Annual Interest Rates Up to 73,000% by Illegal Lenders

Family Threats and Public Exposure Are Just the Beginning

"Now, the only thing left for me is to die. I am suffering from 2.4 million won in overdue interest every day."

This is the content of a text message sent by Dr. A, who was once the director of a local hospital, to an investigator from the Gyeonggi Nambu Provincial Police Agency's Criminal Investigation Unit.

Dr. A, who was once a successful specialist, began to spiral downward after coming across an advertisement for a small loan in a KakaoTalk open chat room in September of last year. At the time, A had spent a large sum on expensive equipment for the hospital and was struggling to make ends meet, tightening their belt due to a shortage of living expenses.

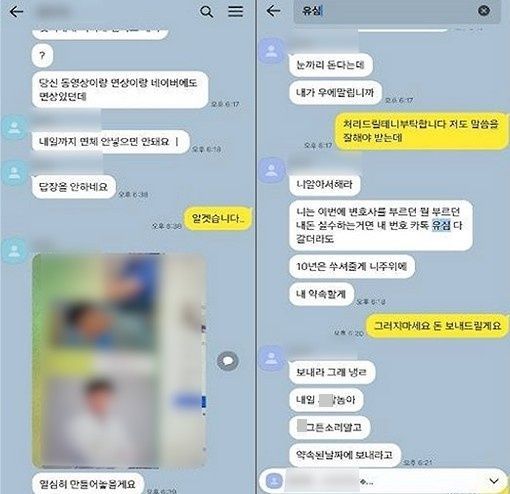

After seeing an advertisement that even loans as small as 200,000 to 300,000 won were available, A entered the chat room. The company introduced themselves as a legitimate lending business and claimed, "Borrowing money will not affect your personal credit at all." A, as if hypnotized, was deceived by their guidance. The loan process was simple. By providing personal information, bank transaction history, a self-recorded video stating that a friend or acquaintance was used as collateral, and cloud contacts from a portal site as requested, the loan was processed remotely.

However, the interest rates were beyond imagination. The borrower was required to repay both principal and interest (100% of the principal) every week, and if this was not met, a daily overdue fee of 40% of the principal was charged as interest. Despite the extremely high interest rate, far exceeding the legal limit of 20%, A borrowed 1.5 million won. A was confident that, as a doctor, there was no way they would fail to repay the loan within the set period.

The consequences were harsh. The staff relentlessly pressured A when payments were not made on time. When the loan became overdue, they contacted A, attaching a photo in a doctor's gown and saying, "Your video and face are on the portal site." The intensity of the threats gradually escalated. They made unspeakable threats, implying harm with a weapon, and pressured A by threatening to inform family and acquaintances. What A feared most was the threat that they would come to the hospital and publicly humiliate them.

Tormented, A took out additional loans to repay the previous ones, again and again. In total, A borrowed 21.5 million won over nine transactions, but all that remained was a mountain of debt. As a result of the incident, A closed the hospital. In a letter to the police, A pleaded, "Within a year, I have paid over 30 million won in interest, excluding the principal, and am still suffering from more than 30 million won in (additional) interest. Enduring more than 2 million won in overdue interest every day is unbearable, and the threats were so terrifying that I even attempted suicide."

On the 11th, the Gyeonggi Nambu Provincial Police Agency's Criminal Investigation Unit announced that it had arrested 13 members of an illegal private lending organization, including the ringleader, Bae, on charges of violating the Lending Business Act and the Debt Collection Act, as well as organizing a criminal group (four of whom were detained), and referred them to the prosecution. In addition, 16 people who provided bank accounts for money laundering for Bae's group were booked for violating the Electronic Financial Transactions Act and handed over to the prosecution.

Bae and others are accused of setting up an office in Yongin from June last year to July this year, providing small loans to 553 people in urgent need of cash, including young adults just starting their careers, office workers, housewives, and nightlife workers, and collecting high interest rates ranging from 238% to 73,000% annually, receiving a total of 1.8 billion won. Victims who failed to meet repayment deadlines were subjected to various forms of illegal debt collection, just like in A's case.

The police launched an investigation after receiving a tip-off in January, and over six months, from July to last month, sequentially arrested Bae's group. Among the victims was a man in his 30s whose debt was revealed to his fianc?e's family, leading to a broken engagement, and who was fired from his job after collection messages were sent to his colleagues. He attempted suicide three times and was most recently found and rescued by police after his family reported him missing.

A police official stated, "If a remote lending company charges interest rates above the legal limit or asks for contact information of family and acquaintances, it is highly likely to be an unregistered illegal lender, so be extremely cautious even with small amounts. If you have suffered from illegal debt collection, you can seek relief, such as support for lawsuits to invalidate the loan contract, through the 'debtor representative system.' We encourage you to apply through the Financial Supervisory Service."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.