Foreign Investors Drive "4,000 KOSPI" and "100,000 Samsung Electronics" Milestones

5.8 Trillion Won in Net Purchases on KOSPI This Month

5.1 Trillion Won in Samsung Electronics Acquired During the Same Period

KOSPI Still Looks Cheap to Fore

The KOSPI has finally surpassed the 4,000 mark, and Samsung Electronics has reached the 100,000 won level. The main driver behind these record highs for both the KOSPI and Samsung Electronics was foreign investors. Since September, foreigners have made net purchases of over 13 trillion won in the Korea Exchange, leading the KOSPI to new record highs. During the same period, they also made net purchases of more than 10 trillion won in Samsung Electronics.

According to the Korea Exchange on the 28th, the previous day, the KOSPI closed at 4,042.83, up 101.24 points (2.57%) from the previous session, surpassing the 4,000 mark for the first time in history. Samsung Electronics finished the session at 102,000 won, up 3.24%, reaching the milestone of "100,000-won Samsung Electronics."

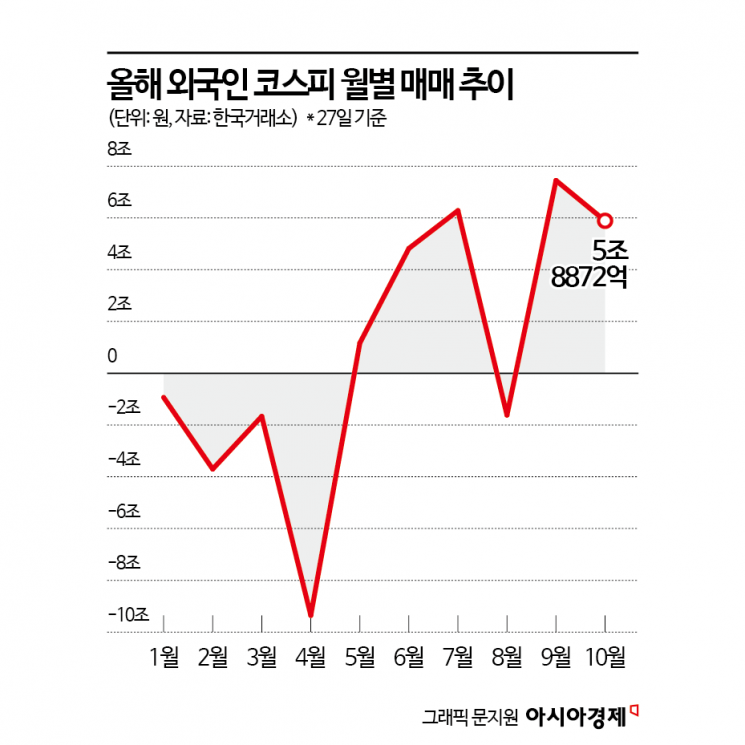

The record-breaking performances of the KOSPI and Samsung Electronics were made possible by foreign investors. This month, foreigners made net purchases of 5.8872 trillion won in the Korea Exchange. The stock with the largest net purchase during this period was Samsung Electronics, with net purchases totaling 5.1947 trillion won.

Foreign investors continued their strong net buying this month, following net purchases of 7.4465 trillion won in the Korea Exchange last month. Kim Junwoo, a researcher at Kyobo Securities, commented, "Foreign inflows continued this month. Although the absolute amount was lower than in September, considering the Chuseok holiday period, it is at a similar level." He added, "However, foreign inflows were more concentrated in the KOSPI compared to September."

Expectations for growth in artificial intelligence (AI) semiconductors and strong performance in the domestic semiconductor sector have fueled foreign buying. Lee Kyungmin, a researcher at Daishin Securities, explained, "Expectations for global AI semiconductor growth, upward revisions to KOSPI semiconductor earnings forecasts, and upgrades in KOSPI earnings and forward earnings per share (EPS) have led to changes in market flows. Since September, foreigners have recorded massive net purchases of over 13 trillion won, with more than 10 trillion won focused on semiconductors." As a result, since September, semiconductors have accounted for 59.7% of the KOSPI's gains.

Accordingly, whether foreign buying continues will likely affect the KOSPI's potential for further gains. Kim Jongmin, a researcher at Samsung Securities, noted, "From the perspective of foreign investors, the domestic stock market is still cheap. With the KOSPI's 12-month forward price-to-book ratio at 1.2 times, it remains undervalued compared to global markets, and the recent growth rate of KOSPI's EPS outpaces that of major international markets, highlighting strong earnings momentum. While the KOSPI may seem expensive in won terms, there are still ample investment opportunities when viewed in dollar terms."

However, given that the recent increase in foreign ownership has slowed, there is a possibility that buying momentum could weaken. Lee pointed out, "The proportion of KOSPI shares held by foreigners, which was in the 31% range in early September, surged to 34.16% as of the 10th of this month, and the share of semiconductors held by foreigners also rose from 51% to 52.46%. However, since immediately after the Chuseok holiday, foreign ownership has plateaued. While inflows that had been concentrated in semiconductors have shifted to other sectors, it may be burdensome to further increase their share in the short term." He added, "The mid- to long-term trend of foreign net buying remains valid, but in the short term, it is important to consider the possibility of profit-taking as we approach a key inflection point."

There is also a possibility that individual investors, who have not yet acted aggressively, may start buying. Back in 2021, when the KOSPI surpassed the 3,000 mark, individuals led large-scale net buying before foreigners took over the baton. This month, individuals made net sales of 8.8544 trillion won in the Korea Exchange. Jung Dawoon, a researcher at LS Securities, predicted, "Individual funds in the domestic stock market are still on a net selling trend, which could become a source of buying power if the index declines." Customer deposits, considered standby funds for the stock market, have surpassed 80 trillion won this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.