KCC’s Sales Heavily Weighted Toward High-Performance Coatings for Automobiles and Shipbuilding

MASGA Project Launch and Tariff Cuts on Cars and Parts Expected to Benefit the Company

With the conclusion of tariff negotiations between South Korea and the United States, the paint industry is experiencing mixed fortunes. Amid heightened volatility across the sector due to the construction market downturn, expectations are particularly high for KCC, which has a significant presence in high value-added segments such as automotive and shipbuilding, as well as in the silicone business.

According to industry sources on November 3, following last month’s conclusion of the South Korea-U.S. tariff negotiations-which reduced tariffs on automobiles and parts from 25% to 15% and established the foundation for the full-scale implementation of the bilateral shipbuilding cooperation project known as MASGA-there is growing speculation that the business structure and competitive landscape of the domestic paint industry will undergo significant changes.

Within and outside the industry, KCC is widely regarded as the primary beneficiary of the agreement. Among the three major domestic paint companies (KCC, Noroo Paint, and Samhwa Paint), KCC derives a relatively large portion of its sales from high-performance coatings for automobiles and ships.

Paints for automobiles and ships often require advanced technologies, such as high heat resistance, resulting in higher profitability. KCC supplies automotive coatings primarily to Hyundai Motor and Kia, while also providing marine coatings to major domestic shipbuilders. Both industries are seeing a recovery in global demand, positioning KCC to capture growth opportunities in both sectors simultaneously.

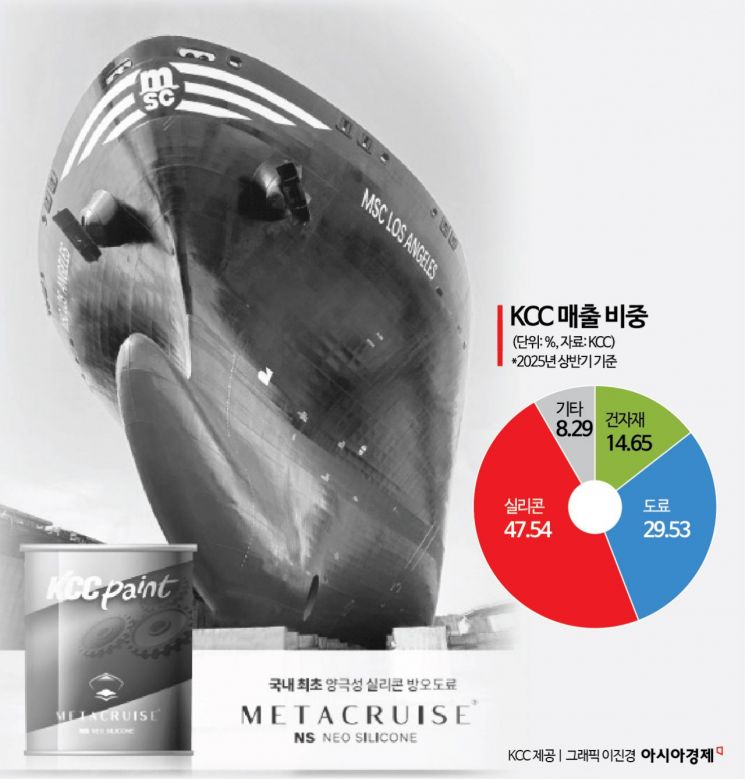

In addition, the silicone business serves as another major revenue stream. Accounting for nearly half of the company’s total sales, the silicone segment covers a broad range of applications, including electronic materials and construction. The company projects significant growth potential for high value-added products, driven by the expansion of the electric vehicle market and increased demand for medical applications due to population aging.

In contrast, Noroo Paint and Samhwa Paint generate most of their sales from architectural products. Their revenues are closely tied to domestic construction and remodeling demand, and with the current slowdown in new construction and housing sales, they are struggling to find momentum for a performance rebound. The simple structure of their product portfolios is seen as a limiting factor. The proportion of paint sales at Noroo Paint and Samhwa Paint stands at 80.7% and 81%, respectively, with the vast majority coming from architectural coatings.

These differences are directly reflected in their financial results. In the first half of this year, KCC recorded an operating profit of 140.3 billion won, similar to the same period last year, while Noroo Paint’s operating profit fell by 24.6% to 14.1 billion won, and Samhwa Paint’s dropped by 64.7% to 8.1 billion won.

KCC plans to further strengthen its technological competitiveness in industrial coatings. The company is accelerating the expansion of its high value-added product lineup by jointly developing eco-friendly paints for ship interiors and high-durability, heat-resistant coatings for naval vessels with HD Hyundai. Recently, KCC participated in the international shipbuilding and marine industry exhibition “Kormarine 2025” held in Busan, where it showcased environmentally friendly silicone antifouling coatings.

Lee Dongwook, a researcher at IBK Investment & Securities, analyzed, “With the final tariff negotiations between South Korea and the United States concluded, KCC’s paint segment-one of its core profit drivers-is expected to continue delivering solid results going forward.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)