Samsung Group Nears 900 Trillion Won Market Cap

Samsung Heavy Industries Leads Group in Stock Returns

Target Prices Raised Amid Order Growth and MASGA Hopes

As Samsung Group is on the verge of surpassing a market capitalization of 900 trillion won, Samsung Heavy Industries is demonstrating a presence rivaling that of Samsung Electronics, the group's flagship company, by posting the highest stock price increase within the group.

According to the Korea Exchange on October 27, Samsung Heavy Industries closed at 248,000 won on the 24th, up 3.77%. During the session, the price soared to 254,500 won, hitting a new 52-week high. Investor sentiment was fueled by news that the company had secured a 341.1 billion won oil tanker order from a Liberian shipowner, as well as its collaboration with Rainbow Robotics to develop shipbuilding robots.

As large-cap stocks are steering the KOSPI rally, the scale of major conglomerates is expanding rapidly. The combined market capitalization of the semiconductor giants Samsung Electronics and SK hynix surpassed 1,000 trillion won for the first time, and Samsung, the undisputed leader in domestic group market capitalization, saw its group market cap surge from the 500 trillion won range at the start of the year to about 860 trillion won as of the 24th, an increase of approximately 72%.

Within Samsung Group, the strong performance of Samsung Heavy Industries has been particularly notable. Since the beginning of this year, the company's stock price has risen by 116%, ranking first in year-to-date returns within the group. This triple-digit growth rate is the only one in the group, even outpacing Samsung Electronics (+85%).

Solid earnings have supported the stock price. Samsung Heavy Industries' provisional sales for the third quarter of this year were 2.6348 trillion won (up 13% year-on-year), and operating profit was 238.1 billion won (up 99%), marking 11 consecutive quarters of profitability since the first quarter of 2023. Cumulative sales to date stand at 7.9081 trillion won, with operating profit at 609.3 billion won. Experts widely agree that the company is on track to easily surpass its 2025 guidance (sales of 10.5 trillion won and operating profit of 630 billion won).

Kim Yongmin, a researcher at Yuanta Securities, explained, "The strong results are due to a sufficient reduction in the proportion of low-priced container ship sales and an increase in high-margin floating liquefied natural gas facility (FLNG) sales. The company also effectively offset one-off costs of 40 billion won from wage and collective agreements through the reversal of provisions and reductions in commissioning costs."

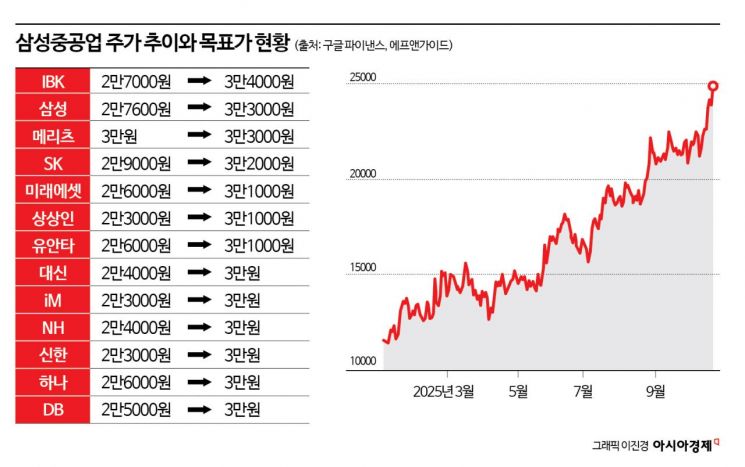

Brokerages are issuing optimistic forecasts for Samsung Heavy Industries. This month alone, 17 securities firms have raised their target price for the company. With global order targets being steadily achieved, there are growing expectations that Samsung Heavy Industries will benefit in earnest from the upcoming U.S. shipbuilding revitalization (MASGA) project. With the latest order from the Liberian shipowner, the company's merchant ship division has achieved 4.5 billion dollars (78%) of its annual target of 5.8 billion dollars.

Lee Seoyeon, a researcher at SangSangIn Securities, stated, "Samsung Heavy Industries is actively pursuing various forms of cooperation, such as signing MOUs with local U.S. companies, in preparation for future shipbuilding collaborations with the United States. However, the stock price has not yet fully reflected these efforts, as it is trading at a 12-month forward price-to-book ratio (PBR) of 3.8 times and a price-to-earnings ratio (PER) of 22 times." She raised her target price from 23,000 won to 31,000 won.

Yoo Jaeseon, a researcher at Hana Securities, analyzed, "Further margin improvement is expected in the fourth quarter, driven by the construction of high-value vessels and increased contributions from offshore business. In addition to merchant ships and offshore projects, the company is also actively exploring local market entry through U.S. naval shipbuilding, MRO (maintenance, repair, and operations), and joint construction of merchant ships."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)