Gold Prices Drop from Record Highs

Investors Move Actively

Gold Banking Balances Rise at Major Banks

Experts Advise "Caution in Investment"

As investors who believe that the rise in gold prices will continue actively move, the balance of gold banking at major commercial banks surged last month. Yonhap News

As investors who believe that the rise in gold prices will continue actively move, the balance of gold banking at major commercial banks surged last month. Yonhap News

While gold prices have declined after reaching a peak, the balance of gold banking at major commercial banks has surged. This is interpreted as investors who believe that gold prices will rise again in the long term are actively moving.

According to the Korea Exchange on November 3, the price of pure gold per gram closed at 188,750 won on the KRX gold market as of October 31. Although this was a 2.81% increase from the previous trading day, it represents a drop of more than 16% in just two weeks compared to the all-time high closing price of 227,000 won on October 15. The decline in gold prices is attributed to the easing of the US-China trade conflict after US President Donald Trump and Chinese President Xi Jinping met at the '2025 Asia-Pacific Economic Cooperation (APEC) Summit' held in Gyeongju, North Gyeongsang Province. As a result, the appeal of gold as a safe-haven asset has somewhat diminished.

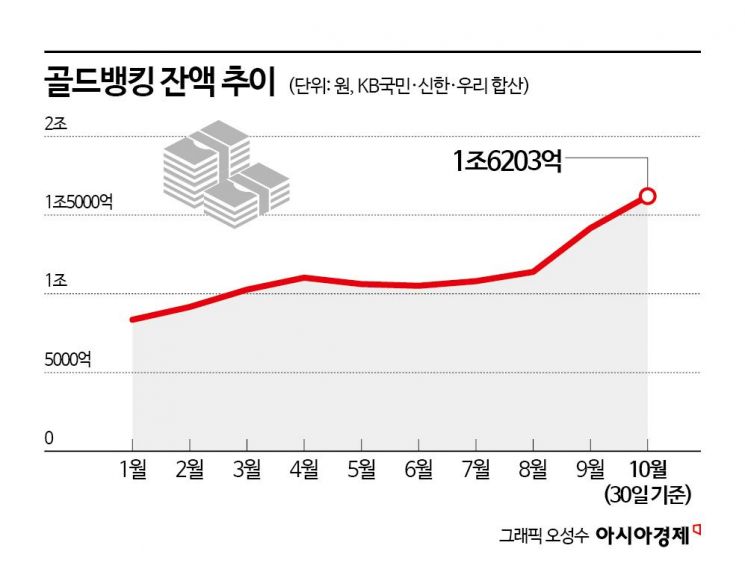

As gold prices declined, gold investors also became more active. According to the banking sector, as of October 30, the gold banking balance at KB Kookmin Bank, Shinhan Bank, and Woori Bank stood at 1.6203 trillion won. This is an increase of 203.2 billion won compared to the end of September (1.4171 trillion won) and marks the highest level so far this year. Gold banking is a product that allows customers to buy and sell gold in units as small as 0.01 grams. When funds are deposited into this account, gold is purchased at the prevailing market price, and when withdrawn, it is sold at the current market price and returned in Korean won.

The gold banking balance at the three banks surged early this year, surpassing 1 trillion won for the first time in March. After maintaining a similar level for a while, it increased sharply again in September, exceeding 1.4 trillion won, and surpassed 1.6 trillion won last month. An official at a major commercial bank said, "It seems that investors who judged gold prices to be in a correction phase became more active."

In fact, the number of gold accounts opened also surged within a month. According to Shinhan Bank, the number of Gold Rich accounts was 184,839 as of October 30, an increase of 6,440 from the previous month (178,399). This is the highest monthly increase since January 2022.

However, market forecasts for gold prices are divided. In a report, Capital Economics in the United Kingdom stated, "It is difficult to justify the sharp rise since August compared to previous gold price rallies," and lowered its year-end 2025 gold price forecast to $3,500 per ounce. In contrast, Bank of America said, "The market entered an overbought zone, leading to this week's correction," and forecast the average gold price in the fourth quarter at $3,800 per ounce. The bank also stated, "The bull market for gold is not over yet," and presented a forecast of $5,000 per ounce for next year.

Experts advise that, since gold prices are difficult to predict, it is important to establish clear investment criteria. Jeong Seongjin, Deputy Director of the Gangnam Star PB Center at KB Kookmin Bank, said, "Rather than investing a large amount, I recommend diversifying within 10% of your liquid assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)