Next-Generation Glass Substrate Market Set to Exceed 12 Trillion Won

Samsung Accelerates Negotiations by Supplying Samples to Big Tech

Securing Market Leadership Through Internalization of Glass Core Technology

Two years after entering the glass substrate business, which is considered a 'game changer' in next-generation semiconductor packaging, Samsung Electro-Mechanics is now in supply negotiations with global big tech companies. The glass substrate market, which has gained prominence due to the spread of artificial intelligence (AI), is expected to exceed 12 trillion won. Samsung Electro-Mechanics is aiming for market leadership by internalizing 'glass core' technology, which is regarded as a key material, in addition to its existing substrate supply references.

According to the semiconductor industry on November 12, Samsung Electro-Mechanics is negotiating glass substrate supply with multiple North American big tech companies. After establishing a pilot line at its Sejong plant in the first half of this year, the company has been producing prototypes and plans to complete sample supply within the year. Industry sources believe that samples have already been supplied to AMD and Broadcom. Apple, which is developing application-specific integrated circuits (ASICs) with Broadcom, is also reportedly considering adopting glass substrates.

If the samples pass the evaluation, discussions on mass production scale and yield conditions are expected to take place next year. Samsung Electro-Mechanics has set 2027 as the target year to begin mass production and supply, reflecting customer requirements. An industry insider commented, "Samsung Electro-Mechanics has already established trust in the global substrate market by successfully supplying flip-chip ball grid array (FC-BGA) products," adding, "The company is expected to have a favorable position in negotiations, especially with existing big tech clients."

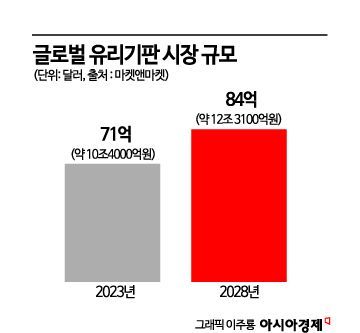

Glass substrates began attracting attention as AI technology advanced. As AI chips require greater computational power, the chip area is increasing and high bandwidth memory (HBM) is being stacked together, resulting in a 'large-area package' structure. Conventional organic substrates made from plastic are prone to warping and other issues, so the AI and foundry (semiconductor contract manufacturing) industries are considering glass substrates, which offer superior thermal expansion stability. Once the market fully emerges, it is projected to surpass 12 trillion won. Market research firm MarketsandMarkets forecasts that the global glass substrate market will grow from $7.1 billion (about 10.4 trillion won) in 2023 to $8.4 billion (about 12.31 trillion won) by 2028.

In terms of speed, SKC is leading the way. Through Absolix, established in 2021, SKC is building the world’s first mass-production line for glass substrates in Georgia, United States, with mass production expected to begin as early as the beginning of next year.

The key variable is securing customers. While SKC has traditionally been a materials company, Samsung Electro-Mechanics has already secured AMD, Broadcom, Tesla, and Amazon as FC-BGA clients. The company reportedly plans to supply Apple, Google, and Meta next year as well. Since the glass substrate market is still in its early stages, with no established standards and requiring advanced technology, Samsung Electro-Mechanics, with its track record in substrate supply, is considered to have an advantage in earning customer trust regarding manufacturing processes.

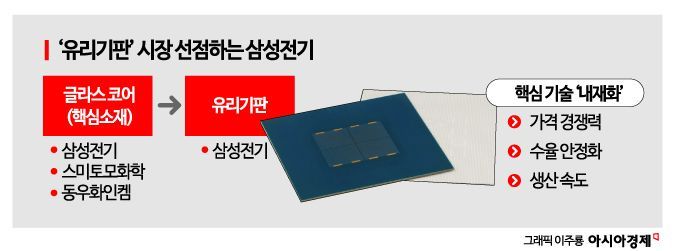

The industry sees next year as a critical turning point in the technology race. Samsung Electro-Mechanics aims to secure a leading position in the market by internalizing the development and production of 'glass core,' the key material for glass substrates. Unlike competitors such as SKC, which procure materials externally, Samsung Electro-Mechanics believes it can gain an edge in both price competitiveness and production speed. The company recently established a joint venture with Japan's Sumitomo Chemical Group to develop glass core technology. Samsung Electro-Mechanics is participating as the major investor with a majority stake, and plans to use idle space and clean rooms at Dongwoo Fine-Chem's Pyeongtaek plant, a subsidiary of Sumitomo Chemical, as its initial production base.

An industry insider said, "The semiconductor substrate market will rapidly shift toward glass substrates. Since they are difficult to manufacture and have high production costs, it is more important to produce according to the quality and conditions required by customers than to focus on speed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)