Spot Price Could Surpass $30 Within the Year

Samsung, SK hynix and Other Memory Makers

Postpone Fixed Price Negotiations

Manufacturers Aim to Secure Higher Profits

By Monitoring the Market Amid Soaring Prices

Concerns Grow Over Disruptions

As DRAM prices soar to unprecedented heights, a wave of 'panic buying' is sweeping the market as buyers rush to secure inventory before prices climb even further. The spot price for DDR5 memory is rising by as much as $1 per day, with some predicting it could surpass $30 before the end of the year. With prices surging, major memory manufacturers are reportedly delaying or postponing contract negotiations with clients, citing the need for further discussions. There are growing concerns that this could disrupt supply schedules for finished product manufacturers such as PC and smartphone companies.

According to the semiconductor industry and foreign media outlets such as Taiwan's DigiTimes on November 5, Samsung Electronics postponed its fixed-price contract negotiations for DDR5 semiconductors with clients from last month to mid-November. DDR5 is a next-generation computer memory used for high-performance data processing. There are even doubts as to whether negotiations will resume in mid-November as planned. It has also been reported that SK hynix and Micron have recently postponed price negotiations in a similar manner.

An industry insider commented, "Each company has different DRAM purchase conditions, so it is difficult to specify the exact scope of the postponed negotiations," but acknowledged that some negotiations have indeed been delayed. A representative from the materials, parts, and equipment sector said, "Recently, memory companies are reducing the immediate availability of spot inventory, which used to be provided to clients on demand, and are instead encouraging more long-term supply contracts lasting several months. As a result, clients who need DRAM immediately are finding spot inventory unavailable, so they are buying at higher prices, which is driving up spot prices even further."

The temporary suspension of supply negotiations by memory manufacturers is seen as a move to monitor market trends amid the ongoing spike in DRAM prices and to respond to higher market prices. The aim is to increase fixed contract prices and secure greater profits. Some analysts suggest that this could be an opportunity for the three major memory companies to restructure their supply chains, focusing more on long-term contracts with global conglomerates that can absorb high DRAM prices.

The move to postpone contracts is believed to be a reaction to the recent surge in DRAM prices, triggered by some companies entering the market to buy at what they perceived as 'bottom prices.' In particular, among startups and small to medium-sized enterprises lacking sufficient capital but needing DRAM for artificial intelligence (AI) development, there is a widespread sense of "buy now or never." As prices rise, companies are scrambling to secure inventory, fueling further price increases. This has led to concerns that the current 'DRAM inflation' phase could persist for an extended period.

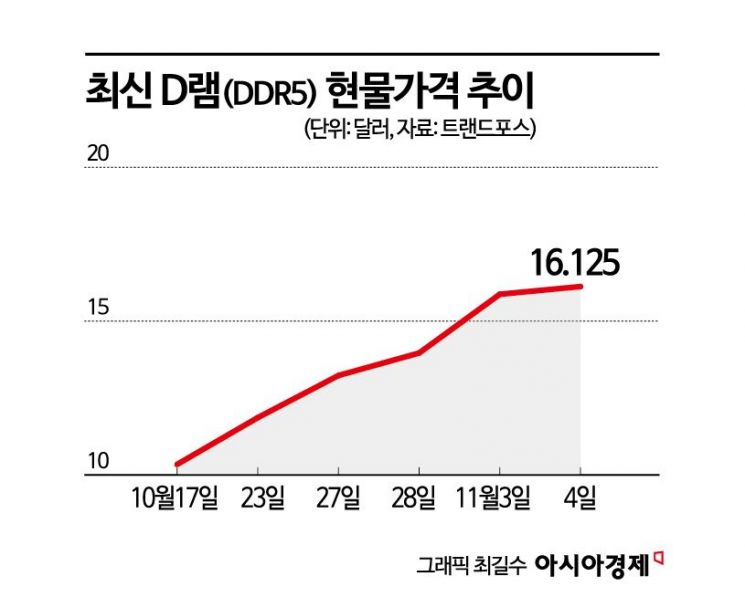

The panic buying trend is also evident in market indicators. According to research by TrendForce and DRAMeXchange, on November 4, the spot price for DDR5 16Gb (2Gx8) 4800/5600 reached a high of $24, with an average price of $16.125. Spot transactions reflect actual prices formed on a given day and are regarded as a direct indicator of market sentiment. With DDR5 spot prices rising by $1 per day, there is speculation that the price could exceed $30 before year-end. If this trend continues, fixed contract prices between companies, to be announced at the end of this month, are expected to surpass $15 and reach new annual highs.

Taiwan's DigiTimes reported, "Clients of memory companies are in a dilemma, uncertain whether DRAM prices will stabilize in the future and unsure if they should purchase DRAM now at high prices. If this trend continues, prices could rise by 30% to 50% per quarter through the first half of next year, pushing DDR5 16Gb prices above $30." Ahn Ki-hyun, Executive Director of the Korea Semiconductor Industry Association, commented, "Even $7 (the fixed contract price for generic DRAM products in October) is considered expensive. If prices reach $23 to $30, buyers may refuse to purchase. If transactions are being made at close to $30, it is likely due to urgent demand or panic buying." There are also predictions that the temporary suspension of semiconductor price negotiations will impact not only the manufacturing of finished products such as PCs and smartphones but also their prices. An industry insider added, "Delays in negotiations could disrupt supply schedules for finished product manufacturers."

The prevailing analysis is that the recent surge in DRAM prices has been triggered by memory supply failing to keep up with demand. High-bandwidth memory (HBM), essential for AI semiconductors developed by big tech companies such as Nvidia and AMD, is only supplied by Samsung Electronics, SK hynix, and Micron in the United States. Unless this supply-demand imbalance is resolved, the upward trend in prices is expected to continue.

Chey Tae-won, Chairman of SK Group, also recently pointed out, "The memory supply bottleneck is intensifying, and memory chip supply has become a bigger constraint than graphics processing units (GPUs)." He emphasized the strategic importance of Korea's semiconductor production network, noting that major global companies are making frequent requests for memory chip supplies.

The industry believes that the key to calming DRAM inflation ultimately lies in expanding production capacity at major memory companies such as Samsung Electronics and SK hynix. Unless these companies increase supply through facility expansion or investment, the market price and delivery structure will inevitably shift in favor of sellers. There is a growing consensus that the initiative in the DRAM market has shifted from buyers to sellers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.