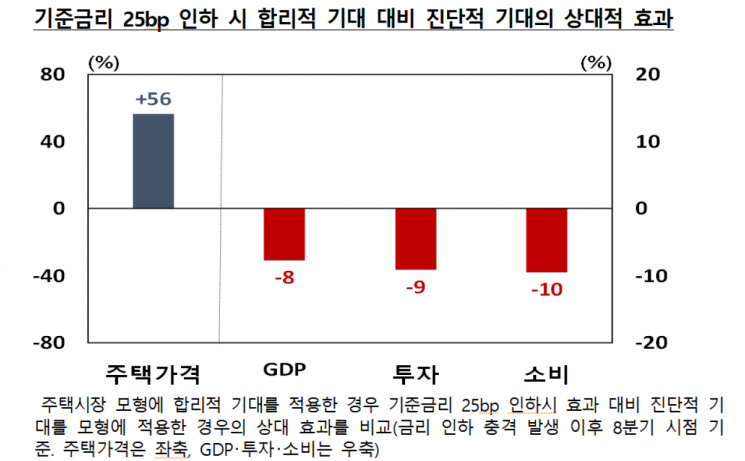

Two Years After a 25bp Policy Rate Cut,

With Diagnostic (Biased) Expectations,

Home Prices Rise 56% More Than Under Rational Expectations

GDP, Investment, and Consumption Increase 8?10% Less

When economic agents selectively recall past news or memories related to rising housing prices-regardless of changes in economic conditions-and form biased expectations (diagnostic expectations) that the upward trend in home prices will continue, the effect of a policy rate cut on boosting growth is found to be minimal. In contrast, housing prices may surge significantly, increasing financial stability risks.

According to the BOK Economic Research Report, "Construction and Implications of a DSGE Model for the Housing Market Reflecting Diagnostic Expectations" (by Yoon Jinwoon and Lee Junghyuk), published by the Bank of Korea on November 11, an analysis using a model incorporating diagnostic expectations showed that when expectations for housing price increases become excessively strong, the rise in home prices is greater compared to the scenario with rational expectations. On the other hand, the growth-boosting effect of a policy rate cut is reduced compared to rational expectations. Assuming diagnostic expectations, eight quarters after a 0.25 percentage point (25 basis points) policy rate cut, home prices rose 56% more than under rational expectations. In contrast, gross domestic product (GDP), investment, and consumption increased 8-10% less.

Yoon Jinwoon, a researcher in the Macroeconomic Modeling Team at the Economic Modeling Office, explained, "These results indicate that when strong expectations of continued housing price increases are formed among economic agents, if the central bank conducts accommodative monetary policy, the effect of boosting growth is weakened, while home prices may rise sharply, increasing financial stability risks."

To mitigate the negative effects of diagnostic expectations, it is necessary to consistently and continuously implement housing market policies so that economic agents do not form excessively high expectations for rising home prices. Yoon added, "When monetary policy easing is implemented to counteract an economic downturn while the upward trend in home prices continues, macroprudential policies need to be strengthened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.