SMIC’s Aggressive Growth as China’s Largest Foundry

Pressure on Prices as It Encroaches on the Mature Process Market

Samsung Must Secure Profitability Through Advanced Technology Competitiveness

SMIC, China's largest foundry (semiconductor contract manufacturing) company, is rapidly expanding its presence in the mature process market by maximizing its production capacity based on domestic demand. Mature processes account for over 30% of global foundry revenue, making this a crucial sector for Samsung Electronics as well. Industry experts have noted that SMIC's aggressive volume strategy is undermining the profitability of this market, which could place additional pressure on Samsung Foundry's recovery.

According to the semiconductor industry on November 18, SMIC set a new record for its quarterly performance. In the third quarter, net profit grew by 28.9% year-on-year to $191.8 million (approximately 280 billion won), while revenue increased by 9.7% to $2.38 billion (about 3.48 trillion won), surpassing market expectations. The factory utilization rate reached 95.8%, effectively operating at full capacity, and the company plans to rapidly expand its fabs up to the 5nm and 7nm nodes (1nm = one-billionth of a meter).

SMIC is benefiting from China's push for semiconductor self-sufficiency in response to U.S. sanctions, capturing massive local fabless demand and supplying advanced artificial intelligence (AI) chips for companies like Huawei. Its capital investment is also substantial. Last year, SMIC invested $7.33 billion (about 10.7 trillion won), and this year, it is expected to maintain or exceed that level. Since 2020, its cumulative investment is reported to have surpassed at least $30 billion (about 43.8 trillion won).

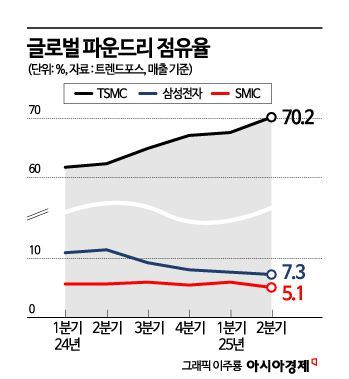

According to TrendForce, the gap between Samsung Electronics and SMIC in the foundry market is narrowing significantly. Samsung's market share fell from around 11% in the second quarter of last year to the 7% range in the second quarter of this year, while SMIC maintained a share of around 5% during the same period, improving its relative position. Although some top-tier companies gained a portion of the market share during this period, the overall trend has been a reduction in the gap between Samsung and SMIC.

SMIC is eroding Samsung's share in the analog semiconductor market focused on mature processes, such as application processors (AP) and CMOS image sensors (CIS) for mid- to low-end smartphones. Taiwan's TSMC has decided to focus on advanced, high-margin orders by selling off its 12-inch mature process equipment, setting up a competitive landscape between Samsung and SMIC.

The main issue is profitability. SMIC's rapid growth and increased supply are driving down prices in the global market. For Samsung, mature processes play a key role in maintaining revenue and offsetting fixed costs at its foundry plants, but declining profitability in this area is a concern. Samsung Electronics also believes that SMIC's market pressure has been a major factor in the recent decline in its foundry revenue and market share.

The proportion of mature process revenue (28nm and above) in the global foundry market has decreased from 50-60% in the early 2020s to around 36% this year. However, since advanced processes below 7nm are driving new growth, the absolute revenue from mature processes has essentially remained stable. Even with profitability issues, SMIC dominates China's domestic market and can afford lower margins thanks to substantial government subsidies. Following the intensification of U.S. sanctions, it is reported that the Chinese government is offsetting power and cost issues associated with using domestic AI chips through subsidies.

Samsung Electronics is responding by securing global clients for its most advanced processes and maintaining partnerships as those processes mature. Rather than directly competing with China’s low-cost, high-volume strategies in mature processes, Samsung aims to secure competitiveness across all process nodes through technological leadership.

An industry official said, "If you secure customers for advanced processes, those partnerships can continue as the technologies mature. Based on customer trust, we will work to increase our share in advanced processes while strengthening competitiveness to maintain profitability in existing process nodes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.