Mortgage Loan Rates Remain High Despite Three Consecutive Base Rate Freezes by the Bank of Korea

Market Rate Increases and Sustained Additional Margins Drive Ongoing Rise in Lending Rates

Although the Bank of Korea has kept its base rate unchanged for three consecutive times, mortgage loan interest rates at major banks are showing a "reverse trend" by rising instead. This is due to the increase in the benchmark financial bond rate, which is used to calculate mortgage loan rates, as well as banks independently maintaining higher spreads to manage household debt. As this trend is expected to continue for the time being, there are projections that the lower bound of the average mortgage loan rate will surpass 4%.

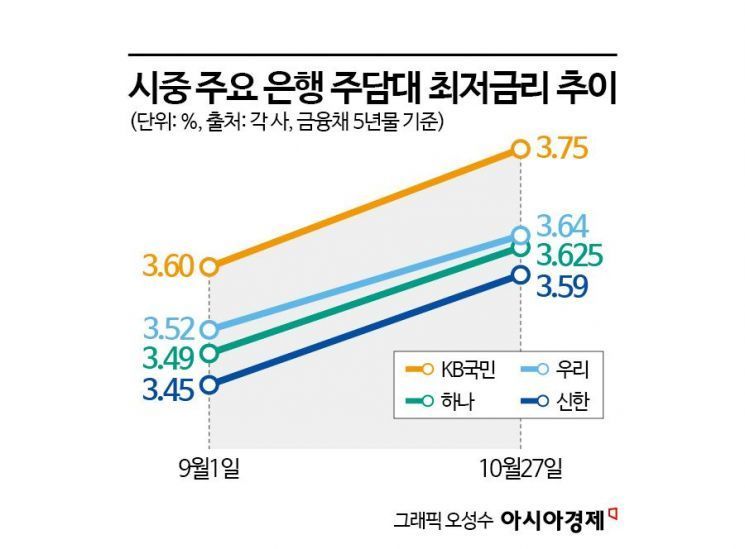

According to the financial sector on October 28, the fixed-rate (five-year financial bond) mortgage loan rates at major commercial banks stood at 3.59% to 5.15% as of October 27. This represents an increase of about 0.12 to 0.15 percentage points at the lower bound compared to the previous month. By bank, KB Kookmin Bank's rates were 3.75% to 5.15%, Shinhan Bank's were 3.59% to 5.00%, Hana Bank's were 3.625% to 4.825%, and Woori Bank's were 3.64% to 4.84%. Compared to September 1, the lower bound of Kookmin Bank's mortgage loan rate rose by 0.15 percentage points, marking the largest increase. This was followed by Shinhan Bank (0.14 percentage points), Hana Bank (0.135 percentage points), and Woori Bank (0.12 percentage points).

The reason mortgage loan rates are rising despite the base rate being held steady for the third time in July, August, and again, is that banks are independently keeping their spreads high to manage the total amount of household debt. According to the Korea Federation of Banks, the average spread (spread minus preferential rate) for new mortgage loans at the four major banks (Kookmin, Shinhan, Hana, and Woori) in August was 1.61%, about four times higher than a year ago (0.38%).

The rise in market interest rates, which serve as the benchmark for mortgage loan calculations, has also played a role. According to the Korea Financial Investment Association, as of October 24, the average rate for five-year AAA financial bonds rose from 2.851% on September 1 to 2.965%, an increase of 0.114 percentage points. On October 1, it reached 3.025%, meaning that for the first time in six months since March, the bank bond rate surpassed 3%. A commercial bank official analyzed, "Not only uncertainties in tariff negotiations, but also expectations that the Bank of Korea will delay its base rate cut longer than anticipated are pushing up market rates." Another commercial bank official said, "Market rates tend to move ahead of the base rate. After falling on expectations of a base rate cut, rates have started rising again as the cut is now expected to be delayed."

With the government maintaining a policy of tightening regulations on household loans, it is highly likely that banks will continue to keep their spreads high for the time being, strengthening the outlook that the lower bound of mortgage loan rates will surpass 4%. The average mortgage loan rate has already exceeded 4%. In addition, as expectations for an additional base rate cut by the Bank of Korea within the year have weakened, there is a high possibility that market rates will continue to rise.

Meanwhile, banks have recently begun raising deposit rates again, which had previously been lowered in anticipation of a base rate cut. Hana Bank increased the maximum rate for its "Hana Regular Deposit" from 2.55% to 2.60% per year. This product's maximum rate had dropped to 2.45% in July, rose to 2.50% last month, and has been raised twice already this month. KakaoBank also raised the one-year maturity rates for its regular deposit and free installment savings products by 0.10 percentage points each in mid-October. The basic rate for a one-year regular deposit is 2.60%, and for free installment savings, it is 2.80%. K Bank also raised the rate for its Code K Regular Deposit one-year maturity product from 2.50% to 2.55%. According to the Korea Federation of Banks, the maximum rate for one-year regular deposits at the five major commercial banks is between 2.55% and 2.60% per year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)