Stock Rally Continues as Tariff Concerns Ease

300,000 Won Breakthrough in Sight

Brokerages Raise Target Prices Across the Board

Hyundai Motor Company is on the verge of surpassing 300,000 won per share, as concerns over tariffs have eased and its stock price continues to rise.

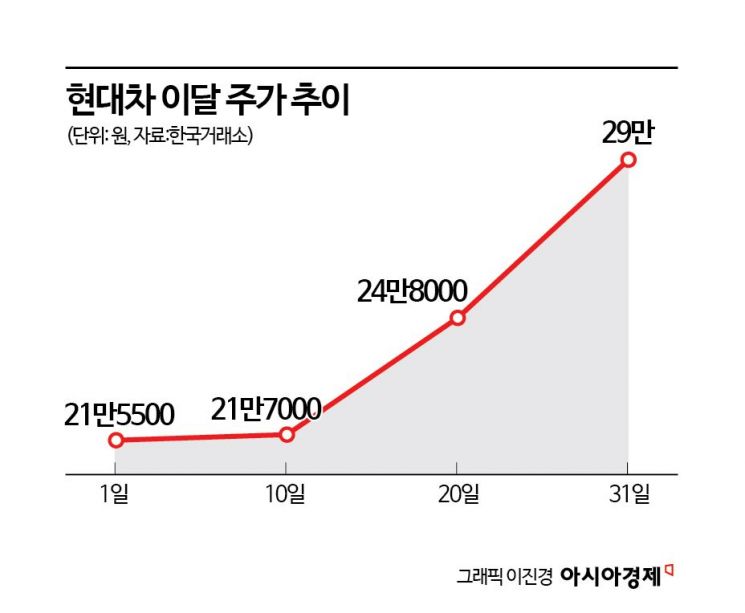

According to the Korea Exchange on November 3, Hyundai Motor closed at 290,000 won on October 31, up 25,000 won (9.43%) from the previous trading day. During the session, the stock climbed as high as 294,000 won, marking a new 52-week high. With three consecutive days of significant gains, Hyundai Motor reclaimed its position as the fifth-largest company by market capitalization, overtaking Doosan Enerbility.

Despite an unprecedented bull market this year, Hyundai Motor's stock price lagged behind other large-cap stocks due to concerns over U.S. tariffs. As a result of this relative underperformance, its market capitalization ranking dropped from fifth at the beginning of the year to ninth in September.

However, following the conclusion of the Korea-U.S. tariff negotiations on October 29, Hyundai Motor has been able to break free from the tariff risk that had previously weighed down its stock price. The stock has surged by about 35% just in November. Compared to its 52-week low of 175,800 won recorded in April, the price has risen by approximately 65%.

Ha Neul, an analyst at NH Investment & Securities, stated, "If the 15% tariff is assumed to be applied starting November 1, the impact on earnings is estimated to begin in 2026. With the uncertainty over tariffs resolved, new investments and changes in parts sourcing that had been on hold in the automotive industry are expected to proceed."

Due to the impact of tariffs, Hyundai Motor's operating profit in the third quarter of this year decreased by about 30% compared to the same period last year. Park Kwangrae, an analyst at Shinhan Investment & Securities, commented, "Third-quarter results met the recently lowered market expectations. While sales reached a quarterly record high thanks to favorable exchange rates, increased sales volume, and improved product mix, operating profit declined due to the full implementation of the 25% tariff, an increase in sales warranty provisions caused by a higher year-end exchange rate, and a rise in major regional incentives."

Securities firms have raised their target prices for Hyundai Motor. Shinhan Investment & Securities raised its target from 270,000 won to 320,000 won; Eugene Investment & Securities from 280,000 won to 350,000 won; Kiwoom Securities from 285,000 won to 310,000 won; LS Securities from 300,000 won to 330,000 won; and Daol Investment & Securities from 330,000 won to 360,000 won. Samsung Securities increased its target price by 19.3% to 340,000 won, while Korea Investment & Securities raised its target from 270,000 won to 305,000 won. Lim Eunyoung, an analyst at Samsung Securities, explained, "This reflects the improved earnings visibility due to the removal of tariff uncertainty, the launch of new models, and the growth in subsidiary performance. The tariff burden is expected to decrease from 1 trillion won per quarter to below 500 billion won, and with the increased proportion of hybrid vehicles and growth at Hyundai Rotem, operating profit next year is expected to recover to the 14 trillion won range." Shin Yooncheol, an analyst at Kiwoom Securities, stated, "We believe Hyundai Motor is at the beginning of a stock price rally. We are raising our 2026 operating profit and net income estimates by 7.2% and 5.9%, respectively, compared to previous forecasts."

With tariff concerns resolved, market attention is expected to shift toward fundamentals and new businesses. Kim Jinseok, an analyst at Mirae Asset Securities, noted, "Since September, companies like GM and Ford have raised their U.S. demand forecasts for this year. With interest rate cuts, the pent-up demand in the U.S. in 2026 is expected to convert into new car demand. Now is the time to focus on the profit growth cycle driven by Hyundai Motor Group's U.S. market share."

Lee Hyunwook, an analyst at IBK Investment & Securities, stated, "With the uncertainty over earnings removed, the next key points to watch are future growth areas such as smart cars and robotics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)