Record-High Net Profit for Ten Major Banking and Non-Banking Groups in First Half

Interest Income Rises on Loan Growth

Bullish Stock Market Drives Increase in Brokerage Commissions

In the first half of the year, domestic financial holding companies achieved record-high net profits. Despite a phase of benchmark interest rate cuts, loan volumes increased, leading to higher interest income, and a bullish stock market boosted fee income from financial products such as equities.

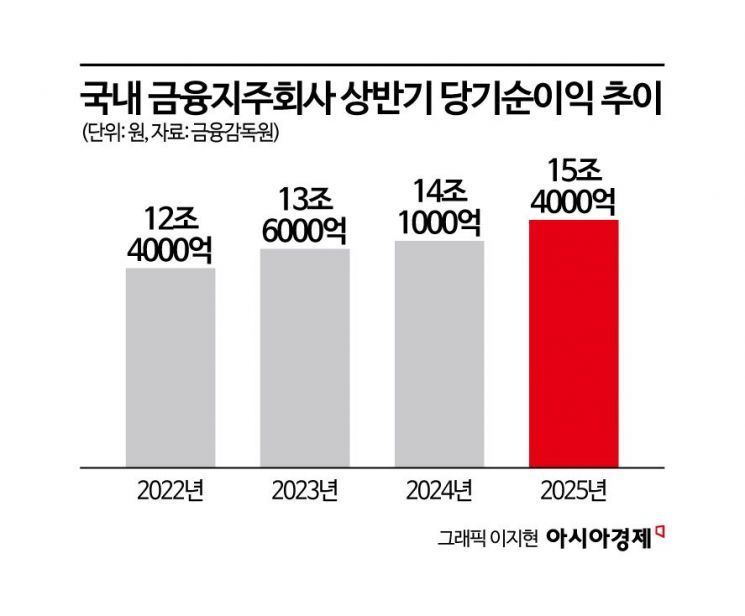

According to the "Interim Business Performance of Financial Holding Companies for the First Half of 2025," released by the Financial Supervisory Service on November 4, the combined net profit of the ten domestic financial holding companies for the first half of this year reached 15.4428 trillion won, up 9.9% (1.3872 trillion won) compared to the same period last year. The domestic financial holding companies include eight banking groups-KB, Shinhan, Hana, Woori, NH, iM, BNK, and JB-as well as two non-banking groups, Korea Investment Financial Holdings and Meritz Financial Group.

The profits of financial holding companies have shown a clear upward trend every year. For the first half, profits steadily increased from 12.4 trillion won in 2022 to 13.6 trillion won in 2023, and 14.1 trillion won in 2024, with an additional increase of nearly 10% this year. In particular, despite the Bank of Korea lowering the benchmark interest rate, the expansion of loans led to a significant increase in interest income. The rise in the stock market, which resulted in higher fee income from financial products such as equities, also contributed to the increase in net profit.

Looking at profit growth rates by business segment, banks’ net profit in the first half increased by 19.3% (1.6898 trillion won) compared to the same period last year. The financial investment sector also rose by 17.9% (439 billion won). In contrast, the insurance sector declined by 3.8% (-93.2 billion won), and specialized credit finance companies such as card and capital companies saw a decrease of 20.0% (-334.3 billion won). The share of banks in total net profit expanded to 59%, up 4.6 percentage points from the previous year. The share for financial investment rose by 1.1 percentage points to 16.4%. In contrast, the share for insurance dropped by 1.9 percentage points to 13.4%, and for specialized credit finance companies, it fell by 2.8 percentage points to 7.5%.

As of the first half, the combined consolidated assets of the ten financial holding companies stood at 3,867.5 trillion won, up 3% from the end of the previous year. In terms of asset composition, banks accounted for 74.2%, financial investment for 11.5%, and insurance for 6.7%.

Capital indicators were generally sound. The total capital ratio and common equity tier 1 capital ratio of banking holding companies in the first half were 15.8% and 13.2%, respectively, both exceeding regulatory requirements. The ratio of substandard and below loans at financial holding companies was 1.04%, up 0.14 percentage points from the end of the previous year. The debt ratio rose by 0.9 percentage points to 29%. The loan loss provision ratio, an indicator of the ability to absorb credit losses, was 104.3%, down 18.1 percentage points from 122.4% at the end of the previous year.

An official from the Financial Supervisory Service stated, "In the first half, financial holding companies posted solid results, with increases in both profits and assets compared to the previous year." However, the official also explained, "It is necessary to secure buffer capacity at the financial holding company level for proactive asset quality management, and to continue efforts to ease borrowers’ interest repayment burdens." The official added, "We will encourage active supervision by financial holding companies to improve the soundness of subsidiaries and prepare for potential risks in the financial sector, such as rising delinquency rates. We will also make every effort to protect financial consumers by ensuring that unsound business practices do not occur at any stage, including inter-subsidiary referrals and linked sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.