As "Female Abe" Takaichi Becomes Japan's Prime Minister,

Yen Weakness Deepens; Won Also Falls, Driving Up Exchange Rate for Two Days Straight

Market Expects "Yen Weakness" Trend to Continue Through Year-End

Focus on Korea-U.S. Negotiation Results

The won-dollar exchange rate, which had appeared to stabilize below 1,430 won, is rising again. While recent movements in tariff negotiations with the United States have influenced the exchange rate, a new factor has emerged: the weak yen. This is due to growing expectations that interest rate hikes in Japan may be delayed or halted after Japan's new Prime Minister Sanae Takaichi signaled an expansion of fiscal spending. As a result, the yen has depreciated sharply, affecting the ongoing trend of a strong dollar and a weak won. The market is now closely watching the outcome of the Korea-US tariff negotiations at the end of this month, as well as the Bank of Japan's (BOJ) policy rate decision.

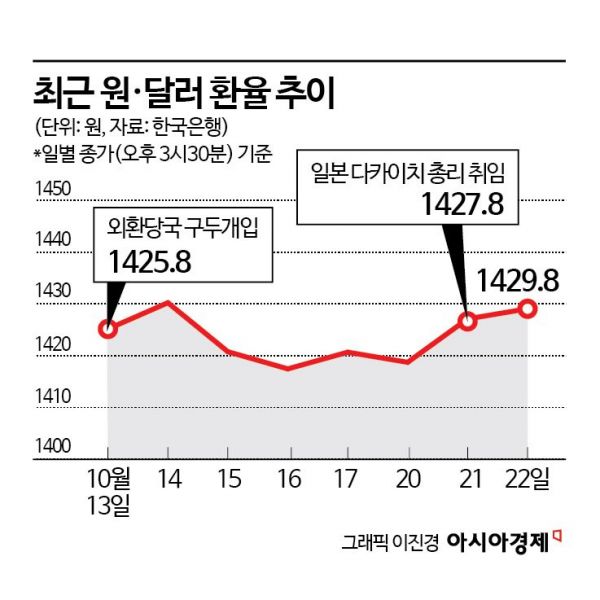

According to the Seoul foreign exchange market on October 23, the won-dollar exchange rate has risen by 10.6 won over the past two days. On October 21, it jumped by 8.6 won, marking the largest fluctuation since October 10 (21 won). The previous day, it opened at 1,431.5 won, the highest opening in about six months, and after a slight decline, closed at 1,429.8 won. However, this still marked the highest weekly closing price in six trading days since October 14 (1,431 won). In after-hours trading, it recorded 1,431 won as of 2 a.m.

Despite heightened expectations for a deal at the end of the month as the negotiation team made an emergency trip to the United States for final adjustments in the Korea-US tariff negotiations, the exchange rate closed higher. Typically, a successful Korea-US tariff agreement reduces uncertainty and acts as a factor for a short-term decline in the exchange rate, but this time, the market reaction was muted.

The main drivers behind the rise in the won-dollar exchange rate over the past two days have been the weak yen, the resulting strong dollar, and the weak won. Until mid-October, the yen had shown a brief rebound, but since October 21, when Sanae Takaichi, often referred to as the successor to Abenomics, took office as the new president of the Liberal Democratic Party and Japan's new prime minister, the yen has weakened further. The market is anticipating that Japan will continue its expansionary fiscal policy and maintain low interest rates.

Consequently, the dollar index (DXY), which measures the value of the US dollar against six major currencies including the yen, rose to 98.91 as of the previous day, reaching its highest level in a week. The already weak won depreciated further, affected not only by the dollar index but also directly by the weak yen. Moon Jeonghee, Chief Economist at KB Kookmin Bank, said, "The correlation between the yen and the won is quite high. As neighboring countries, the market perceives them as similar Asian currencies," adding, "In addition to the won's depreciation due to the rising dollar index caused by the weak yen, the won is also being directly influenced by the yen's value."

The market expects the current trend of yen weakness to continue until the end of the year, impacting the won-dollar exchange rate. The key event is the BOJ's policy rate decision on October 30. If the BOJ raises rates, the period of yen weakness could be shorter. Moon, the chief economist, stated, "The current weakness of the yen is due to expectations that the new Prime Minister Takaichi will pressure the BOJ to keep rates unchanged, making a rate hike unlikely or delayed." He added, "However, considering inflation and other factors, it does not seem easy for the BOJ to change its stance on rate hikes."

He went on to predict, "If not this month, the BOJ will raise rates in December," and explained, "Since Japan is in a phase of raising rates while the US is cutting rates, the narrowing US-Japan interest rate gap could lead to a stronger yen. Even if not immediately, by year-end, the yen-dollar exchange rate could fall below 150 yen."

Min Kyungwon, a researcher at Woori Bank, also commented, "There is a view that the new prime minister will continue former Prime Minister Abe's policies, but the difference is that Abe's era was marked by deflation, while now there is inflation." He continued, "At this point, it is unlikely that the BOJ will make a rate freeze a foregone conclusion." He added, "Once rates are normalized to some extent and uncertainty around Prime Minister Takaichi dissipates, the pattern of yen weakness could disappear. In the first quarter or first half of next year, the yen may even help restrain the strong dollar."

There is also keen interest in whether the Korea-US tariff negotiations will be concluded at the Asia-Pacific Economic Cooperation (APEC) summit to be held in Gyeongju at the end of this month. Moon, the chief economist, noted, "If the Korea-US negotiations are concluded smoothly and the BOJ raises its policy rate within the year, the won-dollar exchange rate could fall to the 1,350-1,400 won range, similar to the levels seen in September." Researcher Min also added, "This could serve as a factor for a temporary decline in the exchange rate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)