Expansion of B2B Focused on Frozen Dough and Desserts

Aiming for Profitability Recovery Through "Solid Management"

Shinsegae Food is accelerating its business transformation by focusing on "solid management" and positioning its manufacturing-based bakery business as a new growth engine. Although sales have continued to increase, growth has slowed, prompting the company to pursue profitability recovery by expanding B2B (business-to-business) supply channels that leverage its large-scale manufacturing infrastructure. The company is actively restructuring to reduce its dependence on group affiliates and target external markets.

According to industry sources on October 18, Shinsegae Food has been strengthening its "selection and concentration" strategy in recent years by streamlining low-profit businesses such as food service and food material distribution. The company is reducing labor-intensive sectors like group catering and restaurant brands, and shifting to a high-efficiency structure centered on manufacturing and supply. In particular, it has pivoted toward a food manufacturing-focused portfolio by enhancing its premium product lines, such as frozen dough and desserts.

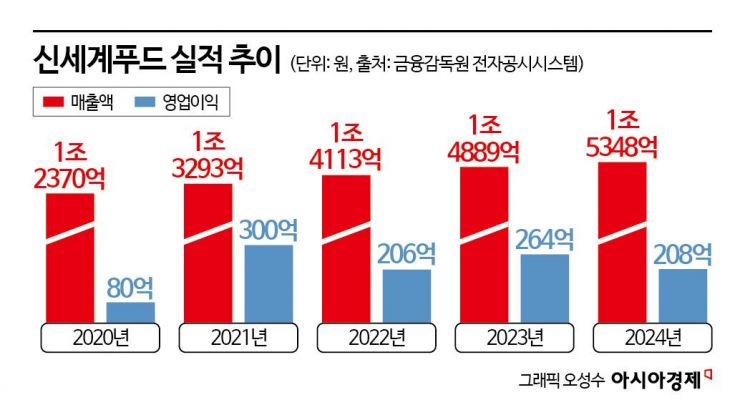

This restructuring is aimed at improving profitability. While Shinsegae Food's sales have steadily grown, the growth rate has been declining. Sales increased from 1.3293 trillion won in 2021 to 1.4113 trillion won in 2022, 1.4889 trillion won in 2023, and 1.5348 trillion won in 2024. However, the annual growth rate dropped from 7.5% to 6.2%, then 5.5%, and finally 3.1%. Last year, operating profit was 20.8 billion won, down 21.4% from the previous year, with an operating margin of only 1.4%.

The reason Shinsegae Food has chosen the bakery business as the core of its transformation is clear: this sector offers both market growth potential and stable supply channels. Since COVID-19, the rapidly expanding takeout and dessert cafe market has driven explosive demand for mass-supply products such as premium frozen dough, sandwich bread, and desserts. As ready-to-eat products become more prevalent, the importance of manufacturing infrastructure that ensures consistent quality and production efficiency has grown. Shinsegae Food is one of the few companies equipped with large-scale manufacturing facilities and a nationwide logistics network, and is considered well-prepared to respond to these market changes.

The domestic bakery market is still dominated by small-scale factories and in-store production. In contrast, Shinsegae Food is one of the few companies with facilities capable of mass production, giving it a competitive edge in production efficiency and quality control. The main companies operating large bakery factories are SPC Samlip, Shinsegae Food, and Lotte Wellfood. In terms of sales, SPC Samlip leads with approximately 916 billion won, followed by Shinsegae Food with about 440 billion won, and Lotte Wellfood with about 123 billion won. Excluding SPC, Shinsegae Food holds the second-largest manufacturing capability in the industry.

The main issue is the high proportion of sales to affiliates. Shinsegae Food still relies heavily on sales to group affiliates. As of last year, approximately 37% of its sales came from related parties, with major clients including Starbucks Korea, Emart24, and SSG Food Market. Reducing internal dependence and expanding external transactions are considered key tasks for business transformation.

In contrast, competitors have already secured a wide range of external channels and are leading the market. SPC Samlip supplies dough and desserts to Paris Baguette, Dunkin, and Starbucks, accounting for over 60% of the market share. Lotte Wellfood, leveraging affiliate brands such as Lotteria and Angel-in-us, is diversifying its supply channels to convenience stores and hotels, while CJ Foodville is expanding its premium dessert product line through its own production facilities for Twosome Place.

Shinsegae Food is also accelerating its efforts to target external markets. Through brands such as Boulangerie, E-Bakery, and Bo&Me within Emart, the company is increasing its supply of desserts and frozen sandwiches, while also expanding its supply chain to external coffee brands like Starbucks and Tim Hortons.

An industry insider commented, "Demand for frozen dough and desserts is rapidly increasing, especially among franchise cafes, so if Shinsegae Food expands its external B2B transactions, there is significant potential for profitability improvement. However, since the proportion of affiliate sales remains high, the speed of acquiring external customers and building brand credibility will be crucial to the company's future success."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)