8.78 Billion Won Lent to Nine Affiliates

Nearly 300 Billion Won Borrowed by Daebang Industrial Development

Over 70 Billion Won Injected into Dongtan-Related Affiliates

Daebang Construction, ranked 22nd in construction capability evaluation, has funneled trillions of won into affiliates owned by Chairman Koo Kyo-woon’s daughter and daughter-in-law. In total, the company has lent nearly 900 billion won to its affiliates. These funds appear to be used to cover rising costs amid the vicious cycle of a construction market downturn and increasing construction expenses. However, there are growing concerns that excessive financial support for struggling affiliates experiencing capital erosion could weaken the group’s overall financial capacity.

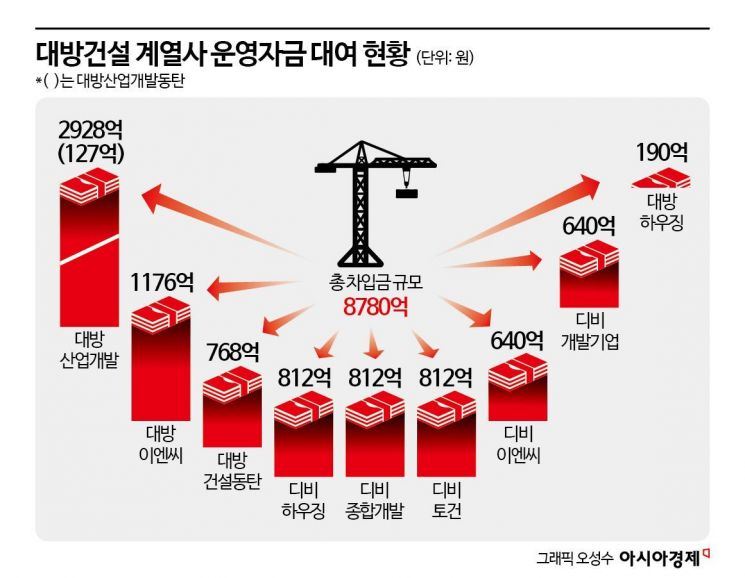

According to the Financial Supervisory Service’s electronic disclosure system on November 13, Daebang Construction lent a total of 878 billion won in operating funds to nine affiliated companies over 35 transactions from January to this month. This represents a 103% increase compared to last year’s consolidated annual loans of 432.7 billion won.

The largest borrower was Daebang Industrial Development, which borrowed 292.8 billion won over 11 transactions. This company is a family business in which Chairman Koo’s daughter, Koo Sujin, and his daughter-in-law each hold 50.01% and 49.99% stakes, respectively, and its outstanding borrowings have been increasing every year. As of this month, the outstanding loan balance (total borrowings) of Daebang Industrial Development, excluding amounts already repaid, stands at 383.1 billion won. The figure jumped from 35.8 billion won in 2023 to 203.3 billion won last year, and has now surpassed 300 billion won this year.

Other affiliates that have borrowed funds from the parent company include Daebang ENC (117.6 billion won), Daebang Construction Dongtan (76.8 billion won), DB Housing, DB General Development, and DB Construction (81.2 billion won), DB ENC and DB Development Enterprise (64 billion won), and Daebang Housing (19 billion won). The Daebang Group is mainly comprised of Daebang Construction and Daebang Industrial Development, in which Chairman Koo’s son and son-in-law hold stakes. Each of these two core companies owns 23 and 11 subsidiaries, respectively.

Significant funds have also flowed into affiliates involved in the Dongtan development project in Gyeonggi Province. Since the beginning of this year, Daebang Construction has lent 76.8 billion won to its affiliate Daebang Construction Dongtan over five transactions. Daebang Construction Dongtan was established in 2017 to develop the mixed-use complex “Dongtan Station The Atrium” in Hwaseong City. After completion in January, all apartments and officetels have been sold. However, commercial facilities are still being offered for sale, and it appears that the company is raising funds for this purpose.

This concentration of funds to affiliates appears to be a measure to secure business performance. Daebang Construction and its group affiliates handle everything internally, from bidding for public land to project development and construction. The group pursues profits through a process of “swarm bidding → internal construction → capital circulation within the ownership structure.” Among these, Daebang Construction secures performance by taking on construction work for projects where its affiliates act as developers. The company plans to supply about 9,000 housing units this year, setting an aggressive sales target despite the construction market downturn.

However, a high proportion of internal transactions can itself become a risk factor for the group’s governance structure. According to the Fair Trade Commission, Daebang Construction’s internal transaction ratio was 42.5% last year, the second highest after Celltrion (65.7%). Daebang Construction has previously been fined and ordered to rectify for reselling public land to family-owned companies.

Another issue is the provision of massive funds even to affiliates in a state of capital erosion. Daebang Construction Dongtan, which received over 70 billion won from Daebang Construction, was a financially distressed affiliate in partial capital erosion as of the end of last year. Last year, Daebang Industrial Development, owned by Chairman Koo’s daughter and daughter-in-law, also lent a total of 12.7 billion won to its subsidiary Daebang Industrial Development Dongtan. As of the end of last year, Daebang Industrial Development Dongtan recorded a negative total equity of 43.3 billion won, falling into complete capital erosion.

Daebang Construction stated that it is providing support to affiliates within the limits that do not burden its financial soundness and in compliance with legal requirements. A Daebang Construction official explained, “Inter-affiliate loans are a measure to secure a stable profit structure through efficient internal capital circulation,” adding, “These are conducted as financial transactions applying legally recognized normal interest rates.” The official further stated, “The scale of support is selectively executed, taking into account each affiliate’s business progress and Daebang Construction’s financial capacity, and is currently at a level that can be fully managed within our financial structure.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)