Compared to Physical Supply Chains, Bio Industry Centers on Data and Technology

Fewer Sanctions, Leading to Increased Global Collaboration

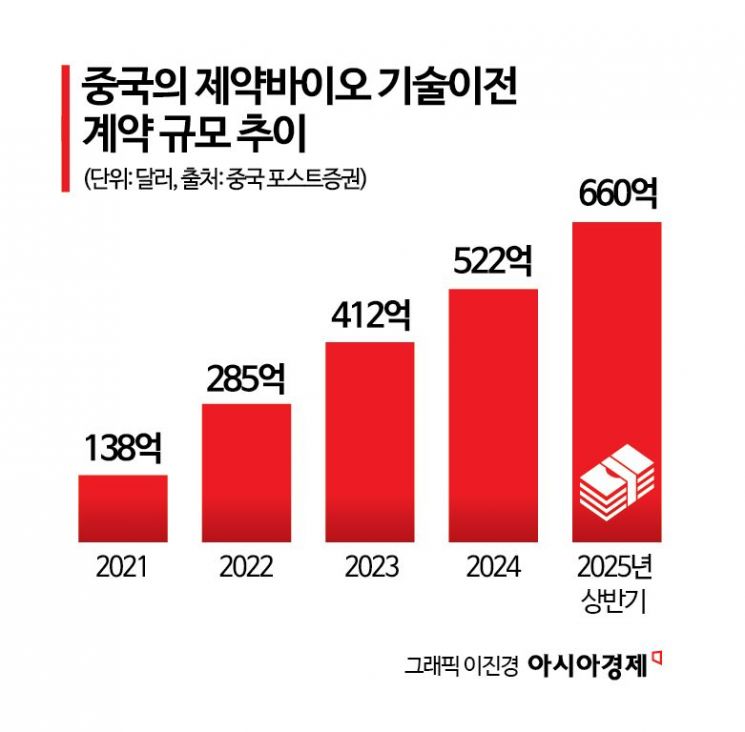

China Accounts for 32% of Global Tech Transfers in First Half

China Shows Edge in Innovative New Drugs

While advanced manufacturing industries such as semiconductors and batteries are decoupling their supply chains due to the ongoing conflict between the United States and China, cooperation with China is actually strengthening in the bio sector. This is due to the industry structure, which revolves around technology, market, and clinical data.

According to the U.S. investment bank Jefferies on November 5, Chinese pharmaceutical and biotech companies accounted for 32% of global pharmaceutical and biotech technology transfer deals in the first half of this year. In the first half of this year, Chinese pharmaceutical companies exported technology worth $66 billion (about 95 trillion won), already surpassing last year's total of $52.2 billion (about 75 trillion won).

This is the complete opposite of what is happening in the global supply chains and cooperative relationships of other high-tech industries such as semiconductors and batteries, where China is being excluded. The reason for this difference lies in the unique principles of the pharmaceutical and biotech industry. While semiconductors and batteries are supply chain industries centered on materials, components, and equipment, pharmaceuticals and biotech are industries based on knowledge and clinical data. Data and technology are the sources of value. Although the United States is implementing a strict China exclusion strategy regarding physical supply chains, there are insufficient standards or grounds for sanctions when it comes to the "invisible supply chains" of data and technology. There are also currently no effective means of sanctions. The United States is pushing for the enactment of a "biosafety law" to regulate cooperation with biotechnology companies from "countries of concern" such as China and Russia, but there is significant opposition even within the U.S. due to concerns about clinical delays and confusion.

Korean companies are also focusing on China as a cooperation partner. Last month, Samsung Bioepis agreed to jointly develop two antibody-drug conjugate (ADC) new drugs with China's Frontline Biopharma. Based on Frontline's bispecific antibody and dual payload technology, the two companies will co-develop two pipelines and have secured certain exclusive licenses. GC Cell introduced "Fucaso," a multiple myeloma treatment, from IASO Bio in Nanjing, China. Fucaso is the world's first fully human-derived BCMA (B-cell maturation antigen) CAR-T therapy, which has already been approved in China and is being administered to patients.

In addition, bio ventures such as ABL Bio, LegoChem Bio, and GI Innovation are also entering into partnerships with Chinese companies. ABL Bio signed a joint development agreement for a bispecific antibody anti-cancer drug worth $400 million (about 577.6 billion won) with I-Mab Biopharma, and GI Innovation signed an exclusive contract with Simcere Pharmaceutical for the immuno-oncology drug "GI-101" in China. LegoChem Bio transferred its ADC (antibody-drug conjugate) candidate "LCB71" technology to CStone Pharmaceuticals, where phase 1 clinical trials are underway locally.

The Chinese pharmaceutical and biotech market is valued at $250 billion (about 340 trillion won), making it the second largest in the world after the United States. Under the government's "Made in China 2025" strategy, bio has been designated as a core industry, and clinical infrastructure is rapidly expanding around major hospitals. The National Medical Products Administration (NMPA) has halved the review period for new drugs. With a patient pool of 1.4 billion people, China offers overwhelming competitiveness in clinical trials for rare diseases and certain cancers. As the global pharmaceutical market is rapidly being reorganized, major pharmaceutical companies are partnering with China for "technology and speed." Japan's Takeda Pharmaceutical signed a 16 trillion won ADC joint development agreement with Innovent Biologics, and GSK entered into a new drug collaboration worth 17 trillion won with Hengrui Medicine. However, there are also considerable risks. Issues such as intellectual property (IP) protection in China, geopolitical risks stemming from U.S.-China tensions, and the reliability of clinical data remain variables.

An industry official commented, "China is no longer just a production base; it is now a market reorganized around innovation. Korean pharmaceutical and biotech companies can secure global competitiveness by simultaneously pursuing technological independence and balanced cooperation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.