27 Out of 33 Countries Have No Differentiation

Korea Shows the Largest Gap Among Six Countries With Tiered Systems

"Eliminate Differentiation and Introduce a Direct Refund System"

In an era where new technologies determine survival, the structure in which tax benefits decrease as companies grow is becoming entrenched. In Korea, support systems intended to encourage research and development (R&D) investment show a significant gap between large corporations and small and medium-sized enterprises (SMEs), and there is not even a direct refund system. Among the 33 member countries of the Organisation for Economic Co-operation and Development (OECD), only Korea and Japan are exceptions.

On October 23, the Korea Chamber of Commerce and Industry announced the results of a comparative analysis of the 'R&D Tax Incentive Systems' of 33 countries listed on the OECD INNOTAX portal. According to the survey, only six countries, including Korea, applied different deduction rates for large corporations and SMEs in their R&D tax incentive systems. The remaining 27 countries, including the United States, the United Kingdom, and France, applied a single deduction rate without any differentiation.

Furthermore, 22 countries-two-thirds of the total-operated a 'direct refund system,' which reimburses companies for amounts that could not be deducted in the current year. In contrast, 11 countries, including Korea and Japan, had no refund system at all. In other words, Korea and Japan are the only countries that not only have differentiated deduction rates between large corporations and SMEs but also lack a refund system.

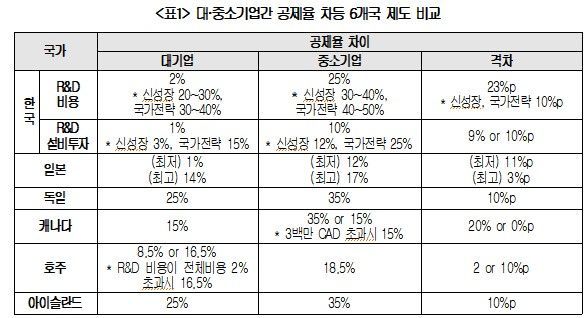

Among the six countries with differentiated systems, Korea had the largest gap in deduction rates. According to the current Restriction of Special Taxation Act, the general R&D tax credit rate is 2% for large corporations and 25% for SMEs, a difference of 23 percentage points. Even in the case of new growth and original technologies and national strategic technologies, there is a gap of 10 percentage points. For R&D facility investment, the rate is 1% for large corporations and 10% for SMEs, a difference of 9 to 10 percentage points.

In Japan, the deduction rate for large corporations ranges from 1% to 14% depending on the increase in R&D spending, while for SMEs it is between 12% and 17%, resulting in a gap of 3 to 11 percentage points. In some cases, large corporations even receive a higher deduction rate. In Australia as well, large corporations that invest above a certain threshold (2% of total investment) receive a higher deduction rate of 16.5% instead of 8.5%, meaning that the more they invest, the greater the incentive.

Among the 27 countries with no differentiation between large corporations and SMEs, some (such as the United Kingdom and France) provide additional support only in exceptional cases. For example, France exempts companies established within the last eight years from paying social security contributions for R&D personnel, and the United Kingdom allows loss-making SMEs to deduct R&D expenses from taxable income if R&D costs exceed 30% of total expenses.

Even when comparing only the deduction rates for large corporations, Korea ranks at the bottom. Of the 18 OECD countries that operate a corporate tax credit system, Korea's general R&D deduction rate is the lowest at 2%. This is lower than Italy (10%) and Hungary (10%), and more than 30 percentage points lower than Portugal (32.5%).

For new growth and national strategic technologies, Korea's deduction rates are similar to or even higher than those of major countries, but the scope of application is limited. As of 2024, only 7.6% of large corporations reported tax credits for new growth and national strategic technologies, meaning that most large corporations still only benefit from the general R&D deduction rate of 2%.

Even when companies receive tax credits, if the amount of tax payable is small, there will be unused credits. Of the 33 OECD countries, 22 operate refund systems that return these unused credits in cash. Among these, 17 countries make refunds available to all companies regardless of size. In five countries-the United States, Australia, Canada, Poland, and Colombia-refunds are allowed only for SMEs or startups.

France refunds the remaining credit after carrying it forward for three years, while Spain refunds up to 80% of the credit. In contrast, 11 countries, including Korea, Japan, Finland, and Mexico, have no refund system. However, Korea allows unused credits to be carried forward for up to 10 years, while Chile and Lithuania operate systems that allow unlimited carryforward.

The Korea Chamber of Commerce and Industry emphasized, "The stepwise structure in which incentives decrease as companies grow actually becomes an obstacle to growth," and called for the abolition of the differentiated support system between large corporations and SMEs.

The organization also pointed out the need to introduce a direct refund system to enhance the effectiveness of R&D investment. It explained, "Since there is a time lag before returns are generated from R&D investment, refunding unused credits would reduce uncertainty for companies and enable bolder investments."

Additionally, the necessity of benchmarking overseas systems was raised. For example, if accelerated depreciation systems like those in the United Kingdom, France, and Denmark-which allow for rapid depreciation of initial investment costs-are introduced, companies can reduce their corporate tax burden early on and continue to invest further. In Japan, higher deduction rates are granted for open innovation with academia, research institutes, and startups, encouraging collaborative R&D.

Kang Seokgu, head of the Research Division at the Korea Chamber of Commerce and Industry, stated, "As the competition for technological supremacy between countries intensifies, R&D tax support that can enhance companies' innovation capabilities is crucial," adding, "The system should be redesigned to provide incentives based on performance rather than company size."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)