Prospects for K-pop Expansion in the U.S.

Korea Creative Content Agency LA Center Releases Report

K-pop Growth Rate in the U.S. at 7?15%

Lower Than Emerging Markets Like Hong Kong

Key Factor: Declining Content Turnover

Stronger Fandoms, Weaker External Spread

Group NMIXX performing at the 'KCON LA 2023' concert held in the United States. Photo by Yonhap News

Group NMIXX performing at the 'KCON LA 2023' concert held in the United States. Photo by Yonhap News

K-pop has now grown beyond being just a "genre" to become an entire "industry." On the global path pioneered by BTS and BLACKPINK, groups like SEVENTEEN and Stray Kids are surging ahead, establishing themselves as major players in the U.S. music market. However, reaching this point does not guarantee lasting presence. Slowing streaming growth, concentrated fandoms, and structural imbalances in the industry are hindering K-pop's next leap forward.

According to the report "Current Status and Prospects of K-pop Expansion in the United States," released on October 29 by the Korea Creative Content Agency's Los Angeles (LA) Business Center, K-pop is still growing, but its pace has entered an adjustment phase.

U.S. Record Market Revenue Hits All-Time High... At the Crossroads of Growth and Imbalance

In the first half of this year, U.S. record sales reached a record high of 5.6 billion dollars. Streaming accounted for 84%, marking an increase for the fifth consecutive year. Paid subscription accounts rose by 6.4%, and subscription revenue increased by 5.7%. As the focus shifts from "ownership" to "access," music is consumed more widely and rapidly. K-pop has gained global exposure within this structure, but it is also experiencing the side effect of widening disparities between genres. Genres with strong fandoms survive, but mainstream pathways are narrowing.

The same pattern is seen in physical album sales. K-pop’s presence is clear: five out of the top ten best-selling CDs in the U.S. during the first half of the year were K-pop albums. While overall physical album sales declined by 5.9%, K-pop alone showed growth, driven by concentrated purchases from loyal fans. Among U.S. K-pop fans, 82% reported listening daily. Eighty percent are women, and most are Millennials & Gen Z. Their main platforms are YouTube (87%) and Spotify (75%), indicating that the base remains relatively narrow.

Stray Kids won the Best K-Pop category with "S-Class" at the 2023 MTV Video Music Awards (MTV VMA). Photo by Yonhap News

Stray Kids won the Best K-Pop category with "S-Class" at the 2023 MTV Video Music Awards (MTV VMA). Photo by Yonhap News

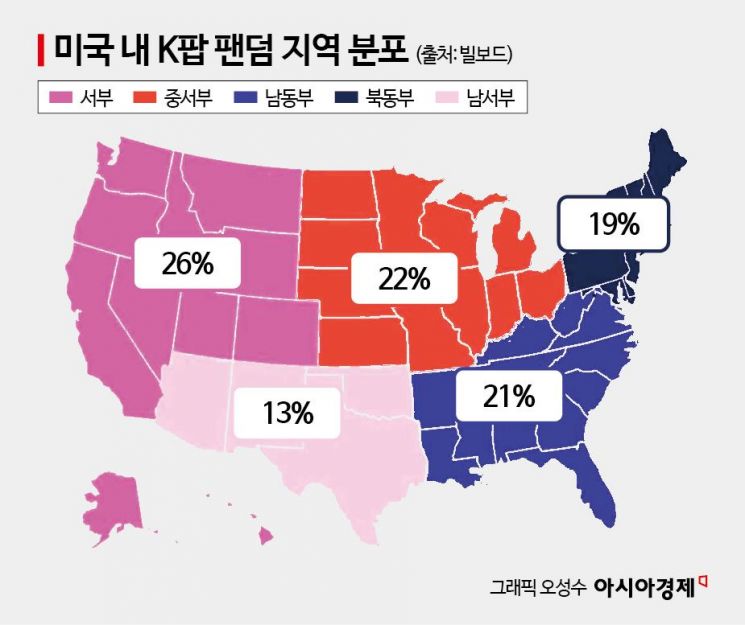

The same applies to concerts. Tour revenues for Stray Kids, SEVENTEEN, and BLACKPINK have reached record highs, but audiences are concentrated in major cities like Los Angeles, New York, and Chicago. Expansion into the central and southern regions of the U.S. remains limited. While profits are breaking records, the overall fan base is not expanding accordingly.

K-pop Growth Rate in the U.S. Projected at 7-15%... Lower Than in Emerging Markets

The Korea Creative Content Agency projects K-pop’s growth rate in the U.S. this year at 7-15%. While this is a "premium growth rate" exceeding the global music average, it is lower than that of emerging markets such as Vietnam and Hong Kong. The slowdown is clear.

The cause is not a decline in popularity. Most importantly, streaming has reached its limit. The market is saturated, making further expansion difficult. Fewer new releases have resulted in lower turnover. Data analysis firms Luminate and PwC pointed out that the decrease in new song releases slows content turnover, which works against K-pop’s new-release-driven model. As American listeners’ tastes shift back toward early 2000s pop sounds, the appeal of "novelty" that K-pop has emphasized has also weakened.

The inward focus of fandoms is not a positive development. As fan activities intensify within closed communities such as Discord, Reddit, WhatsApp, and Twitch, points of contact with the broader public decrease. The Korea Creative Content Agency’s report notes, "K-pop fandoms have formed independent entities, but they are becoming confined within themselves." The paradox is that the stronger the cohesion within the fan base, the slower the spread to the general public.

Barriers remain in radio and pop airplay as well. While Jennie’s "Like Jennie" showed potential by entering the pop radio charts, such cases are still exceptions. In the U.S., radio remains a key channel for mainstream popularity.

BLACKPINK held an encore concert of their world tour 'BORN PINK' at Stade De France in Paris, France. Photo by Yonhap News

BLACKPINK held an encore concert of their world tour 'BORN PINK' at Stade De France in Paris, France. Photo by Yonhap News

K-pop’s Challenge Is Not "Speed" But "Expansion"... "Increase Exposure Frequency"

K-pop’s achievements are clear. Stray Kids reached No. 1 on the Billboard 200 with seven albums, and SEVENTEEN ranked third in global tour revenue in the first half of the year. The original soundtrack "Golden" from the Netflix animation "K-Pop Demon Hunters" topped the Billboard Hot 100 for six consecutive weeks, demonstrating the potential of intellectual property.

However, the industry remains confined to a narrow triangle of "fandom, streaming, and big-city tours." While this ensures revenue stability, it reduces momentum for expansion. As repetitive consumption among a limited audience continues, overall growth rates decline.

President Lee Jae-myung appeared on Arirang International Broadcasting's program "K-Pop: The Next Chapter" Photo by Yonhap News

President Lee Jae-myung appeared on Arirang International Broadcasting's program "K-Pop: The Next Chapter" Photo by Yonhap News

Now, the challenge for K-pop is not "speed," but "expansion." The Korea Creative Content Agency’s report suggests shortening the cycle between new releases and increasing exposure frequency through collaborations, original soundtracks, and other diverse formats. It also advises enhancing radio-friendly mixing and arrangements targeting English-speaking listeners, and spreading memes and challenges created within closed communities to open platforms to attract non-fans. For concerts, the strategy should shift from focusing only on major cities to connecting medium-sized cities. What K-pop needs now is not just louder cheers, but resonance that spreads farther.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)