U.S. Production Surges While Weekend Overtime Disappears in Korea

"Manufacturing Hollowing-Out" in Electric Vehicles Accelerates

Hyundai Ulsan Plant Line 12

Weekend Overtime Rarely Conducted This Year

Ioniq 5 Production Plummets in Korea, Soars in the U.S.

Will Tariff Barriers Drive More Production Out of Korea?

Weekend overtime work has disappeared from the electric vehicle production line at Hyundai Motor Company's Ulsan plant. Partial shutdowns, where operations are halted for several days, have already occurred eight times this year alone.

Some analysts attribute this to the prolonged electric vehicle chasm-a temporary stagnation in demand-but unlike in Korea, production volume in the United States is actually increasing. The argument that this marks the beginning of "manufacturing hollowing-out," where domestic production capacity shifts overseas, is gaining traction.

According to the automobile industry on November 4, Hyundai Motor Company did not schedule weekend overtime for Line 12 of Ulsan Plant 1, which produces the Ioniq 5 and Kona Electric, for this month.

This contrasts with Ulsan Plants 2 through 5, which are conducting overtime work every Saturday this month except for November 8, when the National Workers' Rally is scheduled. These plants primarily manufacture internal combustion engine vehicles such as the Santa Fe, Palisade, Avante, and Tucson.

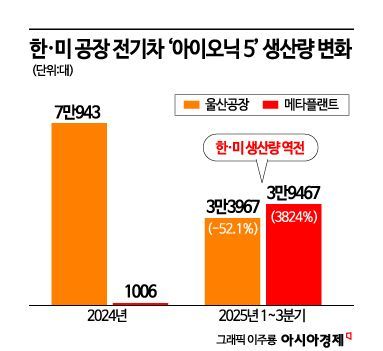

Line 12 has rarely operated weekend overtime since the beginning of this year. Since February, shutdowns have also become frequent. The line was halted from October 29 to 31. It is also reported that "pitch-downs," or reductions in hourly production volume, are being carried out regularly. As a result, Ioniq 5 production in the first to third quarters of this year dropped to 33,967 units, which is nearly half of the 70,943 units produced during the same period last year.

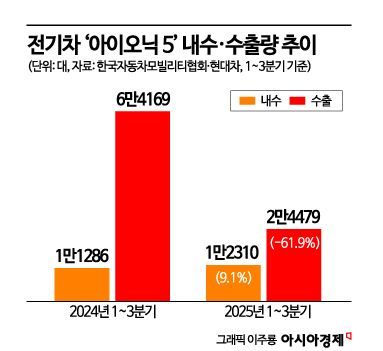

During this period, however, domestic sales actually increased. In the first to third quarters, domestic sales of the Ioniq 5 reached 12,310 units, up 9.1% compared to the same period last year.

The decline in production volume can be traced to exports. Exports during this period amounted to 24,479 units, a sharp 61.9% drop compared to the same period last year. This is one of the reasons fueling concerns about the hollowing-out of domestic production.

Notably, overseas production of the Ioniq 5 has surpassed domestic output. This is largely due to the sharp increase in production in the United States, which is a key market for the Ioniq 5.

At Hyundai Motor Group Metaplant America (HMGMA) in Georgia, which began full-scale operations this year, 39,467 units of the Ioniq 5 were produced in the first to third quarters-more than the output at the Ulsan plant. This accounts for the majority of the 41,090 Ioniq 5 units sold in the United States during this period.

Concerns Grow Over Manufacturing Hollowing-Out Amid Sluggish Exports and Trump Tariffs

Industry insiders point out that the reduced operating rate of Ulsan Plant 1's electric vehicle line should be attributed more to the trend of "manufacturing moving out of Korea" than to a simple decline in electric vehicle sales. The U.S. tariff barrier is further accelerating this trend. Since the imposition of U.S. tariffs, Hyundai Motor Group has been steadily increasing local production in the United States.

There is a growing belief that manufacturing hollowing-out could expand beyond electric vehicles to hybrids and internal combustion engine vehicles. In September, Hyundai's Alabama plant achieved its highest monthly production this year with 35,371 units, a 52% surge compared to the 23,251 units produced in January. Notably, production of the Santa Fe Hybrid Electric Vehicle (HEV) nearly tripled, rising from 2,325 units to 6,974 units.

HMGMA's production capacity will also increase to 500,000 units by 2028. At the New York Investor Day in September, Hyundai Motor Company President Jose Munoz announced plans to raise the proportion of U.S. production from the current 42% to 80% by 2030.

Hyundai Motor Company is not only increasing exports from its plants in China and India to third countries, but is also building a new plant in Saudi Arabia targeting the Middle East market. All of these are facilities that could substitute for domestic production.

Hyundai Motor Company has stated its intention to assign new vehicle models to domestic plants in response to increasing overseas production, but how Ulsan Line 12 will be utilized remains undecided. A Hyundai Motor labor union official said, "Preparatory work is necessary to produce hybrids or other models instead of electric vehicles," adding, "There are no concrete discussions underway yet."

Experts warn that the Ulsan plant case could mark the acceleration of manufacturing hollowing-out. In Germany, a leading automotive nation, local production was ramped up to enter the Chinese market, but sluggish sales led to the loss of approximately 51,500 jobs in the domestic automotive industry over the past year, according to a report by Ernst & Young.

Lee Hangkoo, a research fellow at the Korea Automotive Technology Institute, stated, "With the rise of protectionism such as tariffs, not only Hyundai Motor Company but also global automakers are structurally compelled to increase local production overseas to secure global supply chains," adding, "There is a need for policy support to maintain domestic production by boosting domestic demand through purchase subsidies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.