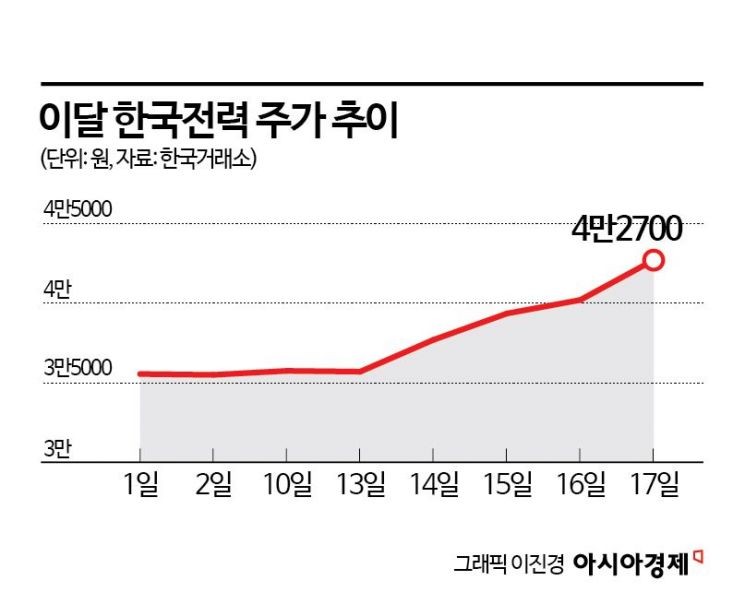

Shares Hit 52-Week High After Four Consecutive Days of Gains

Restored Earnings Confidence Attracts Foreign Investors

The stock price of Korea Electric Power Corporation (KEPCO) is on the rise, driven by continued buying from foreign investors. Although the foreign ownership ratio had been steadily declining for some time, it appears that foreign investors have returned as confidence in the company’s performance has been restored.

According to the Korea Exchange on October 20, KEPCO closed at 42,700 won on October 17, up 6.22%. During intraday trading, the stock climbed to 43,300 won, marking a new 52-week high. In just this month alone, the stock has risen by 18.45%.

Consistent buying by foreign investors has been the driving force behind this upward trend. Foreign investors have been net buyers of KEPCO every single day this month. Looking at the year as a whole, KEPCO is the third most purchased stock by foreign investors, following Samsung Electronics and SK Hynix. Since the beginning of the year, foreign investors have been net buyers of Samsung Electronics for 7.8356 trillion won, SK Hynix for 2.5935 trillion won, and KEPCO for 1.2961 trillion won. Moon Kyungwon, a researcher at Meritz Securities, commented, "Although KEPCO's market capitalization is smaller than that of Samsung Electronics and SK Hynix, the gap in net buying amounts is relatively narrow. As a result, KEPCO's foreign ownership ratio has risen to 22.39%. Over the past 10 years, the correlation between KEPCO’s stock price and its foreign ownership ratio has been as high as 0.83, indicating a very close relationship."

There is a view that foreign investors have been steadily buying KEPCO shares due to the restoration of confidence in its performance. Researcher Moon explained, "Before 2018, foreign investors were highly sensitive to oil price fluctuations and return on equity (ROE) forecasts. However, from 2018 to 2024, the foreign ownership ratio declined structurally regardless of oil prices or performance. This was because both domestic and international uncertainties, such as energy mix policies, dividends, and raw material prices, undermined confidence in the company’s results." He added, "The return of foreign investors this year can be interpreted as a recovery in performance reliability, helped by consecutive rate hikes, stabilization of raw material prices, and the resumption of dividends." KEPCO returned to profitability last year for the first time in four years and resumed dividend payments.

KEPCO’s performance in the third quarter of this year is also expected to be solid. According to financial information provider FnGuide, the consensus for KEPCO’s third-quarter operating profit (the average of securities firms’ forecasts) is 27.0244 trillion won in revenue, up 3.53% year-on-year, and 5.0235 trillion won in operating profit, up 47.92%. Choi Kyuhun, a researcher at Shinhan Investment Corp., stated, "The decrease in fuel and power purchase costs, combined with the continued effect of the peak season and rate hikes, will likely result in record quarterly profits. It appears that the stabilization of energy prices is continuously contributing to the reduction in fuel costs."

With solid performance expected, foreign buying is also forecast to continue. Researcher Moon said, "As improvements in quarterly results are confirmed in the future, further increases in foreign ownership are expected. The current foreign ownership ratio of 22% is still lower than the 30-35% seen before 2018."

Expectations for the nuclear power business also remain valid. Researcher Moon analyzed, "Beyond simple performance improvement, the extent of ROE improvement can be even greater when rates are raised. In addition, KEPCO’s growth potential could be reassessed through overseas nuclear power orders, such as in the United States, so there is significant room for valuation growth." Researcher Choi also noted, "Although there has been various noise regarding Team Korea’s entry into the US nuclear power market, more concrete results are expected to emerge at the Asia-Pacific Economic Cooperation (APEC) summit scheduled for the end of October. Expectations related to KEPCO’s nuclear power business could once again be strongly reflected in its stock price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.