Over 150 Tteokbokki Franchise Brands in Korea

Yeopgi Tteokbokki's Average Annual Sales Surpass "Kyochon Chicken"

As the "Yeopgi Tteokbokki syndrome," which combines spicy flavors and delivery services, sweeps across the country-especially among younger generations-Buldakbal Ttaengcho Dongdaemun Yeopgi Tteokbokki (Yeopgi Tteokbokki) has surpassed the average sales of chicken franchises, including Kyochon Chicken.

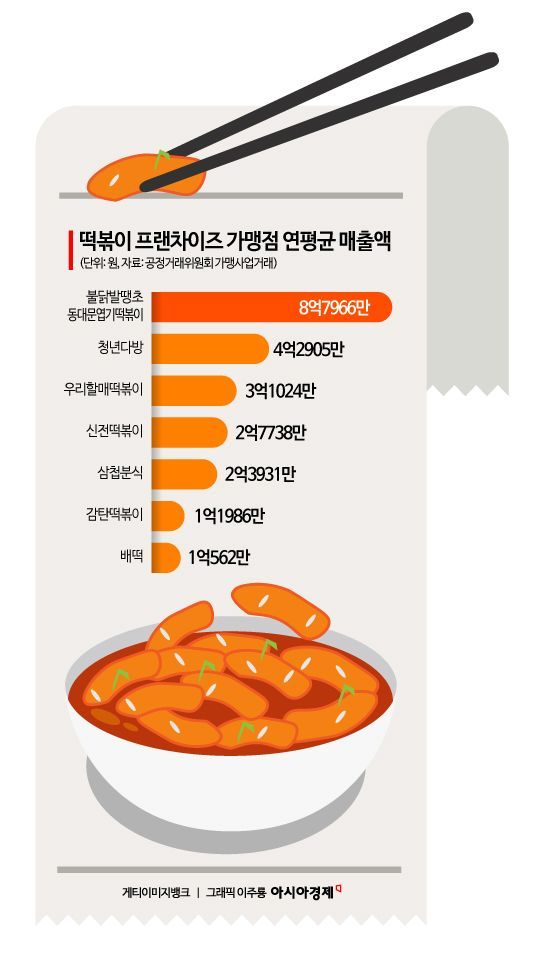

According to the Fair Trade Commission on November 7, there are currently about 150 tteokbokki franchise brands in South Korea. Among them, the top brands in terms of sales include Yeopgi Tteokbokki, Sinjeon Tteokbokki, Cheongnyeon Dabang, Baetteok, Woorihalmae Tteokbokki, Samcheop Bunsik, and Gamtaan Tteokbokki. Tteokbokki, which was once considered a side menu in the snack food category, is now recognized as a major pillar of the dining industry.

Average Sales of 879.66 Million Won... Surpassing Chicken Franchises

Last year, the average sales per Yeopgi Tteokbokki franchise store reached 879.66 million won, an increase of about 10% compared to the previous year (799.85 million won). This figure is higher than Kyochon Chicken, which has the highest average sales among chicken franchises at 727.26 million won. Compared to other leading brands, such as BHC (529.72 million won) and BBQ (508.79 million won), the difference exceeds 300 million won. As of 2023, the average sales per franchise outlet in the food service industry stood at 323 million won.

Yeopgi Tteokbokki, which opened its first store in 2009, initially gained popularity among "spicy food enthusiasts." In the 2020s, its popularity soared through social networking services (SNS) and delivery platforms. The brand segmented its spicy levels into six stages and implemented fandom-driven marketing strategies such as "Yeopgi Tteokbokki goods" and the "Yeopgi Tteokbokki Challenge," growing into a nationwide brand.

The number of stores has also been steadily increasing: 552 in 2022, 602 in 2023, and 659 as of 2024. It is highly likely to surpass 700 stores within this year. While many food service franchises have been reducing their number of outlets due to the economic downturn, Yeopgi Tteokbokki has been expanding its store network.

The performance of its operator, Hot Seasoner, has also improved. Last year, Hot Seasoner recorded sales of 123 billion won, a 13% increase from the previous year's 108.3 billion won. Operating profit surged by 89%, from 2.7 billion won to 5.1 billion won. Analysts attribute this growth to the brand's competitive edge, which is based on a "pride in spiciness" culture.

Sinjeon, Cheongnyeon Dabang, Baetteok... Competition for Generational Tastes

In terms of the number of franchise stores, Sinjeon Tteokbokki ranks first, operating 818 outlets as of last month. The number of franchises, which was 722 in 2022, briefly decreased to 702 in 2023 but has been increasing again since last year. The average sales per Sinjeon Tteokbokki franchise is 429.05 million won.

The operator, The Sinjeon, recorded sales of 17.9 billion won last year, a 44% increase from the previous year's 12.4 billion won. However, operating profit fell by 16%, from 4.2 billion won to 3.5 billion won. Rising delivery fees and raw material costs are believed to have pressured the profit margin.

Sinjeon Tteokbokki began in 1999 in front of Kyungmyeong Girls' High School in Daegu. At the time, the founder, Ha Seongho, was a 23-year-old who started the business with the goal of creating a "mecca for spicy tteokbokki," and began franchising in 2003. Since 2015, the brand has expanded overseas to Australia, the United States, Vietnam, Taiwan, the Philippines, Japan, and Canada. Its signature feature is the "individual cooking method," where dishes are prepared in a pot upon order.

Cheongnyeon Dabang, with 356 stores, reported average annual sales per store of 429.05 million won. With its caf?-style interior and a "premium snack food" concept that combines coffee and desserts, the brand targets office workers in their 20s and 30s.

In contrast, Baetteok, which was once highly popular, has seen its growth slow. The number of stores dropped from 490 in 2022 to 325 last year, and average annual sales per store fell to 105.62 million won. As the "rose tteokbokki craze" that spread through SNS has subsided, the brand appears to have entered a period of adjustment.

Woorihalmae Tteokbokki recorded average sales of 310.24 million won, while Samcheop Bunsik reported 239.31 million won.

The reasons tteokbokki is emerging as a popular choice for restaurant startups are its low ingredient costs and fast turnover rate. An industry insider commented, "Tteokbokki is easy to prepare and requires less labor, making it favorable for solo entrepreneurs. The initial investment is more than 20% cheaper compared to chicken franchises."

According to Fair Trade Commission data, the average startup cost for a Yeopgi Tteokbokki franchise is 160 million won, lower than Kyochon Chicken's 200 million won. As the consumption structure has shifted toward delivery, dependence on dine-in stores is low, and labor costs are relatively modest. The insider added, "While chicken is mainly a family dining option, tteokbokki is an item favored by young people, such as friends and couples. With high exposure on social media and a short repurchase cycle, its growth potential is significant."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.