition, KB Kookmin, Shinhan, and Hana Bank have temporarily suspended new enrollments for Mortgage Credit Insurance (MCI) and Mortgage Credit Guarantee (MCG). As a result, only the amount excluding the small deposit for tenants (banggongje) is eligible for loans, effectively reducing the available loan amount. Woori Bank has set a monthly household loan limit of 1 billion won per branch, meaning each branch can only process two to three mortgage loans per month. Woori Bank plans to maintain this limit for the time being.

This phenomenon has also been observed at KakaoBank, which recently resumed accepting mortgage loan applications. On November 18, KakaoBank resumed accepting new mortgage loan applications for home purchases and raised its additional interest rate, but the daily loan cap was reached immediately after applications opened. Among actual borrowers, there is now a need to "rush in" every day to secure a loan. KakaoBank had suspended applications for about a month to update its system following the October 15 real estate policy, and raised its additional interest rate by about 0.2 percentage points upon resuming. Currently, KakaoBank’s mortgage loan interest rates range from 4.059% to 5.497% per annum, and the 6-month variable rate linked to the new COFIX stands at 3.85% to 5.561% per annum. Despite the increase in the additional interest rate, KakaoBank’s rates remain relatively competitive compared to other commercial banks, which is believed to have driven demand.

The lending restrictions at commercial banks are closely tied to the financial authorities’ efforts to strengthen total household loan management. After the inauguration of the Lee Jaemyung administration, the financial authorities announced the "June 27 Measures," the first household debt policy under the new government, and ordered banks to reduce the target for household loan growth in the second half of the year from the previous 7.2 trillion won to 3.6 trillion won, half the original amount.

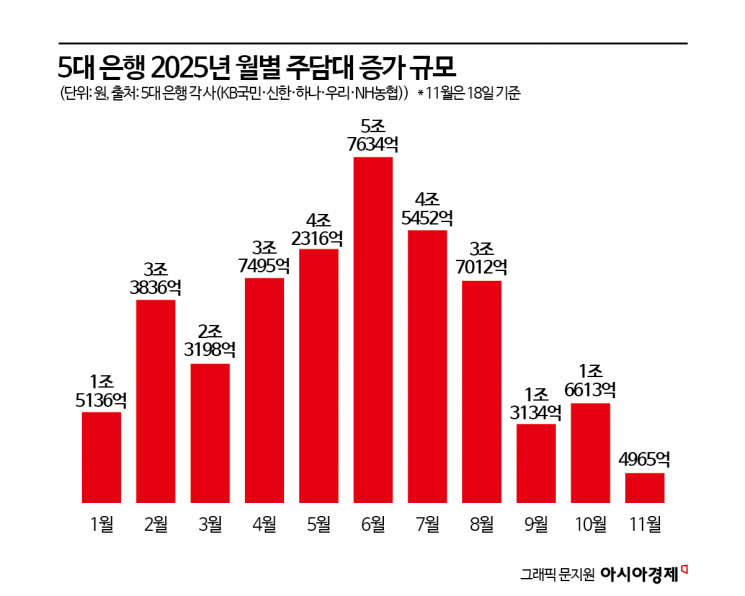

In fact, the growth of mortgage loans has already slowed significantly. As of November 18, the outstanding balance of mortgage loans at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 611.1426 trillion won, an increase of only 496.5 billion won from the end of the previous month (610.6461 trillion won). With eight business days remaining until the end of the month, at this pace, the monthly increase is likely to fall below 1 trillion won. This is just one-sixth of the increase seen in June, when mortgage loan growth was at its highest this year (5.7634 trillion won), and it is the lowest growth recorded so far this year.

Rising mortgage rates are also increasing the burden on actual borrowers. The variable mortgage loan rates at the five major commercial banks now range from 3.63% to 6.18% per annum, with the upper end exceeding 6%. At internet-only K Bank, the upper end of the variable mortgage rate is in the 7% range.

An official at a commercial bank said, "Unlike last year, we managed household loan growth more precisely from the beginning of this year, but the authorities’ decision to halve the second-half target led to the early exhaustion of lending caps. Typically, lending limits are reset at the beginning of the year, so the situation is expected to ease early next year. However, given the government’s policy stance to prevent overheating in the real estate market, banks will have no choice but to take an even more conservative approach to household debt management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.