Samsung Asset Management Holds Press Conference for Listing of New KODEX Korea Sovereign AI ETF

Park Myungje, Head of ETF Division: "We Will Contribute to the Growth of Korea's Capital Market"

Lim Taehyuk, Head of ETF Management: "The First Step Tow

Samsung Asset Management, the first company in the domestic exchange-traded fund (ETF) industry to achieve 100 trillion won in net assets, is taking its first step toward 200 trillion won with the launch of the "KODEX Korea Sovereign AI" ETF. This product will be listed on the 21st and is designed to make focused investments in companies participating in the government-led large-scale AI project, "Sovereign AI."

On the 20th, Samsung Asset Management held a press conference at the Westin Chosun Hotel in Sogong-dong, Seoul, to commemorate the listing of the "KODEX Korea Sovereign AI" ETF.

At the event, Samsung Asset Management reflected on its achievements over the past 23 years as a leader in the domestic ETF market, with the "Kodex ETF" growing to 100 trillion won in net assets. The company introduced KODEX Korea Sovereign AI as an innovative product to lead the domestic ETF market going forward. Myeongje Park, Head of the ETF Division, and Taehyuk Lim, Head of ETF Management, delivered remarks.

◆The First Step Toward the Next 100 Trillion: 'Korea Sovereign AI'

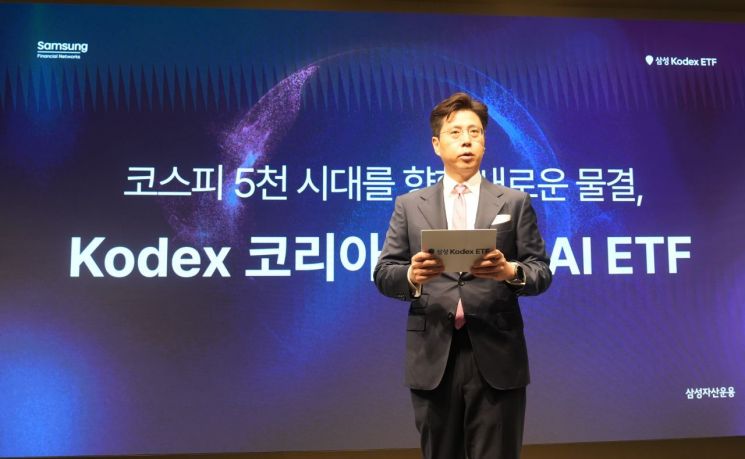

Myeongje Park, head of the ETF division at Samsung Asset Management, is speaking at the press conference for the launch of the Samsung Kodex Korea Sovereign AI ETF held on the 20th at the Westin Chosun Hotel in Jung-gu, Seoul. Samsung Asset Management.

Myeongje Park, head of the ETF division at Samsung Asset Management, is speaking at the press conference for the launch of the Samsung Kodex Korea Sovereign AI ETF held on the 20th at the Westin Chosun Hotel in Jung-gu, Seoul. Samsung Asset Management.

Myeongje Park, Head of the ETF Division (Vice President), opened the press conference by sharing the company’s aspirations as an industry-leading asset manager in celebration of achieving 100 trillion won in Kodex ETF net assets. Park stated, "Thanks to the customers who trusted and invested in KODEX, we have become the first in the industry to reach 100 trillion won in net assets, 23 years after launching KODEX 200, the nation’s first ETF, in 2002." He added, "As the leading asset manager in the industry, Samsung Asset Management will use this milestone as a springboard to continue contributing to the growth of Korea’s capital markets with innovative investment products."

Taehyuk Lim, Head of ETF Management, said, "Samsung Asset Management is taking its first step toward another 100 trillion won with the listing of KODEX Korea Sovereign AI." He explained, "The next market leaders will be companies that increase earnings per share (EPS) through technological innovation." He went on to express his expectations, saying, "Korea Sovereign AI will become the new market leader ushering in the ‘KOSPI 5000 era.’"

◆AI National Champions: One-Stop Investment in the AI Value Chain

"KODEX Korea Sovereign AI" is an ETF that focuses on companies participating in the "Sovereign AI" project led by the Korean government. It enables investors to invest in leading national AI value chain companies all at once.

Sovereign AI refers to an AI infrastructure system that does not rely on external AI infrastructure or models but is subject to state-led operational control. Through the government-led Sovereign AI project, it is expected that major obstacles to AI industry growth-such as securing graphics processing units (GPUs) and building data centers, which require large-scale funding-will largely be resolved. Companies participating in Sovereign AI are also expected to further strengthen their AI competitiveness as they benefit from policies such as securing public data, national cloud projects, and talent support. This is seen as laying the foundation for a Korea-tailored AI industry.

KODEX Korea Sovereign AI has expanded its investment scope to cover the entire AI value chain, including listed companies participating in the government’s "independent AI foundation model project" consortium, as well as AI semiconductors, data centers, cloud, software, and energy.

Major constituents include: ▲Naver, a core AI company with AI foundation capabilities; ▲LG CNS in the AI infrastructure sector; ▲SK Hynix in the AI semiconductor field; and ▲Doosan Enerbility in the AI energy sector. Naver can receive a concentrated investment weight of over 22%.

Taehyuk Lim commented, "State-led Sovereign AI is already a global trend and is expected to become a key sector driving the KOSPI 5000 era." He added, "Investors seeking to quickly tap into the growth potential of the Korea-tailored AI market will find new investment opportunities through KODEX Korea Sovereign AI."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.