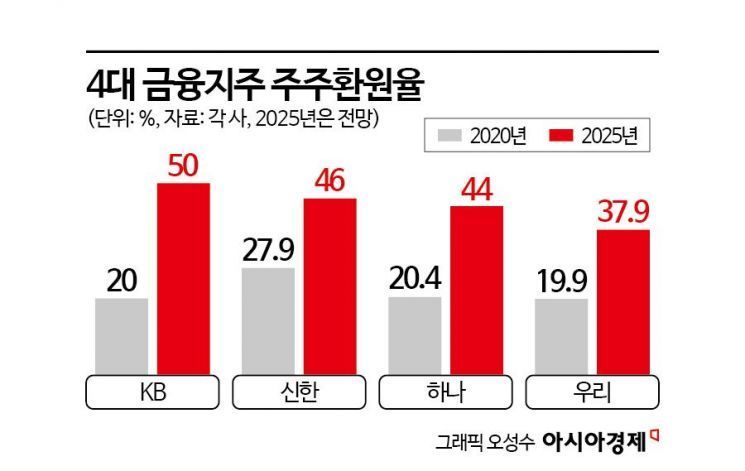

KB Expected to Become First Financial Holding Company to Surpass 50% Shareholder Return Rate

Shinhan and Hana Aim for Early Achievement of 50% Shareholder Return Target

Woori Financial Group Introduces Tax-Free Dividends for the First Time

The four major financial holding companies have once again posted record-breaking results in the third quarter of this year, accelerating their shareholder return initiatives. With comprehensive measures such as dividends and share buybacks and cancellations, the scale of returns to shareholders has expanded to the point where half of the profits are being distributed. Not only is the shareholder return ratio expected to surpass 50%, but both earnings and shareholder returns are projected to reach all-time highs.

According to the financial sector on November 4, the four major financial holding companies-KB, Shinhan, Hana, and Woori-each achieved their highest-ever third-quarter results this year. KB Financial Group posted a net profit of 1.686 trillion won in the third quarter, marking a 4.1% increase from the same period last year. On a cumulative basis, net profit reached 5.1217 trillion won, up 16.6% year-on-year. This represents the largest cumulative third-quarter result in the company's history.

Shinhan, Hana, and Woori Financial Group also each recorded more than 1 trillion won in net profit. Shinhan Financial Group posted a net profit of 1.4235 trillion won in the third quarter, up 9.7% from a year earlier. Hana Financial Group reported 1.1324 trillion won in net profit, and a cumulative total of 3.4334 trillion won, both representing record highs. Woori Financial Group also set new records with 1.2444 trillion won in third-quarter net profit and a cumulative 2.7964 trillion won.

Buoyed by these record results, the four major financial holding companies are continuing to expand shareholder returns. KB Financial Group's shareholder return ratio is expected to reach 54% this year, making it the first among domestic financial holding companies to surpass 50%. The shareholder return ratio, which was 39.8% last year, has risen by more than 10 percentage points this year. KB Financial Group resolved to pay a cash dividend of 930 won per share-an increase of 135 won from the previous year-for a total of 335.7 billion won. This represents a 17% increase compared to last year.

The shareholder return ratio is calculated by dividing the sum of dividends and share buybacks by net profit; a higher ratio indicates a more shareholder-friendly company.

Shinhan Financial Group's shareholder return ratio is expected to be around 46% this year. The company is steadily executing its previously announced plan, made in July, to buy back and cancel 800 billion won worth of its own shares. Of this, 600 billion won will be completed by the end of this year, with the remaining 200 billion won scheduled for buyback and cancellation by January next year.

Hana Financial Group's shareholder return ratio is projected to be about 44% this year. In its third-quarter earnings announcement, Hana Financial Group unveiled an additional 150 billion won share buyback and cancellation plan to enhance corporate value. The company has previously announced its goal to achieve a 50% shareholder return ratio by 2027, and to reach this target ahead of schedule, it will carry out a 150 billion won share buyback and cancellation and pay a quarterly cash dividend of 920 won per share. Including 653.1 billion won in share buybacks completed by the third quarter and the previously announced annual cash dividend totaling 1 trillion won, the total shareholder return for this year is expected to reach a record 1.8031 trillion won.

Despite achieving record-high results, Woori Financial Group's capacity for shareholder returns is somewhat lower than its peers, as its Common Equity Tier 1 (CET1) ratio, which serves as the basis for shareholder returns, falls short of the financial authorities' target of 13%. However, the company has taken shareholder-friendly steps, such as being the first among domestic financial holding companies to introduce tax-free dividends. After capital expansion is completed following the incorporation of Tongyang Life Insurance and ABL Life Insurance next year, Woori Financial Group is expected to accelerate its shareholder return plans.

The financial holding companies are also positively considering the introduction of tax-free dividends. Tax-free dividends allow shareholders to receive dividends in full without paying taxes (15.4% withholding tax), resulting in an effective dividend yield of about 18.2%. Following Woori Financial Group's lead, KB, Shinhan, and Hana Financial Group are also reportedly considering adopting this system.

An industry insider commented, "In recent years, the shareholder return ratio has increased by around 20 to 30 percentage points, significantly expanding shareholder returns. This year, with record-high earnings driven by increased interest and fee income, the companies have announced the largest-ever shareholder return measures. However, whether this can be sustained remains a challenge going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)