Korea's First AI and Data-Based Insurance Assessment Service

Introducing Six New Solutions for Saving on Insurance Premiums

BankSalad, a company specializing in MyData services, announced on November 18 that it has launched a new insurance premium reduction solution, further strengthening its data- and artificial intelligence (AI)-based personalized insurance assessment services.

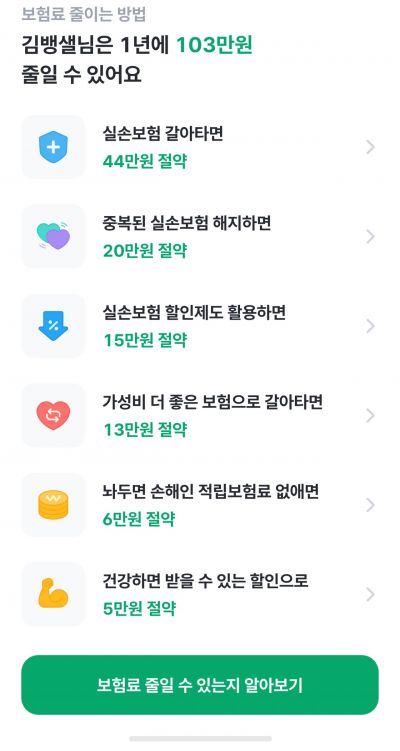

The insurance premium reduction solution analyzes health MyData and insurance data to suggest ways to save on insurance premiums, such as switching indemnity insurance, canceling duplicate indemnity insurance, utilizing indemnity insurance discount programs, removing savings premiums, switching to more cost-effective insurance, and improving health checkup results.

Each solution assesses the possibility of premium discounts and provides information on the expected savings, requirements, and discount criteria.

Users can reduce unnecessary expenses from their existing insurance policies or receive an assessment of their current situation.

BankSalad plans to add three more premium reduction solutions within this year: shortening the insurance premium payment period, replacing products scheduled for premium increases, and addressing coverage items with low effectiveness. Through these additions, the company aims to help lower insurance premiums and optimize insurance structures over the long term.

BankSalad was the first in Korea to introduce a data- and AI-based insurance assessment service. In the third quarter, the number of service consultations increased by 255% compared to the same period last year.

A BankSalad representative stated, "Our goal is to maximize the benefits of our customers' insurance experiences," adding, "Just as we introduced the country's only financial and health MyData insurance service, we will continue to launch innovative services in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.